How Data Is Changing Commercial Real Estate

The property industry has reached a tipping point as Proptech adoption hits critical mass and commercial real estate executives start to see tangible returns from digital investments.

According to leading real estate software, data and advisory company Altus Group, 60 per cent of senior executives in the world’s biggest real estate firms now recognise the impact of Proptech on their company's bottom line.

In the company's annual commercial real estate (CRE) innovation report, Altus surveyed 400 commercial real estate executives from across the globe to gauge how the sector is reacting to the disruptive impact of technology.

For the first time in five years, the survey highlighted a noticeable shift to an acknowledgement that many advanced technologies can potentially solve countless current challenges.

Technology is already shifting the goalposts for some major real estate companies, many of which now use advanced data to track numerous touch points across their portfolio.

Altus Group chief executive Bob Courteau acknowledges the highly fragmented sector would need further consolidation in order for technologies to become mainstream.

“CRE continues to rapidly accelerate its digital transformation and despite the growing complexity stemming from the proliferation of data,” Courteau said.

“The industry is clearly shifting from a stage of ‘trial and testing’ to one of practical innovation to solve their current challenges today.

“At the same time, continued automation and significant Proptech consolidation will both have a major impact and deliver considerable opportunities for the industry.”

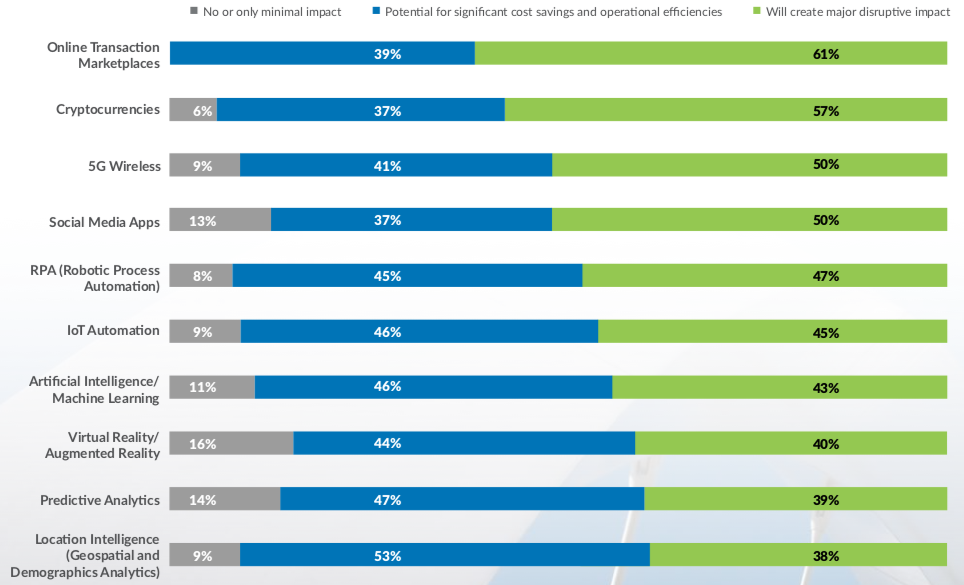

The impacts of technologies on CRE

Consolidation the key

The deep analytical dive showed managers noted that while the industry is making key investments and hedging its bets, the globally fragmented Proptech market will need to consolidate in order for these technologies to start gaining traction and delivering results.

Up until now, Australian corporate real estate companies have been weary of new tech dating too quickly and being superseded before it's given any value.

Nine out of ten CRE executives said significant consolidation is needed for Proptech to more effectively deliver on the needs of the CRE industry, with 43 per cent saying it is already underway or will occur within 12 months.

Areas of Proptech most likely to experience consolidation include property management, property transactions and listing services, and financing and lending firms.

Nine out of ten CRE executives also believe global data standards for commercial real estate will eventually be adopted, however, numerous obstacles were identified including a lack of standardised data definitions on a global scale, and privacy and data protection regulations.

Data complexity growing

| Impediments to firms collecting or utilizing more data to drive decision-making | 2015 | 2020 |

|---|---|---|

| Issues around the regulatory requirements of collection and management of data | 47% | 59% |

| Lack of internal expertise/capability | 29% | 52% |

| Lack of normalized data formats | 40% | 48% |

| Lack of appetite from the company to invest in the required technology | 36% | 43% |

| Issues around veracity or accuracy of data | 52% | 40% |

| Lack of tools to assist with data capture & analysis | 44% | 37% |

| No impediments to collecting or utilizing more data to drive decision-making | 18% | 3% |

The 5G factor

The report’s authors also point to the forthcoming 5G wireless technology, recognised by the commercial real estate industry as a potential game changer in order to bridge emerging Proptech.

The 5G network offers rampant possibilities for both businesses and consumers and is expected to offer speeds 20 times faster than 4G LTE.

Half of survey respondents acknowledged 5G wireless will create major disruptive impact on the CRE industry with 81 per cent saying it will support increased adoption and use related to smart city development.

The rollout of 5G would also rapidly revolutionise automated supply chain and procurement and automated inventory replenishment.

Whilst the report acknowledges one of the short term impacts of new technology will be further downward pressure on jobs, executives were bullish that 5G, needed to power the latest technological advances and would also lead to job creation.

Some REITs are making substantial gains from leasing their own towers and fibre cables to service providers, effectively acting as “telecom landlords”.

Drowning in data

Altus say the future also requires prioritisation by CRE firms to address these challenges through dedicated executive ownership and governance related to overall data strategy.

Currently half of CRE teams are spending at least 15 per cent to over 25 per cent of their time managing and organising data (equivalent to two to three months of the year).

To combat this, eight out of 10 CRE firms now have a chief data officer or equivalent senior executive who oversees their organisation’s data strategy and data governance.

This compares to Altus Group’s 2016 research where 44 per cent of firms surveyed indicated a lack of executive sponsorship.

Click here for more information on Altus Group’s Commercial Real Estate (CRE) Innovation Report.

The Urban Developer is proud to partner with Altus Group to deliver this article to you. In doing so, we can continue to publish our free daily news, information, insights and opinion to you, our valued readers.