Sydney, Melbourne in Top Five Asia Pacific Markets

Investors in the Asia Pacific are doubling down on markets that are “large, liquid and defensive” as real estate globally enters a period of slower growth, according to a 2020 Asia Pacific real estate forecast published by PwC and the Urban Land Institute.

Sydney and Melbourne rank in the top five markets for both investment prospects and development prospects, continuing Australia’s long-standing appeal as a focus for domestic and international capital.

ULI Asia Pacific chairman Nicholas Brooke said the markets that ranked highest offered significant numbers of core assets that remain the preference for regional institutional investors.

“The [report’s] findings reflect the prevailing sentiment throughout the real estate industry in general is entering a period of slow growth,” Brooke said.

“We can expect this emphasis on core properties to continue as the market cycle changes.”

Despite the rising tide of anti-globalism and significant pullback of Chinese investors, cross-border capital made up 50 per cent of total transactions in Australia over 2019—second only to Singapore at 55 per cent.

Related: Melbourne Trumps Sydney as Top Investment Destination

| City investment prospects 2020 | City development prospects 2020 |

|---|---|

| 1. Singapore (6.31) | 1. Ho Chi Minh (5.96) |

| 2. Tokyo (6.11) | 2. Singapore (5.77) |

| 3. Ho Chi Minh (6.06) | 3. Sydney (5.71) |

| 4. Sydney (5.99) | 4. Tokyo (5.64) |

| 5. Melbourne (5.95) | 5. Melbourne (5.56) |

^Source: Emerging Trends in Real Estate Asia Pacific 2020 survey.

Investment volumes in Australian real estate grew 3 per cent in the first half of 2019—the only market of the five busiest Asia Pacific markets to record an increase in transaction volumes.

PwC Asia Pacific Real Estate tax leader KK So said that this year’s report shows how institutional investors preference mature economies like Sydney, Melbourne and Singapore in an uncertain economic environment.

“Investments from the west into the Asia Pacific have waned, but the Asia Pacific-based investors and increasingly investing in markets within the region,” So said.

The funding opportunity is expected to grow to some $50 billion by 2023, as the major banks concede market share as APRA’s strict lending standards continue to curtail activity.

“It’s a pretty exciting opportunity, particularly at this point in the cycle where for some investments you would much rather have debt than equity exposure,” an investor interviewed for the report said.

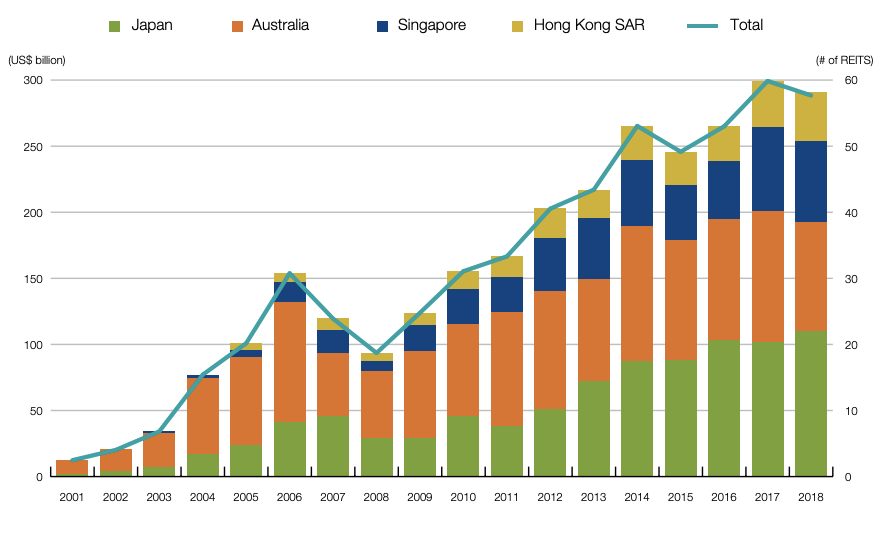

Asia Pacific REIT capitalisation by country

^ Source: DWS Investments.

The report touches on Australia’s highly-competitive REIT market, which—bolstered by the sheer weight of cash held by Australia’s pension funds— continue to push cap rates down across the board.

“Competition in that market will always be tough,” the report notes.

“There is little incentive for building owners to sell because they may not be able to get back into the market if they do.”

Australia’s listed property universe is the region’s oldest, with almost the same number of listed A-REITs as Singapore and a much larger combined market capitalisation—US$61.9 billion in Singapore compared to US$82.3 billion in Australia.

Other “trends” covered by the report include trade friction and geopolitical challenges, the broad adoption of sustainable development practices, co-working and the growing impact of climate risk on real estate investments.