Interest Rates Blamed as Property Market Confidence Slips

Rising interest rates and ongoing supply chain issues have been blamed for a dive in confidence in the country’s property market.

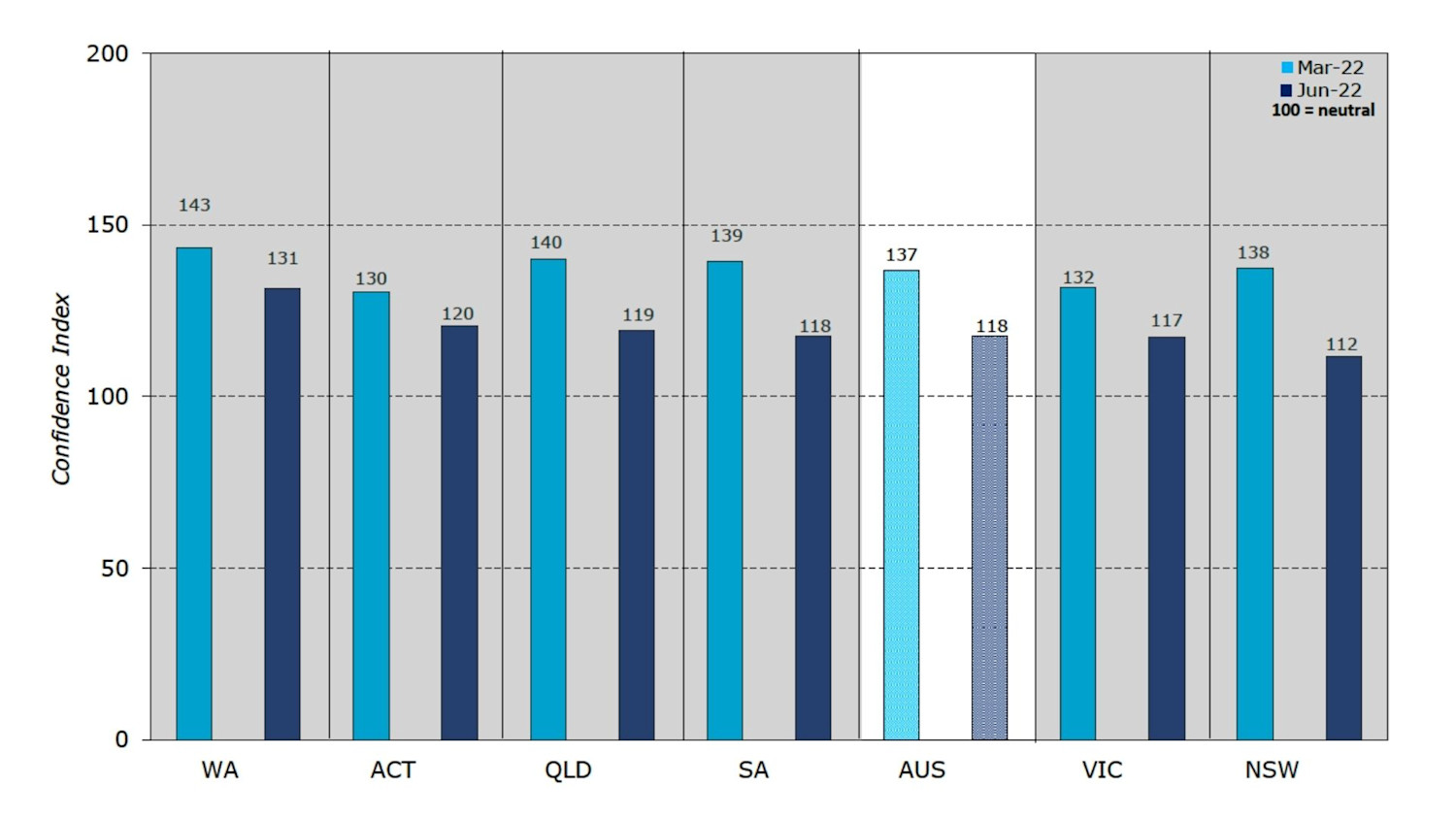

A quarterly survey by the Property Council of Australia, in conjunction with ANZ Bank, found the overall confidence index dropped 19 points across the board in the June quarter to 118 index points.

While the index remains in positive territory (a score of 100 is considered neutral), the result is still below the long-term average of 124 points.

New South Wales showed the biggest decline of 26 points, while South Australia and Queensland each fell 21 points. Confidence in the market was down 15 in Victoria.

Property Council of Australia chief executive Ken Morrison said despite the decline in confidence caused by external factors such as inflation, skill shortages and disrupted supply chains, the sector remained positive about its own work pipelines and staffing plans.

"What we’re seeing in this survey is a steep confidence dip in the broader outlook, yet specific firms remaining optimistic about their own business conditions,” Morrison said.

The impacts of Covid continue to linger, according to the survey, with respondents in most states expecting the pandemic to further hinder business conditions. The greatest impact is likely to be on the commercial office sector. Prior to the quarter, hotels, tourism and leisure had ranked highest in terms of Covid impact.

“There is no doubt that the lingering effects of Covid, inflationary pressures and interest rate implications, energy, and staffing shortages as well as global geopolitical issues have left a dent in confidence, and that comes as little surprise.

“However, when asked to reflect on their own business plans, respondents felt well-positioned to withstand those headwinds, which is why, combined with historic low unemployment figures, confidence overall is still in positive territory,” he said.

PCA confidence survey for June quarter

ANZ senior economist Felicity Emmett said property sentiment had taken a hit on the back of two rate rises already announced by the Reserve Bank, and the expectation of a steep increase in interest rates over the coming year.

“The prospect of sharply higher interest rates, the turn in the global outlook, and talk of a US recession have all taken their toll on the economic outlook,” Emmett said

“Firms are now the most downbeat about the economy than they’ve ever been outside of the worst of the pandemic in 2020 and are particularly negative about the availability of debt finance.

“This pessimism seems overdone given how optimistic firms are about their own work schedule and staffing levels.”

The survey of more than 750 respondents was conducted throughout June, the same month the Reserve Bank of Australia lifted the cash rate by 50 basis points. There have been three consecutive months of rises by the RBA.