Proptech Fever Sweeps the Industry As Investors Brace for the Next Big Thing in 2018

In the wake of the stratospheric rise of the financial technology sector – where "blockchain billionaires" are being minted, financial regulators are grappling with rapid innovation and entrenched players quiver at the thought of complete oblivion – investors and venture capitalists are looking beyond the horizon and eyeing off the next big opportunity.

According to experts around the globe, the property technology – or proptech sector – may well be poised to follow the trajectory of its sister-sector.

What exactly is proptech?

Very simply, proptech refers to technology that is aimed at the real estate industry and attempts to change the way we buy, sell, finance and manage property.

According to London-based real estate advisor Savills, the global real estate industry was worth a eye-watering $217 trillion in 2016, of which approximately 75 per cent is comprised of residential property.

“To give this figure context, the total value of all the gold ever mined is approximately US $6 trillion,” head of Savills' world research, Yolande Barnes said.

The world economy, in contrast, outputs a GDP of about $80 trillion.

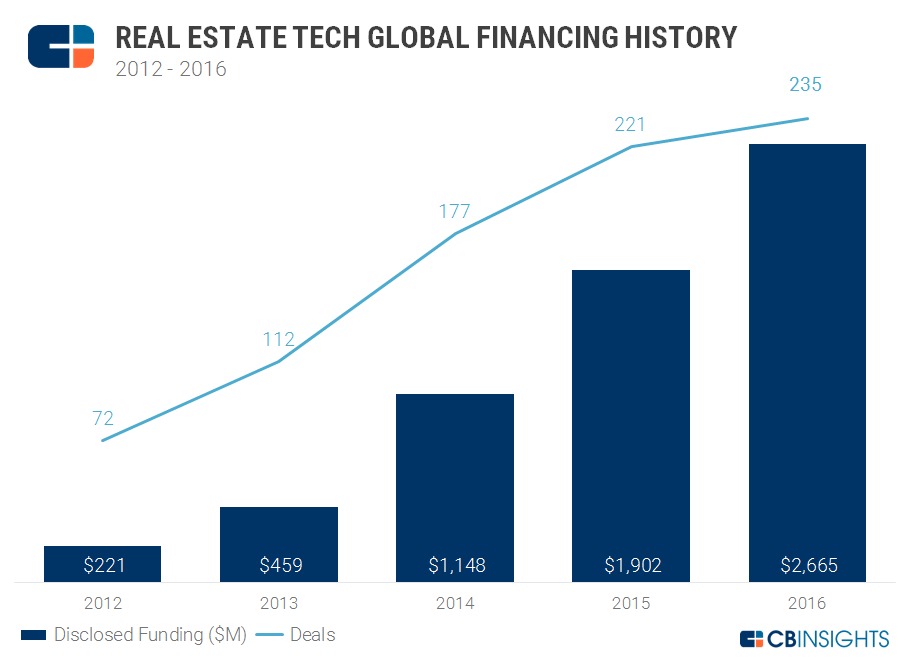

According to CB Insights, approximately US$6 billion in venture capital has been invested globally in proptech since 2011, of which 70 per cent was in the last two years.

With an estimated $3 billion in capital invested in proptech this year alone, it comes as no surprise that a handful of unicorns – start-ups with a valuation in excess of $1 billion – have started to emerge.

Compass, a unicorn and one of the stars of the New York proptech scene is led by Australian serial entrepreneur and young rich lister, Ori Allon.

At its core, Compass is a real estate sales business that uses cutting-edge technology, analytics and data to streamline the process of buying and renting real estate in the United States.

"We started noticing this notion of old, traditional businesses being disrupted by technology, like how Uber started and Airbnb, and it was interesting to me. And we thought real estate could be a classic example. It is a huge business with very little technology, almost no tools other than the very obvious ones," Allon told the Australian Financial Review in 2016.

After launching in 2012, the company is now worth over US $2.2 billion after closing a funding round of US $450 million from Softbank earlier this month.

Why proptech, why now?

The University of Oxford's Said Business School suggests that 2017 marks a watershed moment in the proptech sector.

"Proptech has been building such mass and momentum that it will change the world," the school claims in the recent report, PropTech 3.0: the future of real estate.

According to the report, there are three sub-sectors (verticals) of proptech globally:

Real estate fintech – platforms which facilitate the trading of real estate ownership;

The shared economy – platforms which facilitate the use of real estate assets, and;

Smart real estate – platforms which facilitate the operation and management of real estate assets.

According to a local report by KPMG and Taronga Group's investment arm Real Tech Ventures – who are in the process of raising $100 million to invest in proptech in Australia and abroad – investment into proptech companies will reach $20 billion by 2020.

The report identified urban planning, design and construction, search, sale and acquisition, leasing and management, data analytics and sustainability as the area most likely to rapidly innovate and attract capital investment.

What next for proptech?

As the market heats up, venture capitalists and established property players alike are starting to take notice and, more importantly, put their hands in their pockets.

Commercial property behemoth Charter Hall just recently launched Australia's first proptech accelerator program, in partnership with Collective Campus that serves to lure entrepreneurs into a 13-week program with up to $400,000 of benefits.

"By combining the agility of startups, and their ability to discover new business models, with the domain expertise, reach, and brand of established corporates, we hope to create a program which can accelerate 12 months of development into three," claims the website.

With over $20 billion of property-related funds under management, this may well just be the ‘canary in the mine’ for a property industry in transition.

If the fintech boom of the last five years has been any indication, perhaps we should all strap-in, it's going to be an interesting ride.

For a list of Australian proptech businesses, check out Disrupt Property.