Rate Cuts Likely as Business Confidence Takes a Hit

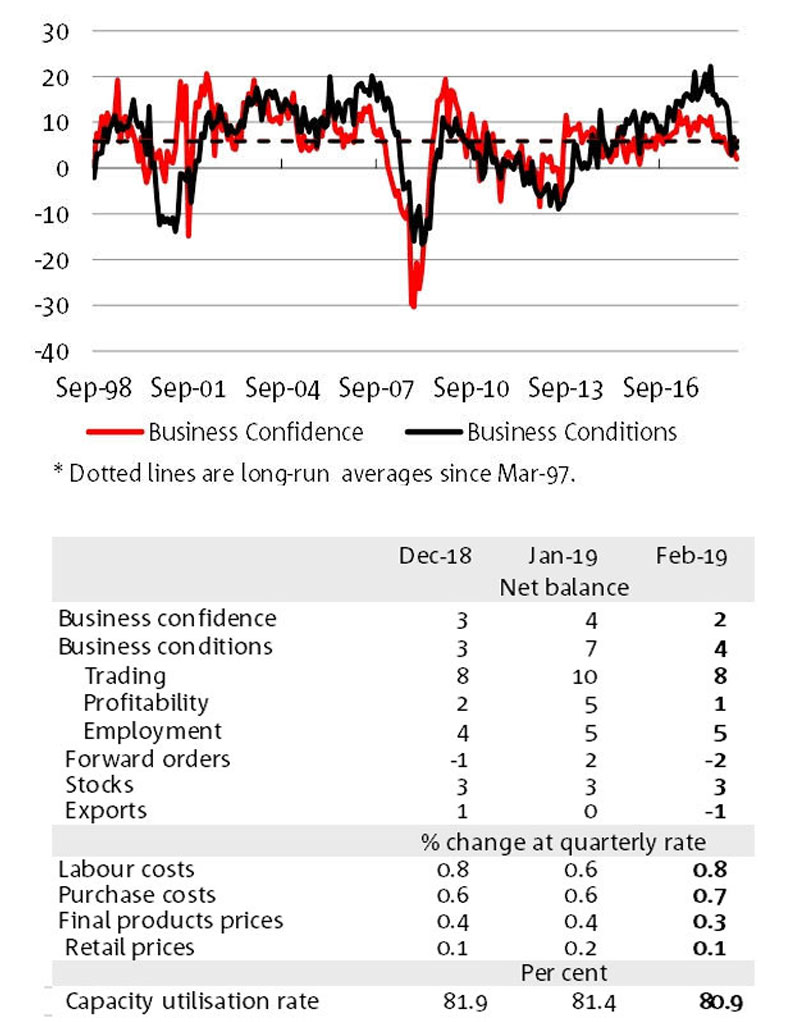

Just about every indicator in NAB’s monthly business confidence survey softened in February, with the loss of momentum experienced in the latter half of 2018 continuing into the first quarter of this year.

Business conditions and confidence declined in February to below-average levels, driven by falls in profitability and trading sub-indexes, while retail remains the weakest industry by some margin.

The survey, which was based on a larger sample size in February, suggests that conditions have “materially deteriorated further to below average levels in 2019”.

“Forward looking indicators point to an ongoing weakness in business conditions,” NAB chief economist Alan Oster said.

“Confidence remains below average; forward orders are negative and capacity utilisation is trending lower. This may have important implications for both future investment and employment decisions of business,” Oster said.

Capacity utilisation is one of the key indicators monitored closely by the Reserve Bank.

NAB has now joined the chorus of experts calling for cash rate cuts, which are looking more and more likely as income and spending growth weakens.

NAB chief economist Alan Oster said that the RBA will likely make two rate cuts in the 2019, taking the interest rate to just 1 per cent by November.

Related: Interest Rates Dictate House Pricing: RBA

Housing finance records biggest annual decline since GFC

NAB's survey adds to weak housing finance figures released on Tuesday, with the ABS figures recording a 2.4 per cent fall in January.

Housing finance for construction and the purchase of new homes declined by more than 20 per cent from a year ago – the largest annual decline since 2008.

“After five years of a sustained building boom, market confidence fell away in the later part of 2018 as dwelling prices corrected, adversely impacting all segments of the market,” HIA chief economist Tim Reardon said.

“Investors and owner-occupiers are delaying purchase decisions and foreign investment has also fallen dramatically for numerous reasons.”

Lending declined at an accelerated pace over the quarter. In the three months to January 2019, lending to owner-occupiers and new home buyers were down by 11.5 per cent in NSW, 15.4 per cent in Victoria and a whopping 29 per cent in Queensland.

South Australia and Western Australia recorded 8 per cent and 7.4 per cent declines respectively, while Tasmania figures dropped 1.7 per cent.