Lendlease Prepares for ‘Challenging’ 2022

Social distancing protocols across construction sites has knocked 16 per cent in revenue off of listed developer and builder Lendlease’s end of year results.

Despite ongoing site shutdowns and lower productivity globally the company has managed to return its books to a healthier position than the previous financial year.

Lendlease reported that statutory profit after tax reached $222 million for the period, following a $310 million loss in the 2020 financial year.

Full year pre-tax operating profit was up 83 per cent, to $377 million, boosted by a 2.7 per cent gain in construction EBITDA profit thanks to the sale of its loss-making engineering and services businesses.

The result was also supported by reducing costs across overheads, employee expenses, and project expenditure.

The figure, lower than market expectations of $390 million, lead to shares falling by 7 per cent to $11.71 in afternoon trade.

Newly-appointed global chief executive Tony Lombardo said the group was now looking to “reset market expectations”, with a full recovery not expected until 2024.

“Despite Covid impacts, profit recovered and the group made significant strategic progress,” Lombardo said.

“[However] we expect the 2022 financial year to be the cyclical low point for both development production and profitability.

“We are targeting to deliver solid returns across the construction and investments segments, although activity levels are likely to continue to be affected by the pandemic.”

Analysts agreed, noting that 2022 would likely be a cyclical low in the company’s earnings expecting downgrades given the weak development guidance.

USB analyst Tom Bodor said the group return on equity target of between 8 and 11 per cent by 2024 reflected a delay of one year to the group’s financial recovery.

“The 2022 financial year is a ‘reset year’ for Lendlease with development return on invested capital expected to be between 2 and 5 per cent versus a target of 10 to 13 per cent,” Bador said.

Lombardo warned that his strategic review of the business, expected to be released at the end of the month, would continue to centre on “disciplined cost management”.

“The recently announced changes to the organisational structure better position the group to accelerate development production, continue to deliver our construction backlog and grow our investments platform in a more focused and efficient way,” Lombardo said.

“The review of the development portfolio reaffirmed the underlying strength of the $114 billion development pipeline across targeted gateway cities.”

Across the year, Lendlease strengthened its role as a residential developer and landlord adding $8.4 billion in projects to its development pipeline, including six urbanisation projects with an end value of $7.4 billion.

The company that has set itself a target of $8 billion plus worth of production per year by 2014 has a work-in-progress pipeline worth $14.5 billion, $7 billion of which are build-to-rent apartment projects as well as master-planned community products.

The company currently has 22 major urbanisation projects across 10 global capitals, including London, Milan and New York.

Locally, the company’s larger projects include Sydney Place, Victoria Cross and Barangaroo South in Sydney, Melbourne Quarter and Victoria Harbour in Melbourne, Brisbane Showgrounds and Waterbank in Perth.

The company also struck up investment partnerships worth $5.1 billion were formed across five upcoming projects.

Lombardo said the shared approach would help the company drive growth in funds under management, including exposure to the rapidly growing sub-sectors of life sciences and data centres.

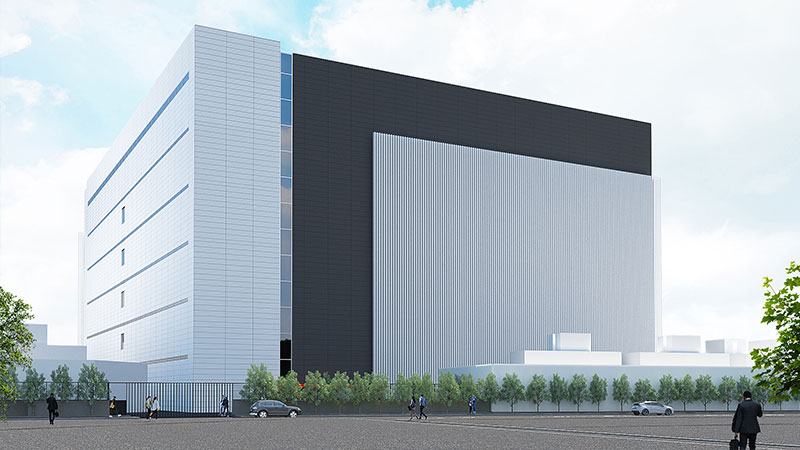

Lendlease shifts gears for hyperscale project

Lendlease will break ground on an $800 million hyperscale centre in Tokyo later this year as demand for data centres continues to surge.

The centre, which will be one of the largest ever delivered in Japan, will span 66,000sq m of office and data racks across a 33,000sq m site.

The project will be delivered by Lendlease Data Centre Partners, funded 20 per cent by Lendlease and 80 per cent a global institutional investor.

Lendlease Japan managing director Andrew Gauci said the centre marked a significant milestone for the group, adding a sizeable project to its global development pipeline.

“The demand for data centres in the Asia Pacific is set to grow exponentially, with internet-related services usage soaring due to the pandemic,” Gauci said.

“This project is of significant scale in a sector of growing importance and will leverage our more than 20 years’ experience in the local communications and data infrastructure space, as well as Lendlease’s broader presence in Japan for over 30 years.”

The group said construction was earmarked to commence later this year with the initial phase to be completed by early 2024.