Just How Bad Is Australia's Two-Speed Office Market?

Cushman & Wakefield has released its national Q1 office research notes for Sydney, Melbourne, Brisbane and Canberra, noting that the divide in Australia’s two-speed office market is narrowing with Melbourne, Brisbane and Canberra all experiencing a tightening in vacancy rates, while Sydney recorded a small increase. The Australian economy rebounded in Q4 2016, recording 1.1% growth quarter-on-quarter.

Key takeaways included:

Below average new supply expected across CBD markets

Tenant demand expected to remain strong in the South East markets.

Tight vacancy to maintain 'landlord favourable' conditions in Sydney and Melbourne.

Melbourne's future office supply pipeline becoming clearer with pre-commitments and construction progress.

Brisbane showing signs of improvement and is past the low point.

Limited stock availability with below-average new supply forecast in Canberra.

Brisbane

The Brisbane CBD leasing market is showing signs of recovery, with a new record peak in net absorption of 94,601 sq m seen in 2016. This was largely driven by supply-led demand, accompanied by several relocations and consolidations by Queensland Government.

Quality is the keyword in Brisbane, as some tenants have chosen to upgrade their office accommodation and take advantage of favourable leasing conditions.

Co-working is on the rise: Cushman & WakefieldImprovement in tenant demand is expected to continue in line with Queensland economic growth. This, supported by limited new supply and secondary stock withdrawal over the near-term, is likely to keep vacancy on a downward trend.

Sydney

Despite strength in the NSW economy and a shortage of nonpremium grade stock, the Sydney CBD vacancy rate rose 60 basis points to 6.2% in the second half of 2016. Negative net absorption of -32,536 sq m was influenced by stock withdrawal and tenant downsizing, and marked the first decline in total occupied space in three years.

With landlord favourable conditions firmly established, existing tenants are expected to prioritise lease extensions and those with the flexibility to hand back excess space are likely to do so. Service sector employment growth, and anticipated negative net supply in 2017 and 2018 are expected to maintain landlordfavourable market characteristics until the new development cycle commences in 2019

Melbourne

The Melbourne CBD recorded 109,612sq m of net absorption in H2 2016, evidence of a strong bounce back in tenant demand following a lacklustre H1 2016 result. Positive net absorption was recorded across all grades, supporting a 60 basis point decline in the overall vacancy rate from 7.0% to 6.4%. Prime vacancy was measured at 6.5%, down from 6.7% in H1 2016.

With effective rents trading at a significant discount to Sydney, Melbourne stands as an attractive proposition for companies looking to enter Australia. In the year ahead, a decline in the vacancy rate is expected to support strong rental growth, however as the next development cycle draws closer this growth can be expected to slow. The new development cycle will commence with 664 Collins Street and Collins Square Tower 5 both due in 2018.

Co-Working: Understanding The Ongoing Evolution

Cushman & Wakefield's latest research publication: Co-Working: Understanding The Ongoing Evolution, demand for co-working spaces is growing at an average of 10-15% per annum across all regions as corporate cultures embrace the concepts of shared work spaces and collaboration.

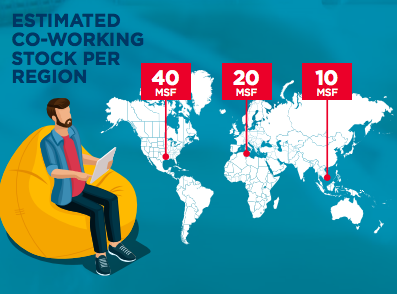

In Washtingtin D.C., the size of Co-working space has doubled in the last five to six years. Last year alone, Co-working operators leased about 5 million square feet (msf) in Asia Pacific. The size of Co-working stock is estimated to be highest, in the range of 40 msf in the United States (US) followed by Europe (20 msf), and Asia Pacific (10 msf).

HSBC is estimated to have achieved cost savings of about US $ 1 million by renting 300 hot desks at a WeWork facility in Hong Kong. WeWork is the largest independent player in the field following its global expansion in recent years and has become the largest occupier of corporate real estate in New York City. Betting big on Asia, WeWork is planning to expand in India after opening several facilities in Seoul, Hong Kong, and Shanghai last year.

Real Estate Costs Are a Big Factor

More than 90% of corporate real estate (CRE) leaders consider total property costs an important consideration in decision making with the banking, financial services, and insurance (BFSI) sector is the most sensitive. Banks have put costs under the microscope as competition and stringent regulations are shrinking their profits substantially in all regions. Nearly half of the BFSI respondents prefer short term leases (one to three years) because of the uncertain operating environment.

Why Is Co-Working So Popular?

Co-working space appeals most to occupiers as they tend to provide designer work environments with several amenities that are attractive to the millennial workforce. Most CRE managers prefer these flexible work settings over other factors such as cost, privacy/security, and scalability. Startups tend to prefer Co-working spaces as these keep costs low, provide networking opportunities, and at the same time give them an option to scale up quickly.