South Australia To Become Australia's Most Competitive Tax Jurisdiction

South Australia is set to become the most competitive tax jurisdiction for commercial investment in Australia, as the government’s second stamp duty reform will come into effect.

The stamp duty will be part of comprehensive legislation aiming to make the state’s commercial property market more competitive.

The first cut came into effect on January 1, 2016, with stamp duty to be completely abolished for commercial property on July 1, 2018.

The projected outcome will see transaction costs lowered, removing any disincentive to trade assets and in turn encouraging investors to trade assets more freely, leading to an increase in transactions in the short to medium term.

Colliers International Director of Investments Services Oliver Totani said the savings that could be made with this stamp duty cut were substantial.

“For each $1million investment made, the savings will be $18,125 post July 1,” he said.

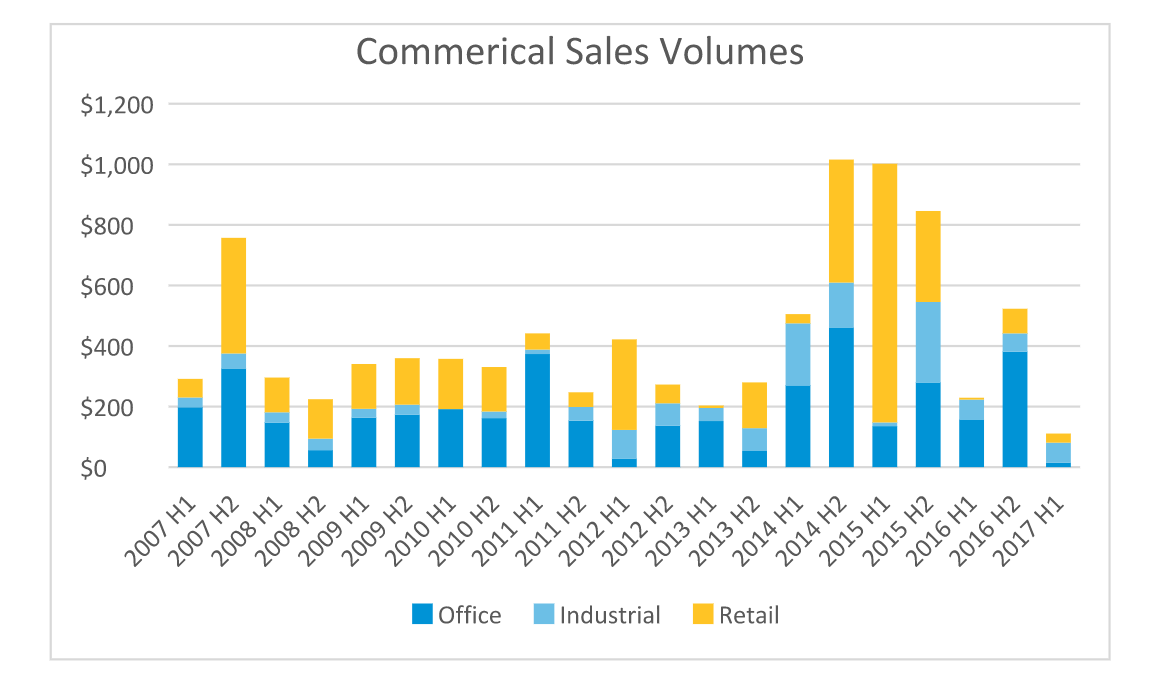

However, Colliers International Radar report said the pending cut stalled commercial property market activity during the first half of 2017, with transaction volumes significantly lower than average as buyers wait for July 1 to purchase.

The current sales volumes for properties more than $5 million saw $111 million of assets change hands in the six months to June 2017, compared to $523 million in the second half of 2016 and $229 million in first half of 2016.

“It would seem the impending cut in stamp duty is delaying the decision to purchase,” Mr Totani said.

“We are seeing increased enquiry in the Adelaide market from a range of investors but many are holding off on committing until post June 30, when the next step down in stamp duty becomes effective.

“We are currently holding several assets back from the market so we can ensure buyers have no risk in receiving the cost savings.”

Colliers International associate director for Research, Kate Gray, said an increase in activity was expected for the second half of 2017 with many vendors holding off from the market until the next cut of stamp duty.

Ms Gray said the savings were about $18,000 per $1million dollars spent at each interval of reforms, generating significant incentive to wait until the cuts were effective.

“Although there is an incentive for purchasers to wait, the increase in the buyer pool post the cut could push property prices up,” she said.

Mr Totani said the Adelaide commercial property market offered exceptional value for investors when compared to Sydney and Melbourne.

“There is growing interest from institutional, offshore and eastern-seaboard investors looking for yield margins, and we expect that this reduction in transaction costs will provide further assistance in widening the gap between Adelaide and Sydney or Melbourne,” he said.