Goodman Group Looks to Invests in Robotics Following $776 million FY Profit

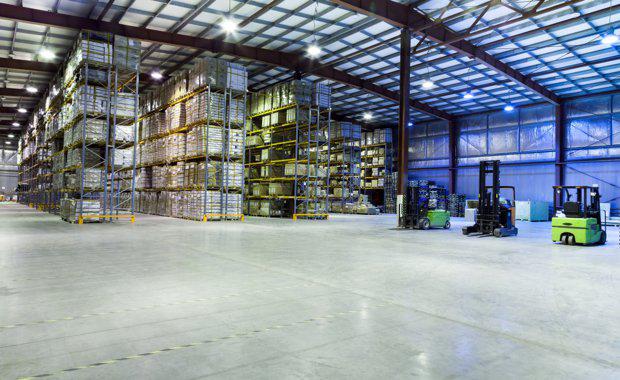

Following a positive financial year, industrial property company Goodman Group will use $3.5 billion of asset sales to develop highly-automated logistic centres.

For the full-year ending 30 June, Goodman Group delivered an operating profit of $776 million, up 8.6% since 2016, and operating earnings per share of 43.1 cents.

“We’ve taken advantage of the property cycle to make $3.5 billion of asset sales across the platform this financial year, redeployed this capital into strategic developments and reduced Group leverage to 5.9%,” chief executive Greg Goodman said.

“This has provided us with greater financial flexibility and enabled us to improve the quality of our global portfolio by focusing on strategic locations in gateway cities, placing our customers close to their customers.”

The Group is forecast to generate $828 million of operating profit in FY18, which will result in operating EPS growth of 6% on FY17.

"Having positioned our business to take advantage of structural changes, we’re now looking to the future,” Goodman said.

“Rapidly advancing technology and increased consumer expectations around price, product availability and delivery, while disruptive for some businesses, are providing us with opportunities.

“Although the evolution of e-commerce and supply chain transformation are still in their early stages, we are seeing increased demand for our expertise in providing high quality logistics facilities in prime locations.

“This is a trend we expect to accelerate over the next five to ten years.”

Goodman said that AI in warehouses is accelerating with not just robotics, but in data collection - where trucks can be sent out at the right traffic times - and bar-coding to ensure the customer can track the parcels and a more efficient internal layout.

Goodman’s end-of-year report indicated a healthy positioning for the group to capitalise on current market conditions and future opportunities.

The group’s continued strategy to improve asset quality through asset rotation and focus on key gateway markets has proven to be successful over the last few years and should continue to provide strong returns.

The industrial property powerhouse look set to benefit from the arrival of online retailer Amazon - and although there was no confirmation that the retailer would lease a Goodman site, Goodman is confident that disruptive technologies would shake-up the industry, "disrupters are here and the followers are on their way".

Amazon said it’s “actively looking” for a warehouse as it prepares to start operations in Australia. Anticipating a price war, analysts have almost halved profit forecasts for local electronics chains such as Harvey Norman Holdings Ltd. and JB Hi-Fi Ltd.

The need for economically-functional distribution and logistic centres will be paramount to the retailer's success, as the cost of serving Australia’s biggest cities, from Perth in the west to Sydney on the eastern seaboard, is expected to undermine Amazon’s high-volume, low-margin model.

“It is costly to establish, develop, and maintain international operations and websites,” Amazon said in its latest report.

“Our international operations may not be profitable on a sustained basis.”

With nine out of 10 Australian households already online, the growth of Internet retail sales will almost halve in the nation in the next five years, according to IBISWorld Pty.

Despite the immediate challenges, Australia is a key piece of Amazon’s long-term goal of creating a global distribution network that connects buyers and sellers from many countries.

That warrants big initial investments without near-term returns.

"Amazon’s ultimate ambition is to have the presence it has in the U.S. everywhere in the world," said James Wang, an internet analyst at New York-based ARK Invest.