Few Positives Ahead for Renters in 2024

The tough conditions for renters, off the back of historic low rental vacancies, will persist in 2024, according to fresh research.

The REA Group’s quarterly PropTrack Rental Report December 2023 found new rental listings on its website in December were 4.6 per cent lower than a year ago, and 20.7 per cent lower than the 10-year average for the month.

Total rental listings were at a record low, falling 4.7 per cent annually to sit 30.2 per cent below the December decade average.

The report said demand based on the number of enquiries per rental listing on its website remained at elevated levels after climbing 3.3 per cent during the year.

Limited supply and high demand meant rental prices skyrocketed in 2023, with the median advertised rent on the website rising 11.5 per cent the year to $580 a week.

However, there was a slower rate of rental price growth in 2023 than the 15.6 per cent increase in 2022.

PropTrack economic research director Cameron Kusher said the rental market was characterised by low supply and strong demand in 2023.

“These conditions made it difficult for renters to find accommodation and saw landlords increase rents, a trend likely to continue in 2024,” Kusher, who authored the report, said.

“While we expect rents to continue to rise this year, it’s likely that the rate of growth will slow.

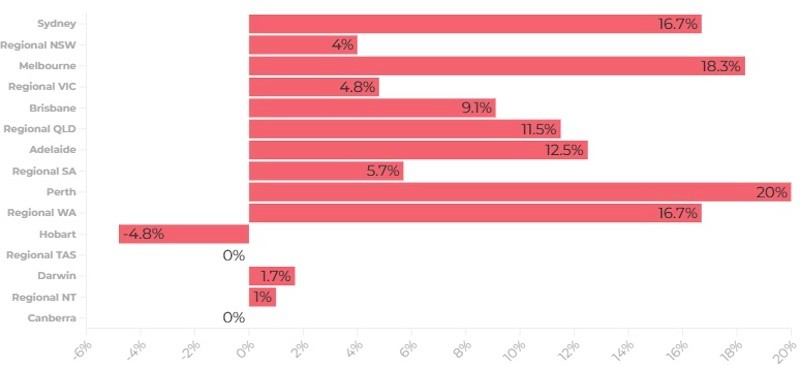

Annual change in median weekly advertised rents December 2023

“The already higher cost of renting and overall increase in the cost of living will limit rent price increases.

“For renters hoping to purchase a property, higher rents are making it difficult to save a deposit, while higher interest rates will make servicing a mortgage more expensive.

“Nationally, investors are still exiting the market. There has been a rebound in new investor lending this year, but it is not enough to sufficiently improve stock levels.”

The report also found that the national rental vacancy rate remained near record lows at 1.1 per cent, lower than the 1.3 per cent recorded in December of the previous year.