Savills Fringe Office Report: Quality CBD Styling, Fitout Essential

According to Savills, the Brisbane fringe office market comprises the five precincts - Urban Renewal (Fortitude Valley, Newstead, Bowen Hills and Herston), Inner South (South Brisbane, West End, Woolloongabba, Kangaroo Point, East Brisbane and Greenslopes), Milton, Spring Hill and Toowong and contains approximately 1.2 million square metres of lettable office space. Savills Brisbane Fringe Office Report, below, hones in on these select hubs using past data to assess performance and predict future expectations for these markets.

According to Savills December 2016 Full Floor Report there were 82 full floors available for lease in the Fringe.

Fringe Office Market

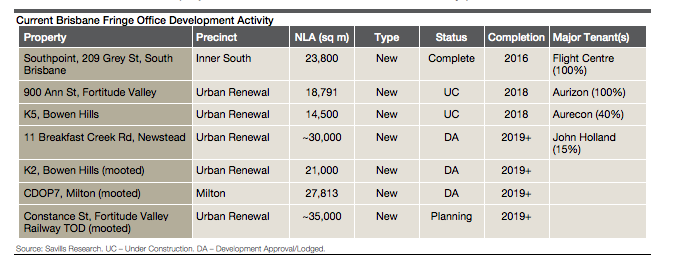

The fringe office market saw the completion of Southpoint during the last quarter of 2016, adding 23,800 square metres of stock. The year ahead will see no new stock added, however 2018 will see the addition of two new buildings. Only two office developments remain under construction including Fortitude Valley’s fully pre-committed 900 Ann St, along with Lend Lease’s second office tower ‘K5’ within the King Street redevelopment precinct, which began construction in the last quarter of 2016. At the time of reporting, Aurecon remain the only tenants to have precommitted to K5, having agreed to lease around 40 percent of the end office space. Both due for completion in 2018, the two buildings combined will add approximately 35,000 square metres to the Urban Renewal precinct, which continues to attract the greatest tenant demand and subsequently the highest office occupancy levels of all the precincts within the Fringe office market.

The below table shows projects under construction and those that may proceed in the medium-term:

Sales Activity

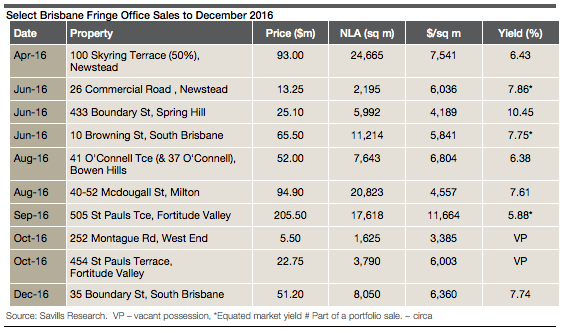

Savills have recorded approximately $846 million worth of office transactions in the 12 months to December 2016 in the Fringe area. This is up 11 percent from $759 million in the previous year, and up on the five year average of $692 million. During the same period 30 properties were sold, down from the previous year of 39, and up on the five year average of 25.

The 'Urban Renewal' precinct continues to record the greatest volume of sales activity during the 12 months to December 2016 with $509 million worth of office transactions, contributing to 60 percent of total sales for the period. This is down on the previous year of $627 million, yet up on the five year average of $401 million.

Outlook

In line with the CBD, the Fringe office market looks to have turned a corner with improved leasing activity over the 2016 calendar year. Looking forward it is expected that this level of tenant demand will slowly gather momentum with flight to quality remaining the predominant trend. This may encourage developers to begin to consider office development projects as the residential market reaches its peak. With little new stock due for completion in the next two years, occupancy levels are expected to continue to improve.

Given the amount of office space still available across metropolitan Brisbane, smaller tenants in particular are likely to continue to take advantage of the competitive rental environment in the CBD with quality fitout a key consideration