Office Markets Entering a “Golden Period”: Dexus

Australia's largest office landlord, Dexus Property Group has announced a $1.26 billion full-year profit as it capitalises on positive trends in the Sydney and Melbourne office markets.

Dexus chief executive Darren Steinberg predicted another two years of strong growth in Sydney and Melbourne.

“Property is a long dated asset class and successful property companies focus on the long term. Five years ago we updated our strategy, building on our foundational strengths of office ownership and funds management to enhance our position in the Australian property market. In that time we have provided an annualised total security holder return of 17.4% and grown our total funds under management from $12.9 billion to $24.9 billion, and we are well positioned to continue the momentum we see in our business today.

“In FY17, we delivered on what we set out to achieve operationally, and for the first time the group has achieved gender pay equity for like-for-like roles. We have a positive outlook for FY18 with guidance for distribution per security growth of 4.0-4.5%,” Steinberg said.

CFO Alison Harrop said: “All of our earnings drivers have contributed positively to this year’s result, and despite remaining active with transactions we maintained our balance sheet strength, positioning us well for FY18.”

Dexus’s net profit after tax was $1,264.2 million, an increase of $4.4 million from the prior year. The key drivers of this movement included funds from operations (FFO) which increased by $6.9 million resulting in FFO per security of 63.8 cents, an increase of 1.1%; and net revaluation gains of investment properties of $704.7 million, representing a 6.5% uplift across the portfolio, were $109.7 million lower than the prior year. This was largely offset by the change in fair value movements in derivatives and interest bearing liabilities and gains from the sale of investment properties compared to FY16.

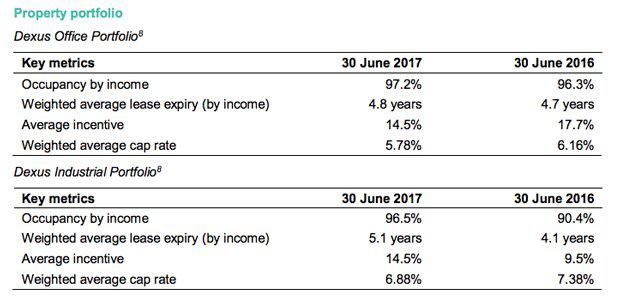

Valuation gains across the property portfolio were the primary driver of an increase of 92 cents in NTA per security to $8.45 over the year. The valuation uplift reflected tightening capitalisation rates supported by market sales evidence, in addition to leasing success and rental growth achieved at office properties, dexus.com and completed industrial developments. At 240 St Georges Terrace in Perth, the impending lease expiry of Woodside in FY19 and the current Perth market conditions contributed to a 17.5% devaluation at this property.

Distribution per security was 45.47 cents for the 12 months ended 30 June 2017, up 4.5% on the prior year, with the payout remaining in line with free cash flow, in accordance with Dexus’s distribution policy. The second half distribution per security of 23.7¢ will be paid 29 August.

Steinberg said the group would focus its investment strategy on Australia’s major cities, and it was riding the trend of urbanisation by winning approvals for more complex schemes on its CBD towers and was proposing technologically advanced towers in and around major cities.