Construction Costs Soar Despite Quarter’s Slowdown

Residential construction costs surged more than 3 per cent last year, new data has revealed.

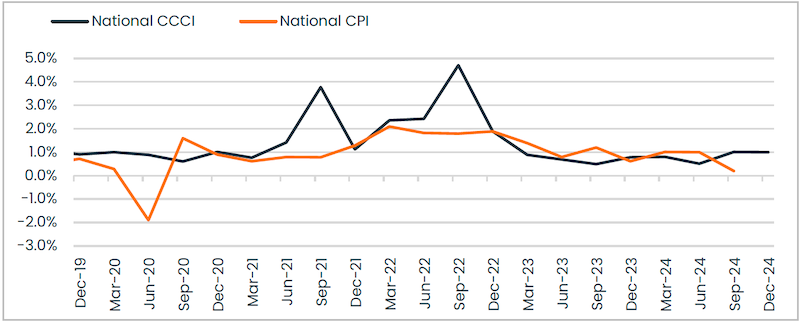

CoreLogic’s Cordell Construction Cost Index (CCCI) found that residential construction costs increased by 3.4 per cent in the year to December—the biggest increase since the 4 per cent increase recorded during the 12 months to September, 2023.

Meanwhile, the quarterly change in constructions costs initially eased to below 1 per cent in 2023 and the first half of 2024 but then rose to 1 per cent during the second half of last year, the report found.

This puts the quarterly change in line with the pre-Covid decade average of 1 per cent.

Queensland had the largest increase over the quarter to December with 1.2 per cent, while in NSW, WA and Victoria costs rose by 1 per cent.

South Australia had the smallest increase—0.9 per cent—for the quarter.

Before the pandemic, the decade annual average was 4 per cent, however, CoreLogic economist Kaytlin Ezzy said, the industry had already been struggling.

“Residential construction companies continue to face profitability challenges with the CCCI up 30.8 per cent since the onset of Covid,” Ezzy said.

She said that as well as compressed margins and continued labour challenges, the construction industry was facing a looming reduction in the construction pipeline.

Data from the Australian Bureau of Statistics has revealed a drop to a 10-year low for new housing commencements. Ezzy said these factors combined have contributed to an increasing number of liquidations, with 2832 construction companies becoming insolvent in the 2023-2024 financial year.

Approvals have increased slightly but remain 7.1 per cent below the decade average, while monthly CPI results have shown that new housing purchases declined 0.6 per cent decline in November of 2024.

“While deflation in new dwelling purchases seems contrary to increasing construction costs, the ABS noted this decline was primarily driven by builders offering discounts and promotional offers to entice business, putting further pressure on margins,” Ezzy said.

And while inflation increased across the year by 2.3 per cent, new housing prices increased by 2.8 per cent over the year to November.

Labour was the main factor driving up construction costs, according to CoreLogic construction cost estimation manager John Bennett.

Quarterly change in construction costs v CPI

“What is constant is that labour continues to be a key driver of cost increases,” Bennett said.

“It was a bit of a mixed bag this quarter, with increases and decreases across different categories.”

Concrete blocks were down by 15 per cent on average while plumbing PEX fitting and pipework were up by 5 per cent.

The CCCI report tracks the rate of change for residential construction costs on a quarterly basis, covering the most common new residential builds in its models but does not cover bespoke or specialised style construction or materials.

It does not consider delays or associated costs due to delays as part of its modelling but does assume that 40 per cent of the cost will represent labour, 5 per cent preliminary work, 5 per cent plant work and 50 per cent materials.