What’s Driving Rents to Record Highs?

So, you think you know why rents climbed.

You probably think was skyrocketing interest rates and a tsunami of migration.

It’s true that interest rates have jumped more over the past year than at any time on record, and it’s true that migration has roared back—in the six months to September 2022 (the latest month for which we’ve official figures) arrivals exceeded departures by 170,000.

But here’s the thing. Advertised rents began climbing sharply in late 2021—six months before the Reserve Bank began pushing up interest rates, and at a time when it was forecast not to.

And “net migration” was negative back when rents were taking off – meaning the number of arrivals didn’t even match the number of departures.

It’s supply and demand

Something else made rents move.

As it happens, there’s no particular reason to think interest rates would have quickly affected rents even if they had been climbing.

If higher rates force some landlords to sell, and they sell to other landlords, the number of properties for rent won’t change.

If those landlords sell to owner occupiers who would otherwise rent, they cut both the number of rental properties and the number of renters.

What matters for rents, as for any price, is the demand for and the supply of the product being priced. More demand (more renters wanting properties) and the price climbs.

More supply (more properties available for rent) and the price falls.

On the face of it, neither demand nor supply was changing much during COVID as rents started climbing. Australia’s population was growing more slowly than at any time in modern history. And, as best as we can tell, the number of properties available for rent was climbing, albeit weakly.

What did change during Covid, according to the research department of the Reserve Bank, was the average number of people per household.

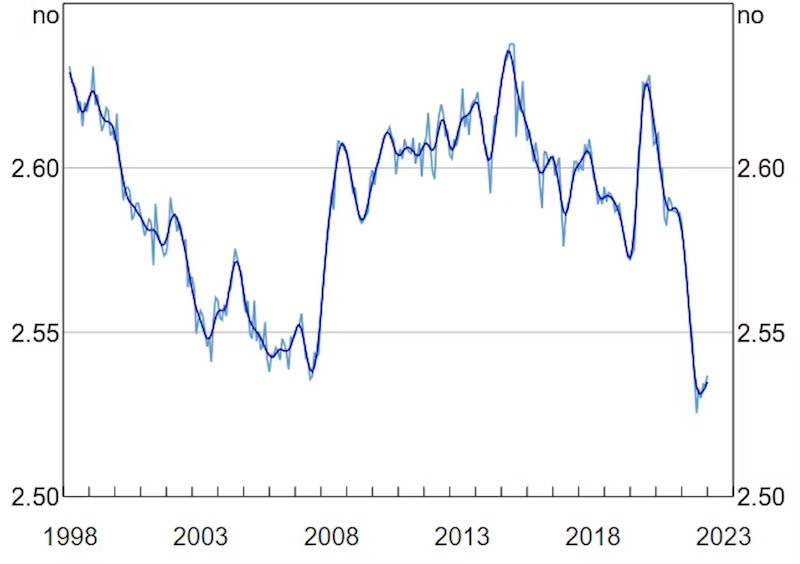

The change doesn’t sound big—the average fell from a bit above 2.6 residents per household to a bit below 2.55—but applied to millions of households it meant about 140,000 more houses and apartments were needed than would have been.

Average household size (capital cities)

The sudden change was awfully hard for the building industry to respond to, especially when it was laid low by Covid.

Why did we suddenly want to live with fewer people?

The head of the Bank’s economic division, Luci Ellis, thinks it was Covid itself, and lockdowns. We suddenly became more precious about sharing space.

‘Love the one you’re with’

Ellis says proportion of Australians living in group houses declined and stayed low. Faced with the choice of living with a large number of housemates and just one other person, perhaps a romantic partner, a lot of renters left group houses and shacked up with each other.

As she put it last year: “On the question of who you would rather be locked down with, at least some Australians have voted with their removalists’ van, by moving out of their share house and in with their partner.”

There’s more to it of course, but where the supply and demand for anything are roughly in balance (rents had been increasing by less than 1 per cent per year in the four years before Covid, and fell in the first year of Covid) any sudden change in either supply or demand can move prices quickly.

Advertised rents aren’t typical…

Having said that, for most renters prices are still moving slowly. Advertised capital city rents are up 13 per cent over the past year, and advertised regional rates up 9 per cent. But average rents (the average of what all renters pay) are up only 4.8 per cent.

The rents charged to ongoing tenants climb much more slowly than the rents charged to new tenants, in part because landlords often like their tenants, and in part because for the first year renters are usually on fixed contracts.

But over time as renters move home, and landlords become less squeamish, more and more renters tend to pay the rents advertised. It makes the increase in advertised rents an unwelcome sign of what’s to come.

…but they’re a sign of rents ahead

And it might get worse. Reserve Bank Governor Philip Lowe says population growth is set to climb to 2 per cent—near the peak reached during the resources boom.

We won’t be able to build houses anything like that fast. Lowe says the last time Australia’s population surged it took about five years for housing supply to fully respond to housing demand.

We’ve ways of dealing with it of course. One is to re-embrace group homes, another is to delay moving out of our parents’ homes, or to move back in.

But even if this does happen, Lowe says, with typical understatement, that rent inflation—ultra-low before Covid—is likely to stay “quite high” for some time.

Author

Peter Martin

Visiting Fellow, Crawford School of Public Policy, Australian National University

This article is republished from The Conversation under a Creative Commons license. Read the original article.