Education Leasing Up 200% Over 12 Month Period

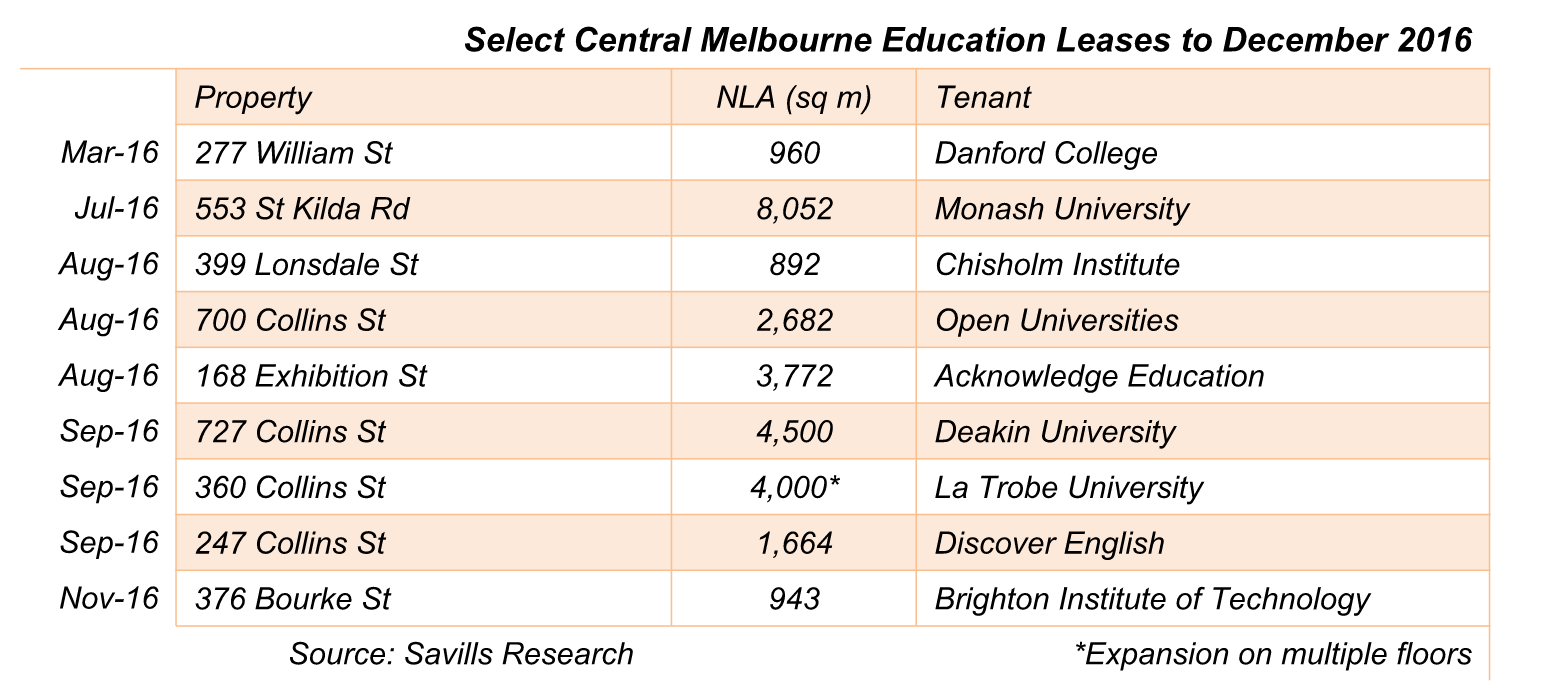

Melbourne CBD’s education sector continues to grow with the total amount of space leased in 2016 up over 200 per cent on the previous year, according to a Savills Research survey.

Despite the data suggesting recent hikes in land taxes have exacerbated stock level shortages, putting increasing upward pressure on rents, Savills Education Sector specialist Mathew Kent said 2017 is likely to deliver as much or more education leasing with Savills currently dealing with more than 15 leasing requirements for in excess of 60,000 square metres.

Some of the educators in the market include Monash University (40,000 square metres), Think Education (2,000 square metres), Baxter (3,000 square metres), and RMIT (10,000 square metres).

The total 39,840 square metres leased (deals over 500 square metres) in 2016 included 14,222 square metres of prime space as institutions, including the top universities, were forced, in some cases, to take higher grade accommodation in a market limited by the availability of education specific space.

Mr Kent said withdrawal of secondary buildings for residential conversion, a lack of 9B accredited buildings, fit-out costs, and competitors in the same building, were all issues which worked to limit the amount of space available to educators.

"For these reasons the availability of suitable accommodation to meet the demand from education users in Melbourne is now at levels where landlords have been able to demand higher rental and more attractive terms for suitable accommodation," he said.

He said the increasing demand for limited space had seen rents rise from a range of $300 per square metre to $350 per square metre, to $550 per square metre plus over the last five years with a corresponding fall in incentives.

Mr Kent said the significant hike in land tax had also had been important in reducing available space.

"The doubling of land tax in low rise buildings may render the current use of a building, in terms of its tenancy profile and rental returns, unviable for some landlords and that has forced them, in some cases, to sell to residential developers."

Savills’ Associate Director Research & Consultancy Monica Mondkar said the education sector accounted for nearly 21 per cent of the 191,484 square metres of office space leased by the Government & Community sector in 2016.

The latest Department of Education figures revealed there were 554,179 full-fee paying international students in Australia on a student visa in 2016 representing a 10.9 per cent increase on 2015 with new enrolments in Victoria up by 12 per cent.

The average annual enrolments growth rate has been 6.5 per cent per year over the last ten years.

Ms Mondkar said the Victorian Government's $31.9 million investment over four years in the international education sector announced in the 2016/2017 budget would likely underpin further rises in student numbers.

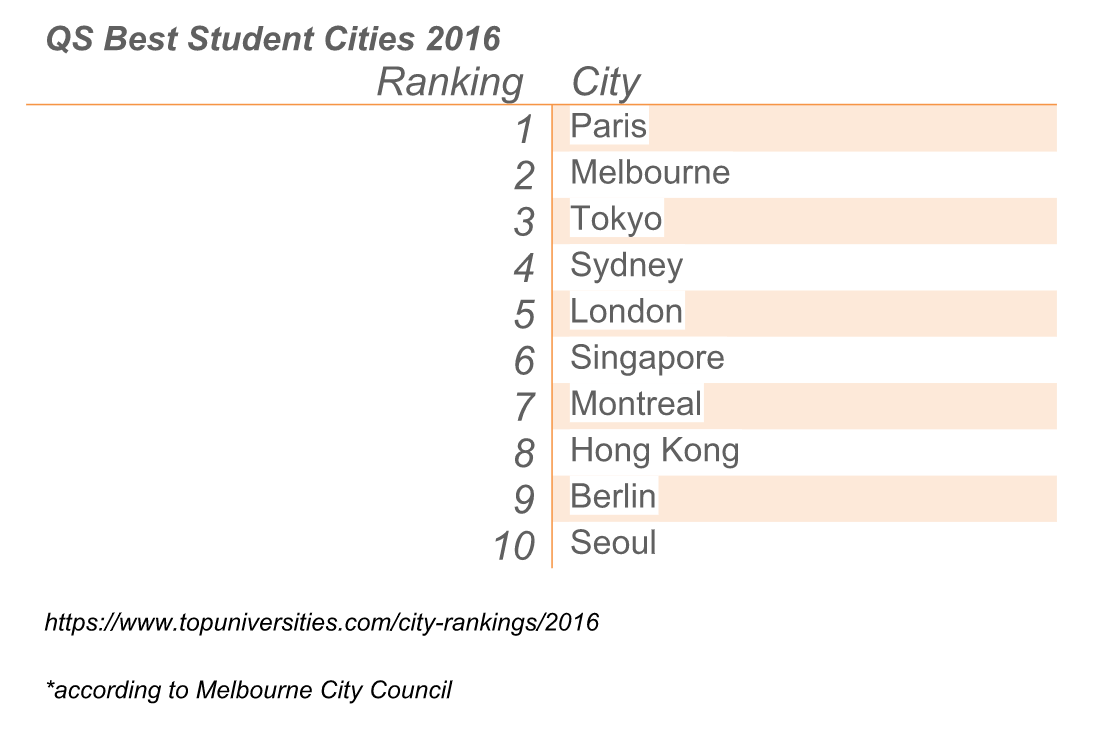

"Student numbers have been increasing year on year and, as Australia’s third biggest export at circa $20 billion, there is little doubt the Melbourne CBD education market will continue to grow and that is reflected in student choice with Melbourne’s international student population at more than 30,000."According to the QS Best Student Cities 2016 index – a ranking of the world’s leading urban destinations for international students by university ranking, affordability, student mix, desirability, and employer activity – Melbourne ranked second behind Paris with Tokyo third followed by Sydney in fourth place.