Mapletree Offloads Mac Park Office Block for $101m

Singapore-based Mapletree Investments has continued to divest Australian office property with the sale of a major A‑grade building in Sydney’s north-west.

Mapletree sold the nine‑level office at 78 Waterloo Road, Macquarie Park, about 18km from the CBD for $101.25 million to Growthpoint.

The building comprises 14,910sq m of A-grade space and generates about $7.4 million in annual rent.

Completed in 2009, the asset is on a 5496sq m site and includes large floorplates, a gym, laboratory fitouts and is 90 per cent occupied.

Six weeks ago, Mapletree traded an Adelaide CBD office asset for about $200 million and late last year it offloaded 147 St Kilda Road, Melbourne, for $90 million to billionaire Solomon Lew who chairs Premier Investments, the owner of Peter Alexander and Smiggle.

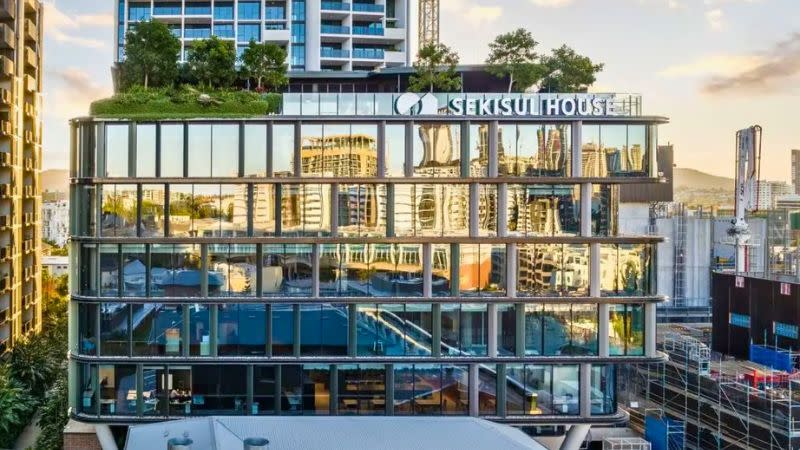

Meanwhile, Sekisui House has sold its six‑level Greenhouse office at 9 Wilson Street in Brisbane’s West End on a second attempt launched mid-last year for $60 million.

The property had initially been listed about $75 million upon completion in 2023.

The A‑grade office forms part of Sekisui House’s West Village masterplanned project and maintains high occupancy, long weighted average lease expiry, and sustainable design certifications.

The buyer is believed to be a partnership between a Queensland investor and a Singaporean sovereign wealth fund.

The $1.2-billion precinct comprises eight buildings on the 2.6ha site, less than 1km from the Brisbane CBD.

In 2022, Sekisui sold the retail component of the precinct to Centuria for $202 million.

Also in Brisbane, Arcana Capital has acquired a CBD office at 126 Margaret Street for $27.43 million.

The building is near major infrastructure projects, including the Cross River Rail Albert Street Station, Queens Wharf, the Kangaroo Point Green Bridge and the Dexus Waterfront Precinct.

The office offers 5544sq m of net lettable area and parking for 48 cars.

The transaction reflected a yield of 8.96 per cent and a rate of $4948 a square metre.

The building’s income is largely derived from education.

Arcana Capital plans to refurbish the property and re-release it to the market.

The precinct is undergoing rapid transformation with new residential towers, student accommodation, and the near-completion of the Cross River Rail Albert Street Station boosting occupier demand.

Sydney and Brisbane office markets continue to attract institutional and private capital, with buyers seeking assets that combine stable income with long-term growth potential.

The combination of infrastructure, precinct transformation and quality building attributes is beginning to drive competition and solid pricing across the national office sector.