Property Investor Retreat: Which State Has Been Hardest Hit?

Property investor activity in the Australian housing market has been falling since early 2015, after macro- prudential policies were implemented in Australian mortgage lending.

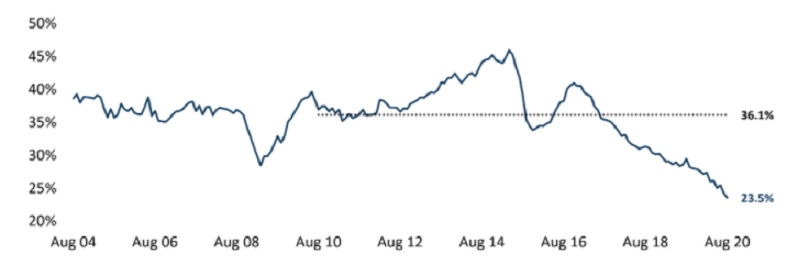

Apart from a brief bounce in 2016, investor participation has been consistently trending lower.

The latest ABS housing finance data shows the portion of housing finance for the purchase of property lent to investors fell to a fresh record low of 23.5 per cent in August. This is significantly lower than the decade average of 36.1 per cent.

The decline of the property investor has been brought about by multiple factors including temporary policies implemented between 2014 and 2019, which limited lending products favoured by investors.

Other factors include mortgage rate premiums for investor loans, less appetite for high loan-to-value-ratio and interest only lending from the banking sector as well as less certainty around prospects for capital gains .

High levels of housing construction have softened rental returns, while the global pandemic has created a particular negative demand shock to the rental market—further inhibiting returns.

But can we expect investor activity to keep declining? When comparing investor activity at the state level with Corelogic rental data, there are clear differences between markets that are may appeal to investors, versus those where the retreat could last longer.

Investor housing finance commitments as a % of total housing finance commitments

^Source: Corelogic, ABS (based on value, excludes refinancing)

For the past decade, investor participation in mortgage activity averaged 41.9 per cent across New South Wales and moved through a record high in late 2014 when investors comprised 55.6 per cent of mortgage demand.

By August 2020, investors as a proportion of housing finance had fallen 28.2 percentage points from that peak, to 27.4per cent.

Across NSW, returns to investors vary greatly by submarket in both the growth of the value of property assets and rental return.

Broadly however, dwelling values across NSW sit 3.5 per cent below the record high reached in July 2017.

Gross rental yields across the state were 3.23 per cent in September, which is just 2 basis points off the record low from October 2017.

Rental market performance has been highly varied through the Covid period.

As one of Australia’s two major international cities, the closure of international borders has created significant shock to the rental market, where new migrants to Australia typically rent.

Outer suburban and regional markets have seen upward pressure on rents, but the wind-back of stimulus to households affected by Covid, and cheaper rents closer to the city, may erode this growth over the coming months.

Ultimately, the biggest boost to investor returns, and an uptick in investor activity, will be dependent on international travel resuming to Australia.

Victoria, namely Melbourne, had the highest exposure to overseas migration as a source of new housing demand prior to Covid, which has significantly impacted rental values, particularly those in inner-city markets.

Across greater Melbourne, unit rents have declined 5.5 per cent, but in submarkets such as Melbourne city, unit rents have seen much more acute declines of -16.2 per cent since March.

Gross rental yields across the state were 3.4 per cent in September, down from 3.7 per cent one year ago.

With dwelling values also down 5.5 per cent across Melbourne, and half a per cent across regional Victoria since the pandemic, investor interest is likely to remain subdued until international travel resumes.

Investors who can afford low or no rental income may take advantage of lower property values towards the market trough.

Investor participation in the Queensland dwelling market shifted significantly lower over 2017, and again with the onset of the pandemic.

Inner Brisbane in particular has seen high levels of unit development, which has placed downward pressure on rents over time.

Since the onset of Stage 2 pandemic restrictions in March, inner Brisbane unit rents have declined a further - 4.8 per cent.

Despite a long period of high supply and subdued investor participation, gross rental yields across the state are far higher than NSW and VIC, largely due to relatively low dwelling values.

A typical dwelling value at September was around $505,000 across Brisbane, and $388,000 across regional Queensland.

Gross rental yields across the state were 4.8 per cent in September, down from 5.0 per cent a year ago.

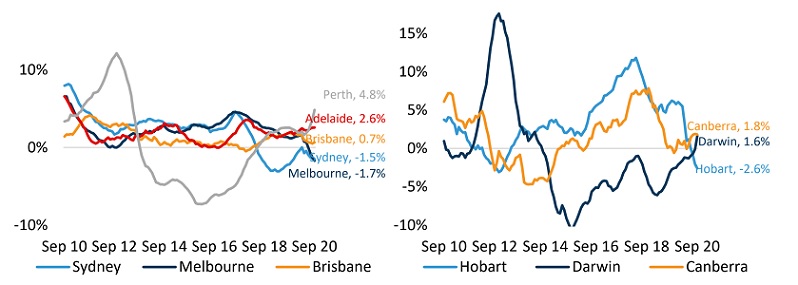

Rolling annual growth in rent values – Capital Cities

^Source: Corelogic

South Australian rental markets have been tightening for the past few years, with positive growth in the Adelaide rental market since 2017.

At September, Adelaide had the second highest annual rent value growth of the city markets at 2.6 per cent over the year, putting rental income growth well above inflation.

Despite the stronger fundamentals, investor participation as a share of mortgage activity has continued to decline.

The portion of investor finance was 20.4 per cent at August, down from the decade average of 31.7 per cent.

However, the rate of decline in investment activity has not been as steep as in other parts of the country.

Between record low mortgage rates, low dwelling prices, volatility and a tightening rental market, South Australia may see an increase in investor participation over the coming quarters.

Western Australia has actually seen a turn in investor participation, and is bucking the general trend of subdued investor activity.

Since bottoming out in April at 14.5 per cent, the share of mortgage finance for the purchase of property to investors has climbed to 17.0 per cent.

This comes after a long period of correction in the Perth property market, which saw momentum gradually gathering in prices and rents from early 2020.

Rental values across Perth grew significantly higher than the national average, at 4.8 per cent in the year to September, which will likely see investor participation continue to rise.

Typical gross rent yields across WA were 4.7 per cent at September, up from 4.6 per cent one year ago.

For years, Tasmania has been a source of strong capital and rental growth.

Between annualised growth and rental return, total annualised return was 12.3 per cent across the state for the past five years.

However, Covid has created a severe disruption to the rental market.

Unit rent values in particular have declined -5.6 per cent, which is the steepest fall of the capital city markets.

The loosening of rental markets since Covid, which has likely had something to do with Airbnb properties converted to the long term market, has provided some much-needed relief for renters.

With a steep retreat in investor participation since March, first home buyers may also face less competition.

However, the return of international and inter-state travel would likely see rental markets tighten once more, as short-term accommodation owners revert their properties in preparation for increased tourism.

The portion of investment across the ACT does not appear to be as disrupted by Covid as other states and territories, but has still trended down over time.

Investor share of mortgage activity has fallen to 24.6 per cent, from a decade average of 32.6 per cent.

Gross rental yields have compressed across the region, from 4.7 per cent in September 2019 to 4.5 per cent at September 2020.

This is likely the result of dwelling value increases since the onset of Covid, and may weaken investor interest in the coming months.

Across Darwin, rental yields are the highest of any capital city market at 5.9 per cent.

However, this is has largely been a function of a long property price correction, where both rent values and property values have declined over time.

The start of 2020 has signalled a recovery in values, with Darwin dwellings up 2.7 per cent from March through to September.

Although investor participation was the lowest of the states and territories at 12.6 per cent, the sheer cyclical correction of Darwin values sees the typical dwelling value at just under $400,000, and may see a gradual recovery in investor interest.

The patterns in respective rental markets suggest that from an affordability and yield perspective, smaller capital city markets may see increasing popularity from investors in the coming months.

For the traditional investor markets such as inner city Sydney and Melbourne, Covid has triggered a further retreat of investors that is likely to last until overseas migration and travel resumes.