Domestic Demand Fuels Prestige Property Prices

Sydney’s prestige residential market is forecast to see price growth of 3 per cent next year, bolstered by domestic demand, a supply shortage and low-interest rates.

The prestige market has continued to perform strongly this year, with price growth in Sydney’s prime market forecast higher than the global forecast of 2 per cent, according to a Knight Frank report.

The Knight Frank Prime Global Forecast 2021 research expects demand for prime Sydney property and prime sales to rise slightly, despite a marginal increase in new supply next year.

In Melbourne, prime price growth is forecast at 1 per cent for next year, with prime sales expected to pick up, although demand is expected to remain lower throughout the year, due to a solid pipeline of new prime supply.

Prime markets are seen as the most desirable and expensive property, generally defined as the top 5 per cent of each market by value.

Earlier this year a Point Piper waterfront estate changed hands for $95 million, at 92 Wolseley Road, in what has been described as “a flight to quality property” being seen in Sydney’s luxury market.

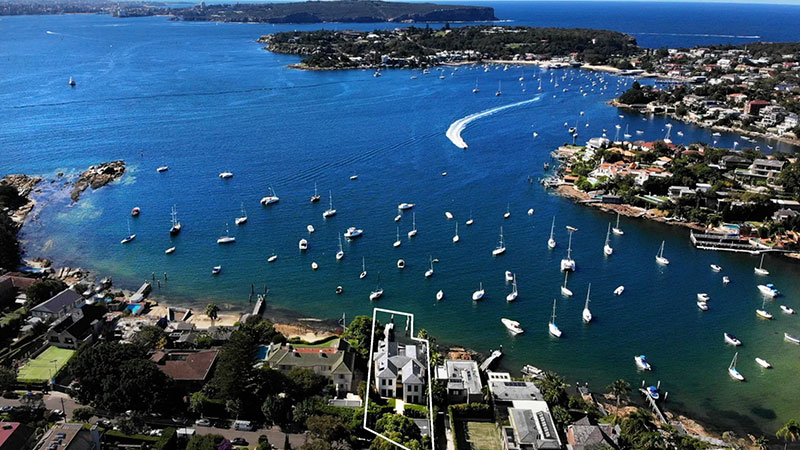

While stock levels are down from this time last year, a sprawling estate with 21-metre frontage to Sydney harbour is currently on the market for $55 million, at 21 Coolong Road in Vaucluse, marketed by Christie’s International Realty.

And a $40 million penthouse at the Kurraba Residences is expected to set a North Shore record when it goes under contract.

High-end buyers flocked to the Kurrabra residences overlooking Sydney Harbour, by Thirdi Developments, with approximately 70 per cent, or around $90 million worth of luxury apartments selling at the project's launch, this month.

Knight Frank head of residential research Michelle Ciesielski says the top three market drivers for Sydney’s prestige sector is pandemic-fuelled domestic demand, a supply shortage and low-interest rates.

While the biggest risks ahead for Sydney’s prime property sector include the global and local economic performance, travel restrictions and the government’s ongoing response to the pandemic.

“While we experienced great challenges this year with Covid-19, our data shows that prime property markets around the world have remained largely resilient, and this has particularly been the case in Australia, with our biggest cities of Sydney and Melbourne continuing to see growth despite lockdowns,” Ciesielski said.

The Knight Frank report, which offers prime price forecasts for 22 cities around the globe in 2021, found Shanghai and Cape Town lead the expectations for price growth next year.

Markets where prime prices are expected to rebound, boosted by low-interest rates, pent-up demand, or tax holidays, include Sydney, London, Paris, Berlin and Madrid.

The report found a handful of markets which saw an unexpected surge this year. These markets include Auckland, Vancouver, Geneva, Los Angeles and Miami, after residents looked to upgrade to larger properties with greater outdoor space.

In these cities, Knight Frank expects price growth to moderate slightly on the back of a busy 2020.

Ciesielski added that the report was undertaken in October, prior to Pfizer’s Covid-19 vaccine announcement, which could positively charge the forecast and stir growth in prime property markets around the globe.

“In 2020, prime prices across the 22 cities are, on average, expected to remain static, before rising by two per cent in 2021,” she said.