Roundtable’s Housing Reforms Face Real-World Delivery Test

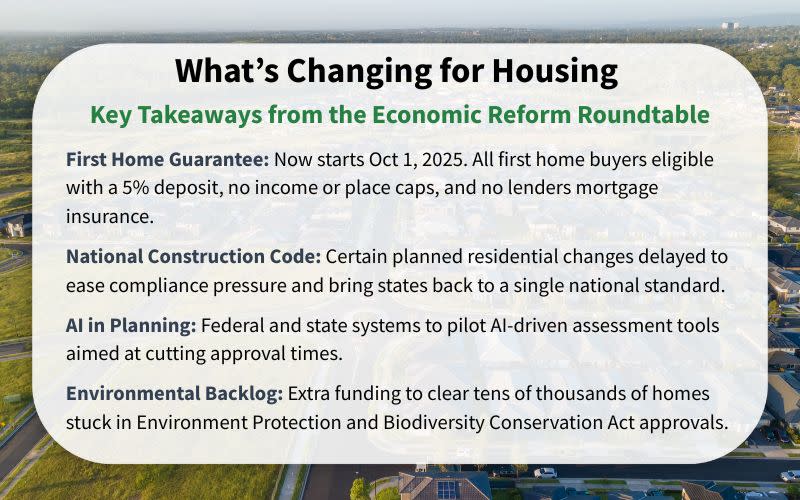

Canberra’s economic reform summit has put housing supply at the centre of a package to cut approval delays, recalibrate the National Construction Code and bring forward a deposit scheme for first home buyers.

The Treasurer’s three-day Economic Reform Roundtable gathered business, unions and community leaders to shape 10 priority reforms, with planning, code changes and environmental assessments topping the property sector’s agenda.

Measures include a pause on non-essential residential code updates, extra resourcing for environmental assessment backlogs, the integration of artificial intelligence into planning systems, and an early start for the 5 per cent deposit First Home Guarantee Scheme.

The First Home Guarantee expansion—now beginning October 1 instead of January—will allow all first home buyers to purchase with a 5 per cent deposit and no lenders mortgage insurance, with no income or place caps.

Property Council: Win-win

The Property Council of Australia backed the Government’s moves on code reform, AI integration and environmental resourcing, saying they could unlock tens of thousands of homes and deliver national consistency in housing standards.

“This is a win-win roadmap to better housing supply,” chief executive Mike Zorbas said.

“Let’s also put AI to work turbocharging housing delivery. A smart rollout of AI into planning and assessment systems will give decision-makers the clarity they need and save valuable time in delivering new homes.”

On the First Home Guarantee expansion, Zorbas said demand-side support must be matched by supply delivery:

“You stack yesterday’s supply boosters on top of helping first home buyers bridge the deposit gap, and we have a better chance of making our welcome 1.2 million homes target.”

Resimax Group: Relief for a tough market

From the ground level, Melbourne-based developer Resimax Group—active across large greenfield communities in the city’s north and west—said the change was relief for a market that had been dead for three years.

“We were looking forward to the scheme starting in January, but this will stop first home buyers sitting on their hands,” development director Callan Ainsaar said.

“It will stimulate activity before Christmas and, combined with recent rate cuts, give the market confidence again.

“It’s one lever among many but in tough conditions this is welcome news, now the challenge is making sure we can deliver the homes.”

Ainsaar said saving for a 20 per cent deposit remained a major barrier, taking the average buyer more than a decade.

“This change cuts that to about three years and removes the cost of mortgage insurance, which is significant.”

While expecting a lift in demand, he warned planning delays could still choke supply.

“From go to whoa, it’s really a three-year process to deliver a stage and the infrastructure that supports it,” he said.

“We need faster approvals and less red tape if we’re going to meet the market.”

He said many developers were still carrying titled stock that was expensive to hold but approvals for future greenfield supply were lagging well behind need.

“Realistically, Victoria needs to be approving at least 20,000 lots a year, and right now we’re falling well short. Even once you get a Precinct Structure Plan (PSP) approved, there’s a lengthy lag before you can get permits and deliver infrastructure.”

Ainsaar said Victoria’s 70–30 policy had “put the handbrake” on Greenfield development and fast-tracking PSPs was critical.

Master Builders: ‘Big wins’ if delivered

Echoing the call for action, Master Builders Australia chief executive Denita Wawn said the commitments on the code, approvals and skills were “direct wins” for the building and construction industry, reflecting long-standing calls to pause non-essential changes, harmonise standards and streamline approvals.

“Builders applaud the Treasurer’s commitment to cut red tape and unlock faster building approvals,” Wawn said.

“These are big wins for our industry and for all Australians. But the test now is delivery. Every day of delay adds cost and pushes the housing crisis further out of reach.”

Wawn said tax reform lacked clarity and reiterated that negative gearing and capital gains tax settings must remain unchanged to avoid undermining new housing supply.

Urban Taskforce: Talkfest without a plan

Not all industry voices were convinced.

Urban Taskforce Australia described the roundtable as “just another talkfest” without a clear plan to address falling construction productivity or the housing shortage.

While the Government announced a pause on some planned National Construction Code residential changes to ease delivery pressures, chief executive Tom Forrest said that didn’t go far enough.

He called for a full freeze on the code and the removal of Commonwealth involvement in environmental assessments under the Environment Protection and Biodiversity Conservation Act, alongside industrial relations reform.

“Urgent work” was needed, he said, to turn ideas into “solid policy reforms” and clear timelines for delivery.

COSBOA: Small business needs certainty

The Council of Small Business Organisations Australia, representing many suppliers and contractors in the property and construction sector, backed the pause on National Construction Code changes and the use of AI to cut approval times.

It also repeated calls for a 20 per cent small business company tax rate and a permanent $150,000 instant asset write-off.