Protect Property Transactions With New Technology

In NSW, off-the-plan property buyers will soon be better protected as long-awaited legal changes come into effect this month.

Buying off-the-plan has become increasingly popular, and real estate agents need to be up to speed on these new legislative changes that may affect their clients.

Off-the-plan developments are becoming more popular across Australia, and in Sydney, many developments are becoming their own communities—Harold Park, Green Square and Central Park in Chippendale are a few great examples.

As more and more off-the-plan development communities are popping up, and these legal changes come in to effect, conveyancers, real estate agents and developers will need to become more accountable to buyers.

To assist with this accountability, real estate agents can rely on their technology provider to support them through legislative updates and simplify workflows.

New legislation reinforces how important it is for all parties involved in a property transaction to conduct their due diligence.

Even with off-the-plan developments. While technically due diligence can only be conducted on existing properties, it is important to make sure the relevant statutory protections are in place to protect all those involved.

A key factor in protecting your clients is understanding their cyber security concerns and safeguarding their deposit. This is a key part of ensuring that all due diligence is met in preparation for sale.

When considering the purchase of an off-the-plan property, help your clients research the developer and find ways to protect your clients from hackers or developer bankruptcy or insolvency.

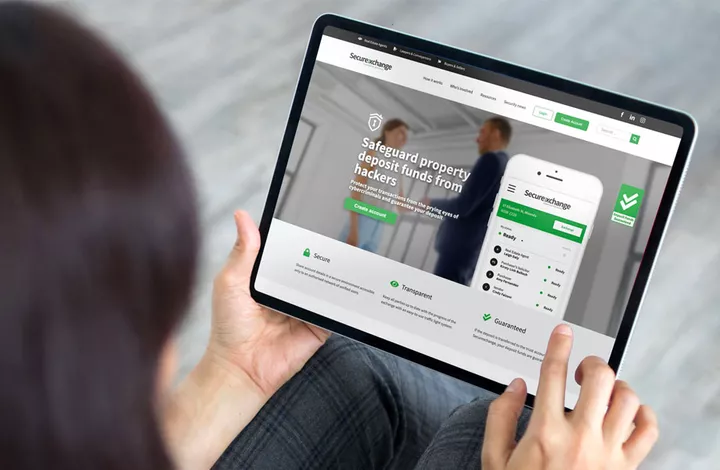

Securexchange is smart technology that can help lawyers and conveyancers to protect property transactions. It allows real estate agents, property lawyers and conveyancers to share account details in a secure environment accessible only to an authorised network of verified users.

Imagine this: You share bank details to purchasers via email and SMS. Unfortunately, this leaves you open to the rising trend in hackers intercepting your email or text messages and posing as you, sending a further communication to your client “updating” them about new deposit account details, thereby redirecting the deposit into fraudulent bank accounts.

A successful hacking attempt can lead to significant financial loss, reputational damage and insurance and litigation issues.

Remember that hackers pick opportunities, not victims. Scamming attacks don’t just happen when you respond to dodgy emails. Hackers can find more sophisticated ways to trick you and your clients unexpectedly.

Real estate agents need to protect their client’s sensitive information and should use software tools to do so. The key to Securexchange is that only verified parties can view trust account and deposit information, streamlining communication between those parties and offering transparency over the progress of the exchange.

Hackers aren't just after bank details anymore, they're focused on infiltrating large value transactions. The property market is especially alluring as it involves constant high-value money transfers between several parties.

Hackers become experts at breaking into email accounts and following transactions as they progress, so they can strike while the iron is hot.

Now, with new legislation and the need to meet client demand, real estate agents, conveyancers and developers need solutions like Securexchange to manage off-the-plan developments, conduct due diligence and keep client information safe.

Smart technology helps to meet volume demands and manage administrative tasks, enabling you to focus on strengthening client relationships.

Click here to find out more about how you can safeguard your client funds from cybercrime.

The Urban Developer is proud to partner with InfoTrack to deliver this article to you. In doing so, we can continue to publish our free daily news, information, insights and opinion to you, our valued readers.