Land Prices Continue To Stretch Higher

The HIA-CoreLogic Residential Land Report for the June 2016 quarter has just been published, offering a comprehensive review of quarterly sales activity and price trends in 41 regional and six capital city markets across Australia.

“Residential land prices in Australia climbed to yet another all-time high during the June 2016 quarter, on the back of strong demand and lower interest rates,” HIA Senior Economist Shane Garrett said.

“Housing affordability has deteriorated across several key markets, and the ongoing rise in land prices is proving very challenging.

“With market supply having fallen further over the past year, policy makers need to look very carefully at ways of bringing about more sustainable outcomes in residential land supply.

"This will inevitably involve tackling issues around the pace of land release, the bottlenecks in the planning process and the excessive burden of taxation,” Mr Garrett said.

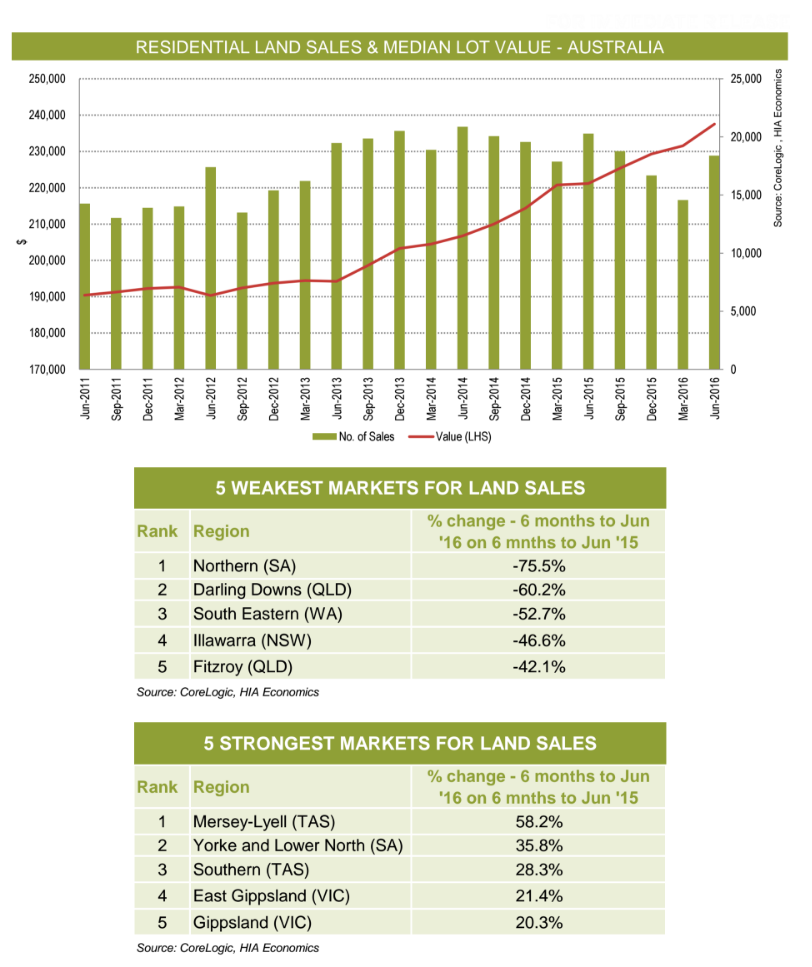

The report says that the median residential land price rose by 2.6 per cent during the June 2016 quarter, to a new all-time high of $237,535. A total of 18,395 residential lots are estimated to have been transacted during the quarter - down by some 9.3 per cent on a year ago.

CoreLogic Research Director Tim Lawless said the increase in land transactions nationally was accompanied by a surge in land sales located in Tasmania as well as in some regional markets.

“Hobart saw land sales jump by almost 27 per cent over the first half of 2016 compared with the same period a year ago, while the largest cities, where affordability constraints are already the most visible, recorded a substantial reduction in land sales over the first six months of 2016," he said.

“The volume of land sales across Sydney was down sharply while land prices surged 14.1 per cent higher over the year.

"The opposing trends of transaction numbers and prices is a clear indication of demand outweighing supply which is creating significant price inflation across vacant land markets.

“While unit markets have seen approvals and construction activity reach spectacular highs, supply levels across the detached housing sector remains insufficient in many areas.

"The lack of available vacant land highlights that greenfield housing markets are likely to remain undersupplied which implies further upwards price pressures across the key vacant land markets where demand remains strong," Mr Lawless said.

During the June 2016 quarter, land transactions experienced the largest increase in Hobart (+26.9 per cent) compared with the same period year earlier. Land turnover was unchanged in Adelaide (+0.2 per cent). Land sales saw the largest reduction in Sydney (-38.3 per cent), followed by Melbourne (-14.3 per cent) and Brisbane (-3.9 per cent). Perth also experienced a small decline in land market turnover (-3.5 per cent).