Opinion: It’s Not Too Late To Invest In Property

By Michael Yardney

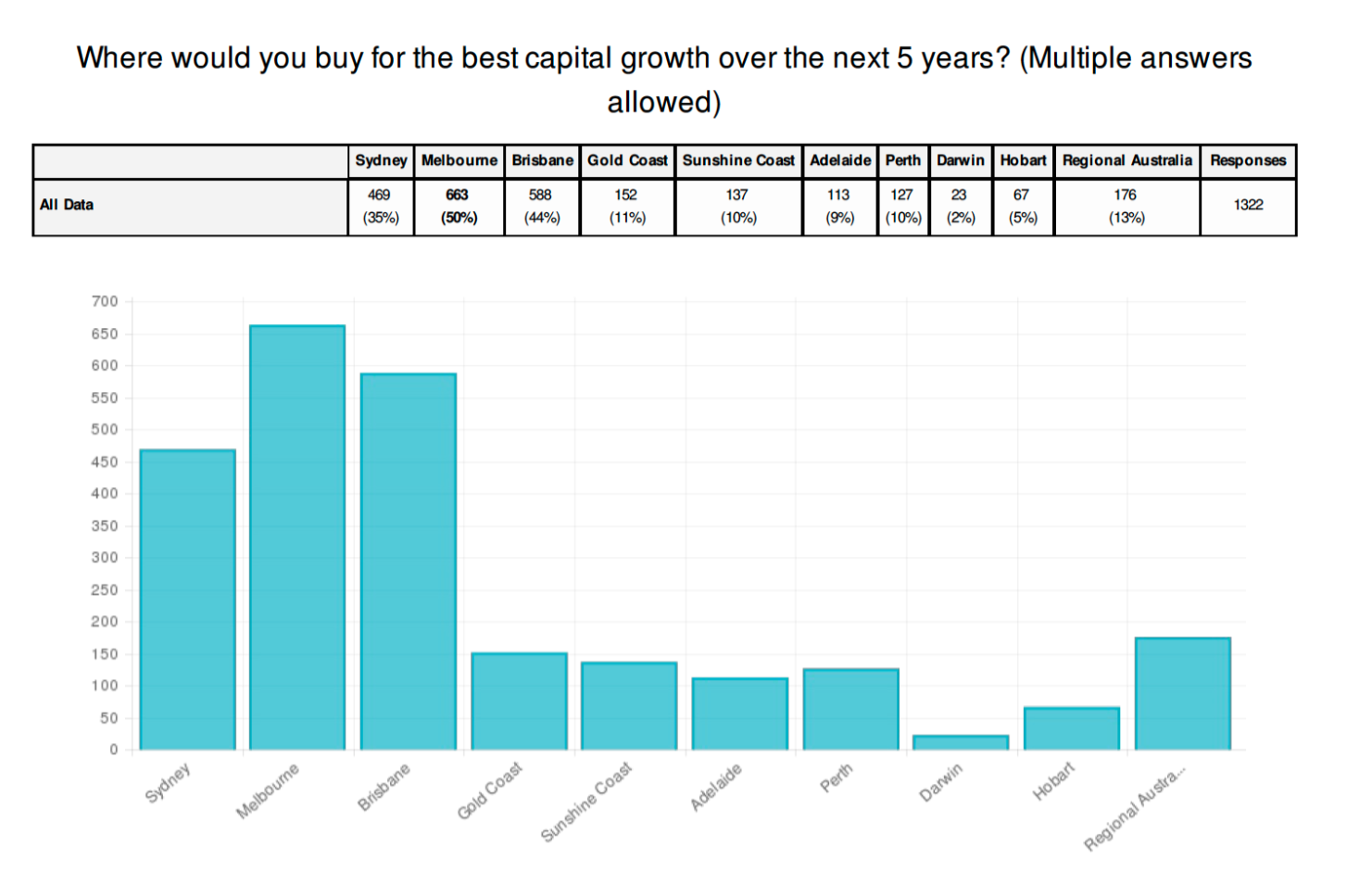

It's not too late to invest in this property cycle, and Melbourne is likely to deliver the best capital growth over the next five years.

These are some of the findings from Australia's largest survey of residential property investors conducted by Michael Yardney's Property Update together with Kevin Turner's Real Estate Talk in December 2016.

The survey gathered insights from 1,322 property investors and budding investors, with more than half of these planning to buy an investment property in 2017.

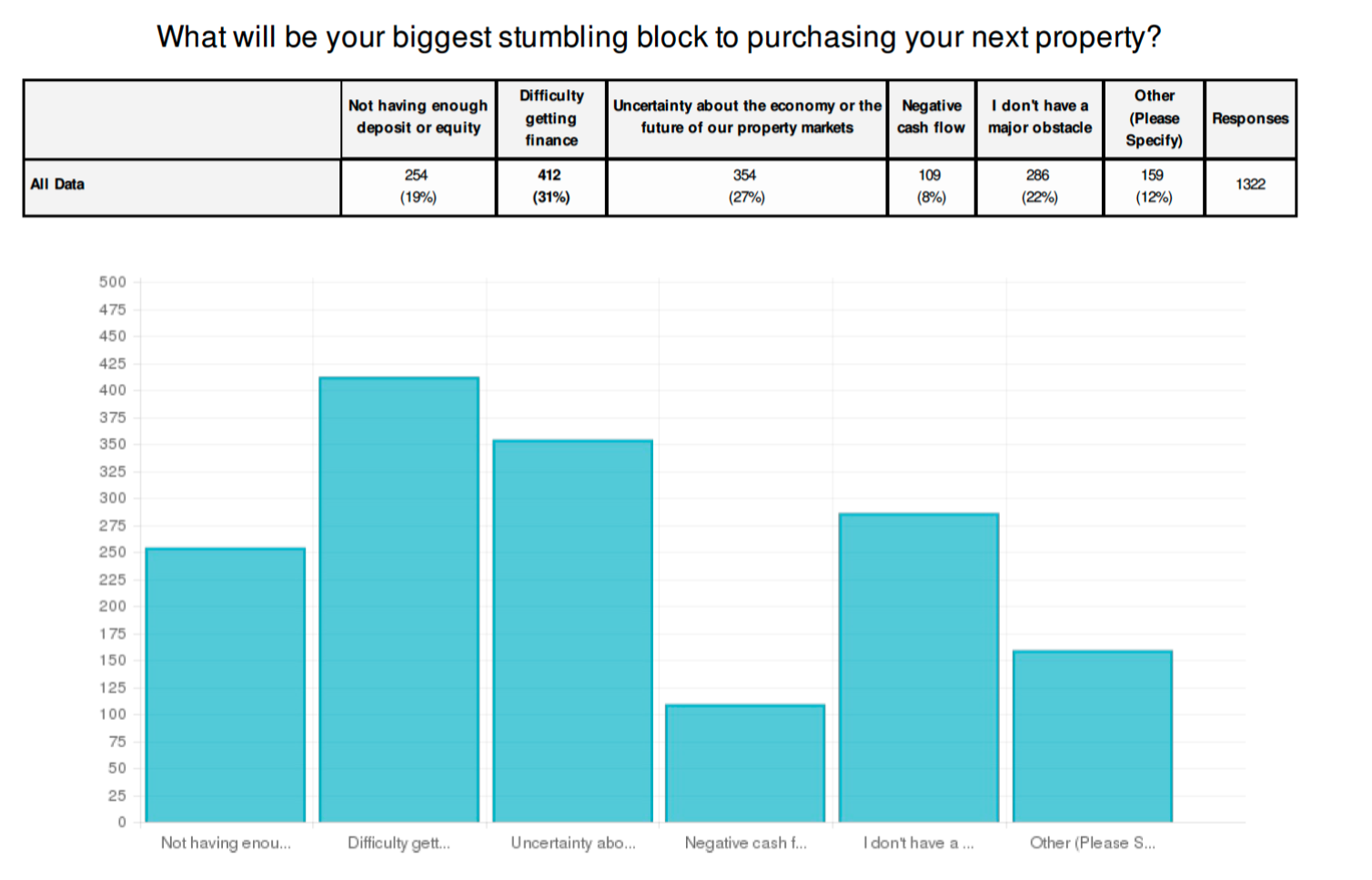

However, 31% of respondents thought that difficulty getting finance would be a stumbling block for them in the coming year and 27% were concerned about the economy and the future of our property markets.

Yet despite the many mixed messages in the media, and the expectation of lower capital growth over the next few year, 54% believe it's still a good time for them to invest with the majority of the investors feeling that a detached home in the Melbourne or Brisbane property markets will deliver the strongest capital growth over the next five years.

2016 Property Investor Survey - Key Stats at a Glance

There were 1,322 respondents

84% owned one or more investment properties, with 47% owning more than three properties

Long-term capital growth is the preferred investment strategy for 60% of the respondents

37% of investors have a negatively geared property portfolio

52% of the respondents were planning to buy an investment property in 2017 while only 14% were to buy a new home.

However differently getting finance was likely to be an obstacle for 31% of investors looking to buy a property in 2017.

The booming Sydney property market is still popular with 35% of respondents thinking Sydney would deliver the best capital growth over the next five years, however Melbourne was the most popular location for consistent capital growth (50%), followed by Brisbane (44%)

The overwhelming majority of respondents (56%) felt a detached home in a suburban block of land in an inner or middle ring capital city suburb would make the best investment over the next five years, with less than 1% of investors looking to buy an off the plan property.

41% of respondents thought the Australian property markets would rise less than 5% in 2017 while 20% thought property values would remain steady throughout the coming year.

44% of respondents thought it was a good time to fix interest rates.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.