Sydney, Melbourne Still Appealing Investment Markets: PwC

Australia's largest and most expensive housing markets, Melbourne and Sydney, have remained among Asia's healthiest investment destinations despite steep price falls and declines in building approvals and activity over the last year.

According to a new report from PwC, the Australian property market has remained the "most appealing" location for those shopping within the Asia Pacific market thanks to sound fundamentals, high yields and increasing rental prospects.

The report which has measured the current outlook on real estate investment and development trends throughout the Asia Pacific region has highlighting emerging markets and sectors to watch.

Amid an impending trade war, rising interest rates, tighter access to credit, and buyer fatigue at sky-high prices for both commercial and residential properties, PwC's survey respondents have pointed to new opportunities particularly in markets such as Vietnam and India which are "ripe for development projects".

Related: Melbourne Trumps Sydney as Top Investment and Development Destination

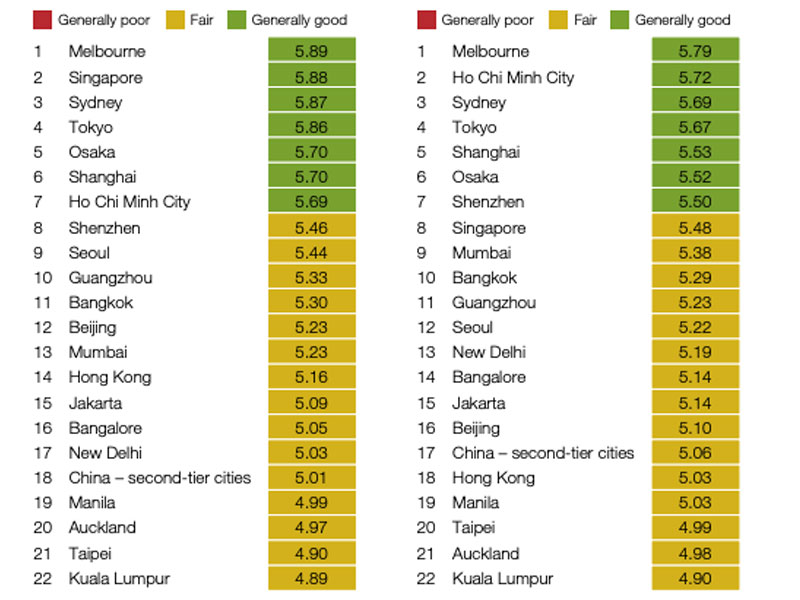

City Investment & Development Prospects for 2019

“With increased competition for assets in gateway cities, investors are increasingly more likely to look further afield, with emerging markets offering potentially higher rewards through higher-yielding plays,” the report says.

Slow-but-steady returns offered by gateway cities in developed markets such as Melbourne, Sydney, Tokyo, and Osaka have remained at the fore of investors preferences with Singapore also benefitting after its rebound from last year’s lows.

Opportunity awaits in Vietnam

Vietnam’s biggest city and business capital continues to rate as the most attractive emerging market destination for investment.

Ho Chi Minh City has moved from strength to strength, and is particularly strong in the development stakes, ranking second behind only Melbourne.

It is also the hottest market for acquisitions in virtually every sector: office, retail, and residential, while second behind only 2020 Olympics host Tokyo for hotels.

Vietnam has become one of the fastest-growing economies in the world, spurring overseas investors to target the nation’s real estate, with land supply in central locations, however, remaining extremely tight.

The population is also young and dynamic, incomes are on the rise, and growth is forecast at an annual 6.6 per cent for each of the next three years by Standard & Poor’s.

“For opportunistic investors, there are plenty of plays,” the report says.

“The Vietnamese government encourages foreign investment, and imposes fewer barriers to foreign participation in the real estate sector than other Southeast Asian developing markets.”

Related: Chinese Buyers ‘Increasingly Sensitive to Upfront Costs’: UBS

PwC's Leading Buy/Hold/Sell Recommendations

| Sector | Buy | Sell |

|---|---|---|

| Office | Ho Chi Minh City, Tokyo | Taipei, Auckland |

| Retail | Ho Chi Minh City, Bangalore | Kuala Lumpur, Auckland |

| Residential | Ho Chi Minh City, Mumbai | Taipei, Kuala Lumpur |

| Industrial | Bangalore, Mumbai | Taipei, Kuala Lumpur |

| Hotels | Tokyo, Ho Chi Minh City | Taipei, Beijing |

Most PwC survey responders also cited India as a current opportunity or a market they would like to enter, although for now, the foreign investment base consists mainly of big institutional players in the game for the long run.

Indian retail and industrial assets are also rising in popularity awash with investment as logistics continues to be a go-to theme, given preexisting structural shortages and vast new demand driven by e-commerce retailing.

Several modern-day asset classes are also gaining traction across Asia with co-working revitalising a stale serviced-office sector drawing better returns and co-living becoming increasingly appealing in Asia’s ultra-high-cost residential environment.

“Asia’s gateway cities are perfect Petri dishes to explore how co-living works in an Asian context, although tenants in co-living complexes are not always focused on cost-saving,” the report says.

Investment in Chinese cities softens

Developers in China are now showing increased price sensitivity when it comes to their land banks, bidding only on attractively priced lots.

Slow growth in jobs and the very strong growth in e-commerce make retail challenging as an investment, particularly on high streets, while geopolitical concerns and tensions with China have made the performance of tourist-focused real estate assets wildly unpredictable.

“The China tap is substantially off, but we’ve seen pockets of interest in different sectors that are aligned with government policy,” the report says.

“So, there’s still an appetite for sectors like senior living and real estate associated with medical or life sciences.”

“Where we’re seeing the tap totally shut is speculative or trophy investments.”