Housing Affordability Makes Slight Improvement Following APRA's Restrictions

Recent APRA-imposed interventions by the government to curb growth in investor activity may have improved housing affordability for owner-occupiers.

In the latest data from the Housing Industry Association's Affordability Index, housing affordability improved slightly in the September quarter -- 0.5 per cent. However, it remains 4.4 per cent below the level recorded a year ago.

“Despite the poor levels of housing affordability there are signs of improvement for home-buyers," HIA principal economist Tim Reardon said.

“Housing affordability has been deteriorating in Australia for decades, particularly in capital cities, as demand for new housing greatly exceeded the supply.

According to Reardon, macro-prudential measures implemented earlier this year to help curb excessive house price growth has influenced the market.

Reardon said the regulations put in place to keep investment activity in check has had the unintended consequence of improving housing affordability for owner-occupiers.

[Related reading: Land Prices Rises in Australia ‘Unrelenting’ as Cash Rate Holds Steady]“The report’s regional analysis demonstrates the substantial differences in affordability conditions around the country,” Reardon said.

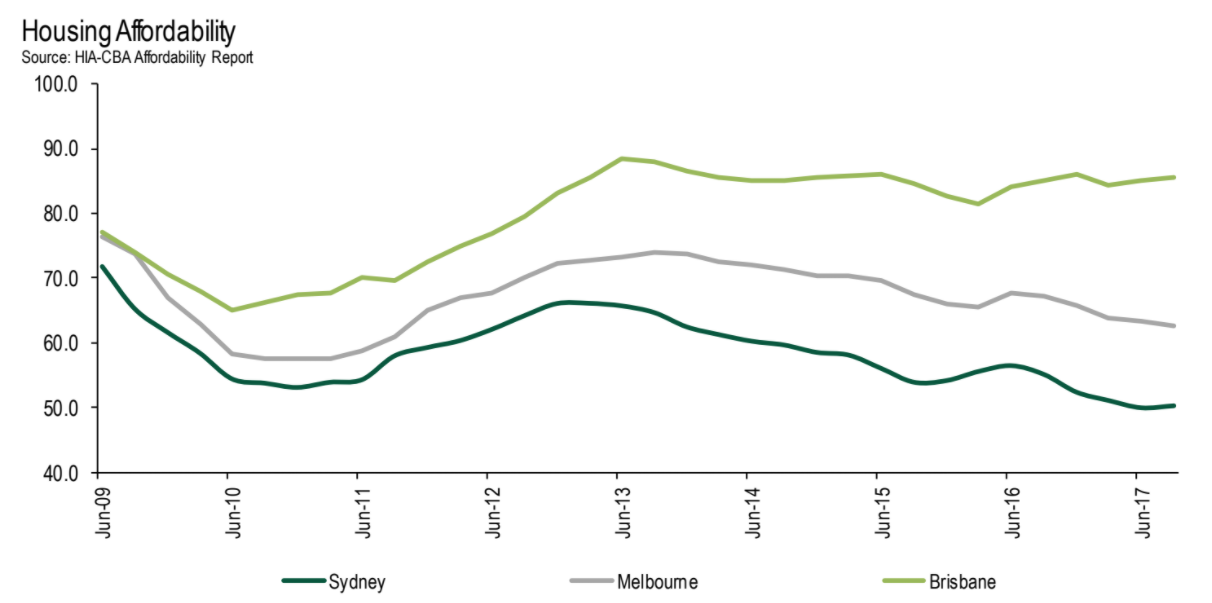

“Sydney retains the mantle as the nation’s least affordable housing market despite the affordability index showing a modest improvement in affordability during the quarter.

"It still takes twice the average Sydney income to service a mortgage on a median priced home in Sydney while avoiding mortgage stress."Brisbane, Adelaide, Perth and Darwin all recorded modest improvements in affordability in the September quarter. Melbourne, Hobart and Canberra each recorded a modest deterioration in affordability during the quarter.