Brisbane Apartment Market at ‘Turning Point’

Despite the continued decline in off-the-plan transactions, a new report reveals it’s the owner-occupier market underpinning strong demand for inner-Brisbane’s apartment stock.

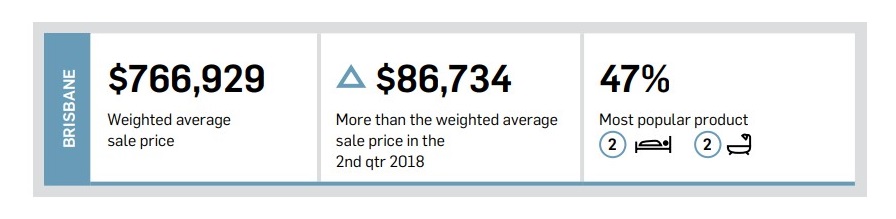

While the quantity of sales dropped to 130 in the second quarter, down from 154 in the first quarter, the weighted average sale price for inner Brisbane’s apartment market increased by $87,000 to a high of $767,000, Urbis research reveals.

“The owner-occupier market were firmly responsible for the increased price-points in the quarter,” Urbis property economics and research director Paul Riga said.

Given the tightening of investor lending conditions and subsequent reduced investor activity, the owner-occupier market made up almost half of all buyers (48 per cent) of inner Brisbane’s apartment stock.

“Importantly, the majority of these sales are in projects that are in presale stage or under construction, which indicates that buyers are becoming more willing to transact off-the-plan if the right opportunity presents itself.”

Riga said the uptick is thanks to two higher priced sales, located in Brisbane’s CBD for $1.28 million and Brisbane's inner east for $1.33 million.

Related: World’s Tallest Man-Made Waterfall Wins Approval in Brisbane

Corelogic data indicates Brisbane’s property market fundamentals are strong in comparison to its southern capital city counterparts.

This was supported by BIS Oxford Economics, which referred to Brisbane’s property market as a "surprise performer" with house price growth of 2 to 3 per cent expected in 2019-20, forecasting greater growth of six per cent in 2020-21.

In its Residential Property Prospects 2018 to 2021 report, BIS' forecast of an oversupply of dwellings in Brisbane’s apartment market will ensure an upside won’t be immediate.

However, Riga believes the turnaround for Brisbane’s apartment market will be sooner rather than later.

“Brisbane is at a turning point."

“There are limited number of projects entering the market, so we’re not going to see that level of supply coming through and this will give demand an opportunity to catch up.”

Project pipeline

Inner Brisbane approvals for the quarter totalled 1674 apartments.

Total approved future supply for Brisbane’s inner south apartment market currently sits at 8481 while Brisbane’s inner north currently has 7,653 approved apartments.

Riga says only 9 per cent of this is currently selling to market, with three to four projects comprising roughly 800 apartments, expected to launch to market next quarter.

“It’s not getting any easier for developers launching new projects, so we aren’t expecting launches to increase over the coming quarters,” Riga said.

“Any new launches have to contain a real selling point, a point of difference, and this has resulted in some exciting potential projects expected over the coming 12 months.”