Labour Shift Weighs On Property Markets

The latest ABS jobs figures data for the first half of March, released on Thursday, held up better than expected but it is the “calm before the storm”, according to economists.

With a residential market beset with uncertainty as to exactly how Covid-19 will impact jobs, migration and mobility going forward, house price growth has started to lose momentum.

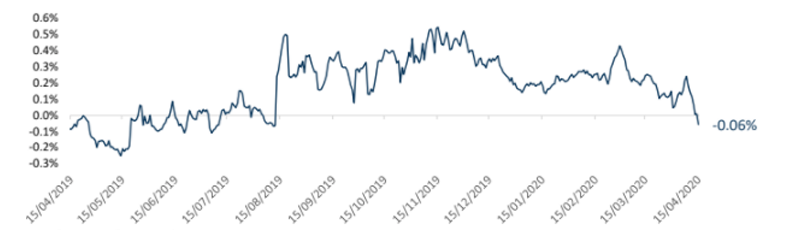

Corelogic data through to mid-April has seen combined capital city housing value growth rates slip into negative territory week-on-week for the first time since August last year.

The headline job numbers are a key indicator of how the housing market will fare going forward, and while the March labour market data did not show a noticeable impact from Covid-19, unemployment won’t remain contained for long.

Commsec senior economist Ryan Felsman said that job numbers will be volatile in the coming months as the hit to labour demand intensifies.

“An earlier-than-anticipated return to work for some businesses—supported by additional government stimulus—is critical in the economic recovery phase,” Felsman said.

“Until a Covid-19 vaccine is found, the economy will likely be susceptible to rolling stoppages as virus outbreaks re-occur, impacting consumer spending and job hiring intentions.”

UBS has now materially revised its forecasts in line with its “full-pandemic scenario” to a decline of at least 10 per cent in house prices over the coming year.

Rolling 7-day change in dwelling values

Employment minister Michaelia Cash said the small increase in the unemployment rate to 5.2 per cent exceeded all market expectations.

“While these figures [saw] the creation of 5,900 jobs, the data only represents the early impacts of Covid-19.

“The government expects the unemployment rate to rise over the coming months.”

Capital Economics economist Marcel Theliant forecasts that the unemployment rate will hit 12 per cent. Australia’s peak unemployment rate reached 11.2 per cent in 1992.

“Google searches for ‘unemployment benefits’ surged at the end of March and were on past form consistent with around two million unemployed people, or an unemployment rate of nearly 15 per cent,” Theliant said.

Corelogic head of research Eliza Owen said that the extent of decline in activity across Corelogic’s platforms show clear signs of a sharp slowdown in housing market activity.

“With plunging property volumes across listings, and less activity from real estate agents and valuers, there is likely to be a severe drop in the number of properties transacted over the coming months.

“But less listing activity also speaks to the moderation of supply against less demand for property. This is one reason that property values are unlikely to fall as quickly, or to the same extent, as transaction volumes.

National cabinet agreed on Thursday that current restrictions will remain in place for at least the next four weeks.