CoWorking: Melbourne's Culture Here To Stay

Hub Australia’s newest Melbourne space, Hub Southern Cross which opened in October 2016.

Knight Frank's recent research into Melbourne's coworking culture revealed a single underlying truth - coworking has rapidly evolved over the past 12 months and is certainly here to stay.

According to their publication Bridging the Gap: Melbourne’s Coworking Culture, Melbourne, Sydney and Brisbane currently have 239 coworking spaces occupying 116,955m2 (of which 56% is in Melbourne).

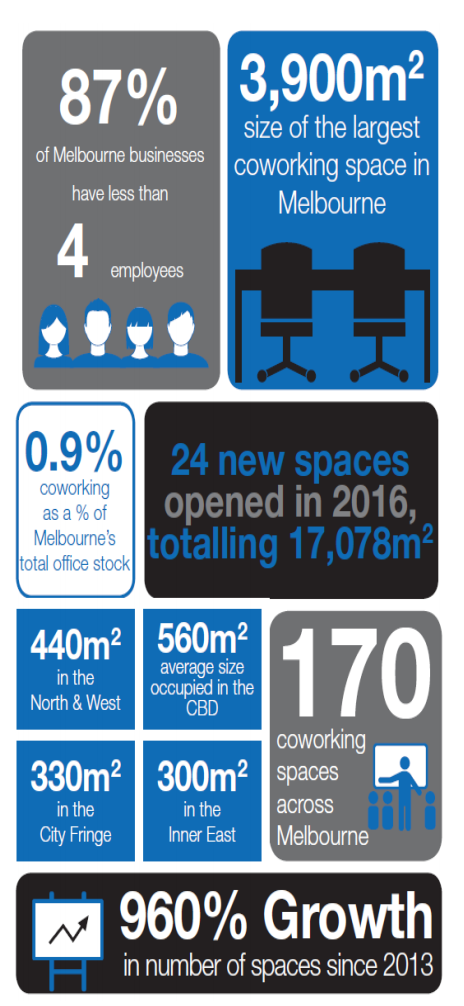

Results from the 2016 global coworking survey indicate that, 61% of coworking providers expanded their operations (in 2016) with 10,000 spaces operating globally, serving 735,000 members. In Melbourne the coworking industry has grown by 960% in the past three years to 65,537m2 across 170 locations, accounting for 0.9% of total office stock.

In 2016, 24 new coworking spaces opened in Melbourne totalling 17,078m2 with five existing operators expanding their footprint, to occupy an additional 7,750m2.

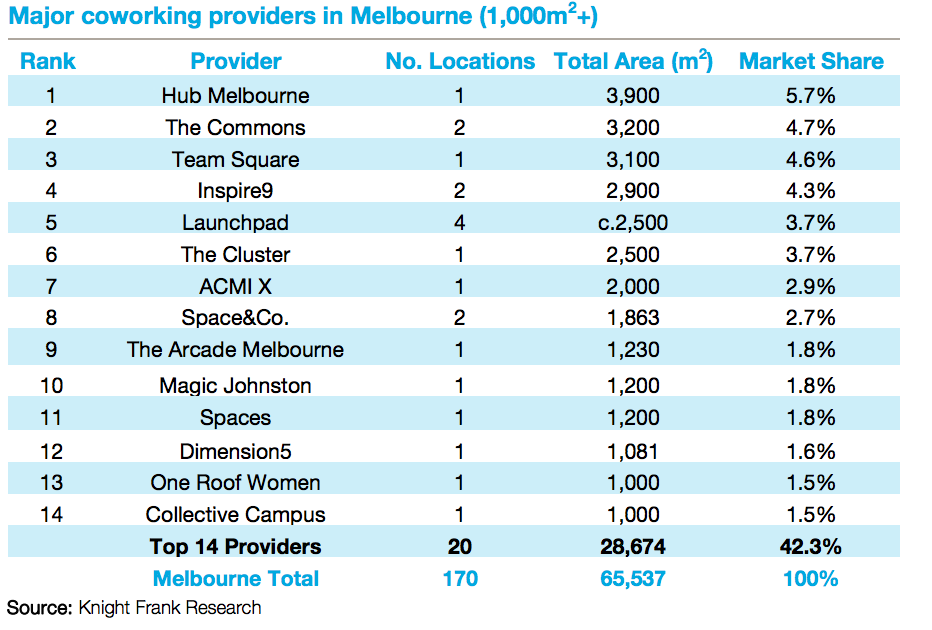

Although a large proportion of Melbourne’s coworking spaces are still in their infancy, existing spaces are beginning to expand into multiple locations. The Commons, who launched their first site in Collingwood in early 2016, opened a further site in South Melbourne in December 2016.

Recently, The Commons pre-committed to 3,000m2 at Grocon’s 54 Wellington Street in Collingwood, and are in negotiations to finalise their fourth Melbourne site with a planned opening in Q4 2017. Inspire 9, one of Melbourne’s first coworking providers opened their second coworking space in Footscray at The Dream Factory, 90 Maribyrnong Road, increasing their footprint from 600m2 to 2,900m2 .

What we can expect from 2017

By Kimberley Paterson, Knight Frank Senior Analyst, Research & Consulting

The number of coworking spaces will continue to grow

The coworking industry is growing at a rapid rate, with the number of members globally predicted to reach 1.2 million by the end of 2017.

Results from the latest global coworking survey indicate that 67% of coworking spaces plan to expand in 2017 with 40% intending to open an additional location.

The number of coworking spaces operating worldwide is anticipated to reach 14,000 by the end of 2017.

The shared workforce will continue to establish itself as the norm

In 2016 many companies incorporated collaborative and shared workspaces into their workplace design in response to greater demand from employees for flexibility, agility and connectivity.

With coworking fast becoming the new required tenant amenity, it is anticipated this trend will continue in 2017 with corporates and landlords evolving the workplace by adopting some variant of the coworking design in order to attract and retain the best staff.

The arrival of international operators

American-owned WeWork launched in Sydney in October 2016, occupying 11,260m2 across two locations at 5 Martin Place and 100 Harris Street.

Currently at 88% occupancy, WeWork plans to open two sites in Melbourne What Can We Expect in 2017? and a further 4,300m2 site in Sydney at 333 George Street by the end of 2017, becoming Australia’s largest coworking provider.

In addition, there are several active requirements in the market from international providers including Singapore based Spacemob and The Working Capitol, both looking to expand their reach across Asia Pacific in 2017.

Coworking spaces will become more specialised

As the market share of the coworking industry grows, there will be increased competition amongst operators in efforts to differentiate themselves through their fit-out, level of amenity and membership offering. This will create heightened emphasis and demand for more private offices, increased amenity such as an onsite cafe, gym, childcare, event space, shared space, wellness rooms and end of trip facilities.

Commercial property will continue to adapt to coworking

Landlords are acknowledging the amenity value and flexibility coworking can bring to their assets. GPT has successfully rolled out Space&Co. which was established in 2014 in response to increased demand from GPT’s existing occupier base for more flexible tenant amenity.

As the coworking industry evolves from its current infancy stage it is anticipated there will be more partnerships between landlords and coworking operators combined with landlords developing their own coworking models.

Coworking will become a further amenity in mixed use schemes

Scape Student Living recently acquired 97 Franklin Street in the Melbourne CBD and is mooted to incorporate a 50,000m2 mixed use scheme comprising retail, office, education, student housing and coworking space. Furthermore, The Commons will open their third coworking space in Q1 2019 at Grocon’s mixed use scheme at 54 Wellington Street in Collingwood, comprising a 13 level office building and a companion five level retail building.