Vaccine Bid Boosts Property Market Positivity

Confidence in property markets is set to continue to grow following the announcement of a coronavirus vaccine breakthrough and the easing of lockdown restrictions.

US drug firm Pfizer has revealed that early data from phase three trials showed its vaccine was more than 90 per cent effective against Covid-19, spurring minister for health Greg Hunt to move quickly in order to secure 10 million units by March next year.

Markets reacted positively to the announcement with investment and confidence returning to the hard hit retail and office sectors.

The forthcoming vaccine, along with reduced bank loan deferrals, extended budget stimulus and lower borrowing costs have also triggered a sharp rise in consumer confidence and property buying intentions.

According to ME Bank’s latest property sentiment survey, consumer sentiment among buyers and sellers in the housing market has returned to pre-Covid levels.

ME Bank’s survey, which gives an indication of market sentiment based on a snapshot of 1,000 owner occupiers, found that since the announcement of restrictions easing, over half of property owners or buyers felt more confident about selling or buying.

Nearly 40 per cent of respondents in the market said they felt "positive", lifting to just 4 percentage points below the same period last year.

The survey found that 65 per cent of respondents are predicting house prices to increase or stay the same where they live, while 20 per cent are expecting them to decline over the next 12 months—compared to 46 per cent and 41 per cent respectively in April.

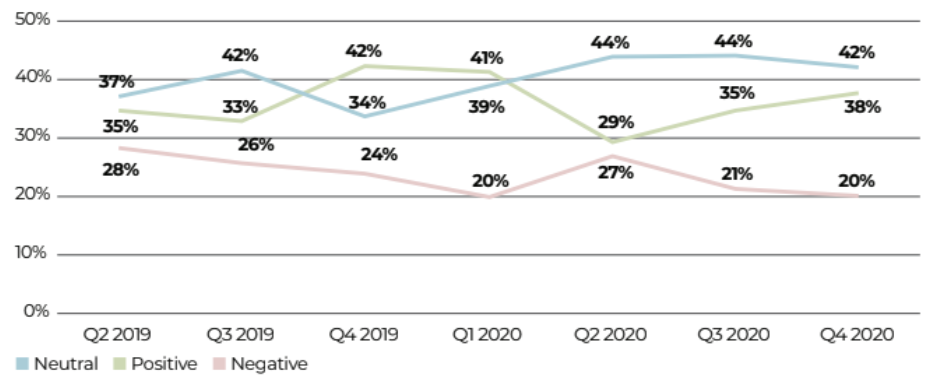

Overall property sentiment

^Source: The ME Quarterly Property Sentiment Report

ME head of home loans Andrew Bartolo said that despite volatility in the market, Australians have a resilient mindset when it comes to property.

“Despite growing positivity and optimism for house prices, there’s still many buyers and sellers who will be more comfortable continuing a ‘watch and see’ approach.

“There are many factors at play, but with the residential property being a prudent investment vehicle and low interest rates, investors seem prepared to weather any property market fluctuations that may occur,” Bartolo said.

First home buyers, up 7 percentage points since October 2019 to 53 per cent, are now the most likely group to purchase.

However, two-thirds of first home buyers pointed to the lack of "choice in the market" while 58 per cent say noted the difficulty to save for a home loan deposit due to the pandemic.

Bartolo expects the cash rate cut at the start of the month to encourage more moves in the market—particularly first home buyers looking to take advantage of the record low interest rates, price falls and reduced investor activity.

Over two-thirds of survey respondents indicated that record low interest rates have made buying or investing in property "more attractive" to them.

Home-owner worries have also clearly started to ease, with only 49 per cent worried about the value of their property falling in October compared to 64 per cent in April.

Sentiment towards housing affordability marginally improved, but remains a wide-reaching concern, with 88 per cent of respondents agreeing "it is a big issue" compared to 90 per cent last quarter.

Expectations on property prices have also returned to within pre-Covid-19 levels.

The Westpac-Melbourne Institute Index of Consumer Confidence has lifted to be 13 per cent above the average over the six months before the economy-wide shutdown in March.

The index, based on responses from 1,200 people, rose by 2.6 per cent in November—the sharpest seen in the history of the series.

The index lifted from 105 in September to a seven-year high of 107.7 points. A reading above 100 points denotes optimism.

Victoria’s consumer confidence has also surged 9 per cent as the first round of easing in restrictions began.

The survey was conducted in the week of November 2-6 before the developments around Pfizer’s coronavirus vaccine and before the second round of easing in restrictions for Melbourne.

Westpac’s house price expectations survey also strengthened, jumping 12 per cent to be only 7.3 per cent below its level in March and 5.5 per cent above its long-term average.

Global ratings firm Moody’s Investor Services said it expects most global economies to begin to turn the corner in 2021, with many governments continuing to unwind their support measures for households and companies.