Portfolios Sales Dominate Record VIC Industrial Scene

Portfolio sales of Victorian industrial property for the year to March dominated a record year which saw total sales of more than $2.145 billion, nearly $600 million up on the long term average, according to Savills research.

Savills Associate Director Research Monica Mondkar said $970 million of the total was sold under national portfolio sales involving Altis, Blackstone, Charter Hall, Duestche Australia, Mapletree and Propertylink.

Funds were the most active buyer purchasing 44 per cent of stock reported sold, while owner-occupiers with 28 purchases, recorded the most transactions. Owner-occupiers were also the most active vendors with 35 per cent of stock reported sold.

Ms Mondkar said sale and leaseback deals offering long term WALEs of 10 years plus were the highlight of owner-occupier sales with Prix Car selling its 810-848 Kororoit Creek Road, Altona North property with a 15 year leaseback and Alex Frasers offloading its three property Laverton North portfolio for $44 million on a sale and leaseback deal with a WALE of 18 years.

The North West region had the most transactions by value with around $845 million in sales or 18 per cent more than the five year average of $715 million, while sales in the South East of $657 million were also up with a 21 per cent rise on the five year average of $517 million.

City Fringe (circa $200 million) and some confidential portfolio sales across all regions, accounted for the remainder of transactions.

Victorian Industrial Director Lynton Williams, said he expected the industrial investment market to continue to provide strong results over the next 12 months and that sustained competition would continue to put downward pressure on yields.

"The industrial investment market is very much a story about yield," he said.

"Why would you not consider a prime industrial asset which is going to deliver you a six to seven per cent plus yield?"That is what’s driving record sales volumes in the industrial investment market and we are going to see more of the same while yields for other property types are offering, in some cases less than half of that return,’’ Mr Williams said.

He said while yield was a key part of the reason for the current strength of the market, investors priced out of office markets, were also now considering blue chip industrial assets in prime locations.

"With competition for office market assets so strong over the last few years some investors have turned their attention to the industrial market and have discovered some prime assets at yields that have been comparatively very attractive.

"Of course the increased volume of buyers in the industrial market has also seen a tightening of yields particularly for prime space in the best locations,’’ Mr Williams said.

Prime yields are now showing 5.75 to 7.25 per cent in Melbourne’s South-East, and 6 to 7 per cent across the North & West and City Fringe precincts.

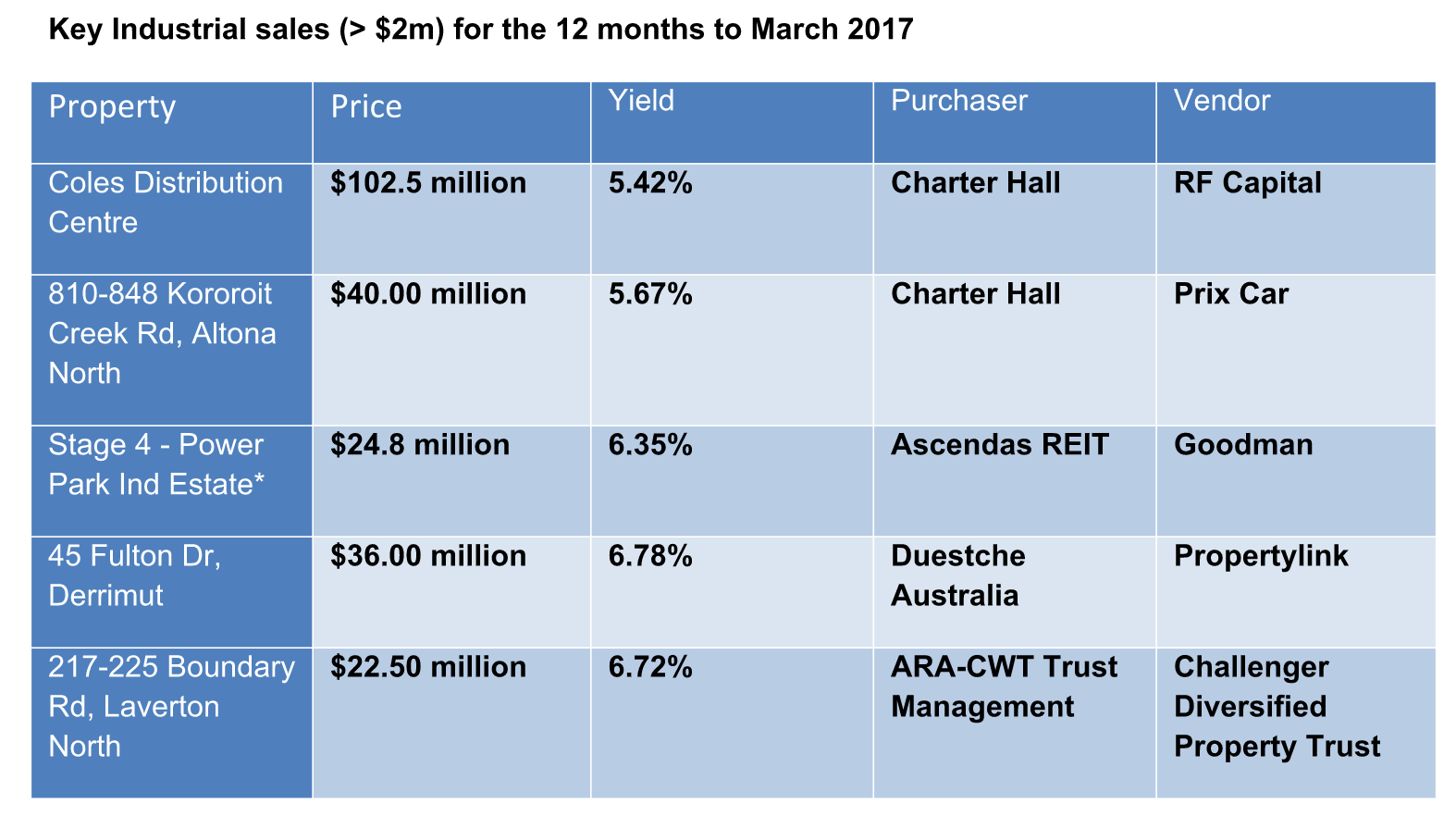

The sharpest reported yield was the 5.42 per cent reflected in Charter Hall’s $102.5 million purchase of Coles Distribution Centre in Doherty’s Road Truganina, while the highest price paid again involved Charter Hall in its $215 fund through deal of Woolworths’ Distribution Centre, at Portlink Industrial Estate, for $215 million.