Interest-only Borrowers Caught in a Trap: Morgan Stanley

Almost half of interest-only borrowers are trapped in interest-only loans, according to analysis by investment bank Morgan Stanley and AlphaWise.

About 650,000 borrowers, with loans up to $230 billion, are “trapped” in interest-only loans and could struggle to refinance.

The survey, which takes in 1800 mortgagors, warns that once the interest-only period ends some borrowers could be forced to sell in an “already deteriorating property market”.

“We found that almost half (45 per cent) of interest-only borrowers would have preferred to be on a principal and interest (P&I) loan, but were either refused by the bank or couldn't manage the higher cash flow,” the analysis said.

These “trapped interest-only” borrowers make up 11 per cent of all mortgage holders and appear higher risk.

“At risk” borrowers who purchased close to the peak of the property cycle would have little to no equity given the slowdown in property market conditions, which has seen prices cool in the past 12-24 months.

More pressure on the housing market

For 60 per cent of trapped interest-only borrowers, their interest-only period ends within the next two years.

“When it does, it is likely that a significant portion will be forced to sell down their property if they cannot extend the IO period and are unwilling, or unable, to move to a principal and interest loan,” the analysis warns.

“This will put further pressure on an already deteriorating housing market.

“Additionally, given their apparent higher risk, while they remain, active borrowers, they are likely to have a higher chance of default or arrears.”

Related: What Opportunities Exist In A Slowing Property Market?

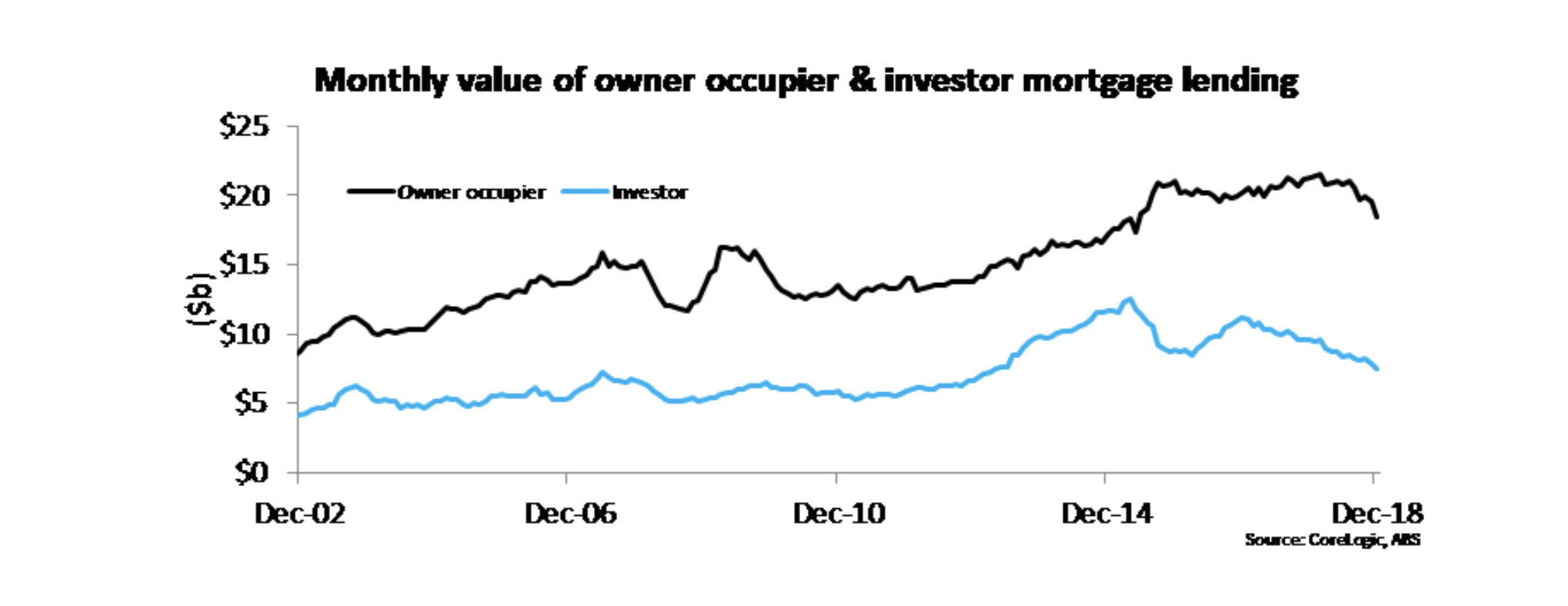

Corelogic data on lending to households shows demand for mortgages has continued to weaken.

Corelogic research analyst Cameron Kusher says new lending to owner-occupiers is the lowest it has been since May 2015, while owner occupier refinances are the lowest they’ve been since August 2017.

Investor new lending is at its lowest value since January 2012.

Related: How Bad Will Australia's Housing Slowdown Actually Get?

Over the month, Corelogic figures show there was a total of $26 billion in mortgage finance to borrowers which was the lowest monthly value since January 2014.

What is the actual driver of the falls?

In its monetary policy statement, the Reserve Bank said demand is falling because of ‘significantly fewer loan applications over the past year or more.’

Kusher says he's not convinced this is the only reason.

“The volumes that eventually make their way to lending teams are likely to be significantly lower but is this actually occurring because of fewer people wanting a mortgage or fewer making it that far?

“I suspect that demand has certainly fallen but possibly it has fallen a greater amount because people are talking to the bank lender or mortgage broker and the feedback they are given is that there is no point applying because with current credit conditions this just isn’t going to get approved.”