Regions Shine as Hotel Sector Soaks Up Travel Renaissance

Pent-up demand for travel means that regional and coastal assets are performing extraordinarily well in a fast-recovering market, according to ResortBrokers’ managing director Trudy Crooks.

Specialist accommodation agency ResortBrokers has been in business since 1985 and has seen trends in the hospitality and accommodation sector come and go.

But a move towards investing in the repositioning of assets has been a major step change in the accommodation industry in the past few years according to Crooks, who will be speaking at The Urban Developer Hotel Development vSummit on April 27.

“In particular, this repositioning is happening in regional and coastal towns, where older properties, which were originally located on the outskirts of town have been built around and are now in prime locations,” she said.

These older properties have major potential in the eyes of investors looking for exposure to the resurging tourism industry.

“Older properties can, for instance, have bigger rooms, which makes them perfect for repositioning. They can be gutted to deliver an even higher standard of offering. We’ve seen a few transactions like that up and down the coast,” Crooks said.

Hotels and hospitality businesses were forced to pivot to domestic rather than international travellers during Covid, which led to the emergence of new tourism hotspots.

CBRE recently reported that domestic overnight travel has surpassed pre-pandemic levels in the domestic-demand dominated states of Queensland, SA, WA and Tasmania.

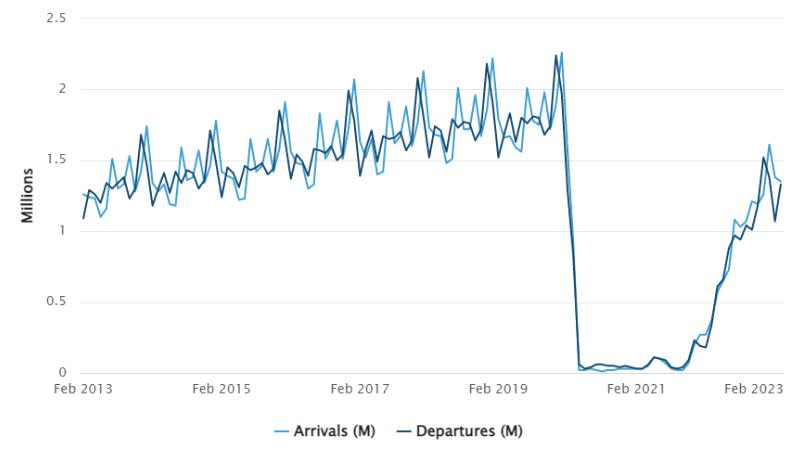

According to the Australian Bureau of Statistics the number of international travellers has risen again, but has not yet returned to pre-Covid levels.

Total overseas arrivals and departures over a decade

“Internationals are barely back yet, so that is putting the spotlight on new places, which has been so encouraging,” said Crooks.

“That includes all those good-sized regional places like Geelong, Port Macquarie, Yamba and the Central Coast—you just can’t get enough properties there. There are a huge amount of transactions happening.”

Not only are domestic tourists happy to stay at home, but according to CBRE they are spending more, an estimated 40 per cent on pre-pandemic spending in the aforementioned states.

This has had an impact on yields and investor interest, Crooks said.

“The biggest question with purchasers, if they're not repositioning, is around financial sustainability, given that domestic tourism has driven demand for locations, which were previously not considered holiday locations,” she said.

“We’re seeing a lot of continued trend of the big funds wanting to buy regional coastal assets, and that new capital is definitely compressing yields, yields have stayed tight.”

Average Daily Rates (ADR) experienced “extraordinary growth” in 2022, according to CBRE, outperforming pre-pandemic rates across all major markets.

Nationally, ADR is up 24 per cent over the year to $228 and occupancy is just 10 per cent shy of pre-pandemic levels at 65 per cent.

But it’s not just regional areas that are growing momentum. City locations are back in business too, Crooks said.

“The cities are really coming back. Occupancies are really strong. The difference is that Brisbane is probably the most in-demand location right now.

“It was always the dodgy cousin, especially with operators and bigger buyers, but now everyone wants a property in Brisbane.

“The other thing we’re seeing is developers looking to build new hotels. Build costs are obviously a massive challenge, but with tariffs and occupancies higher, it’s starting to stack up again, particularly as an alternative to residential.

“So we’re working with developers in the residential space, and we’re having a lot more conversations to work through feasibilities.”

After a dark time, the accommodation and hospitality industry is returning to its former glory, Crooks said.

“People are getting used to spending more, and there are lots of good news stories. It’s really a great time to be in the industry.”

The Urban Developer Hotel Property Development vSummit will take place virtually on Thursday, April 27. Click here to register and learn more.