The pace of housing market boom is slipping as new home approvals drop and building material prices continue to rise.

The Australian Bureau of Statistics data indicated dwelling approvals dropped 7.1 per cent in May, following a 5.7 per cent decline in April.

Despite this, approvals were up 55 per cent on last year with 144,827 new houses approved, the most in a one year period since records began in 1983.

While the results remained elevated, construction activity was decelerating according to the Ai Group’s performance of construction index.

Dwelling approvals: May

| Seasonally adjusted | May 2021 | Monthly Change | Yearly Change |

|---|---|---|---|

| Total dwellings approved | 20,163 | -7.1% | 52.7% |

| Private sector houses | 13,571 | -10.3% | 55.2% |

| Private sector dwellings excluding houses | 6,374 | 1.2 | 53.6% |

^Source: Australian Bureau of Statistics

The construction index showed there were skills shortages as well as supply disruptions and bottlenecks in building materials with those prices hitting all-time highs in June.

These growing workloads combined with building material supply and price uncertainty were having a negative impact on building companies.

Across the country, the number of dwelling approvals fell in Queensland by -13.1 per cent, in South Australia -11.9 per cent, New South Wales by -10.9 per cent and Western Australia by -8.7 per cent.

Victoria and Tasmania were the only places to have an increase by 3.2 and 2.0 per cent respectively.

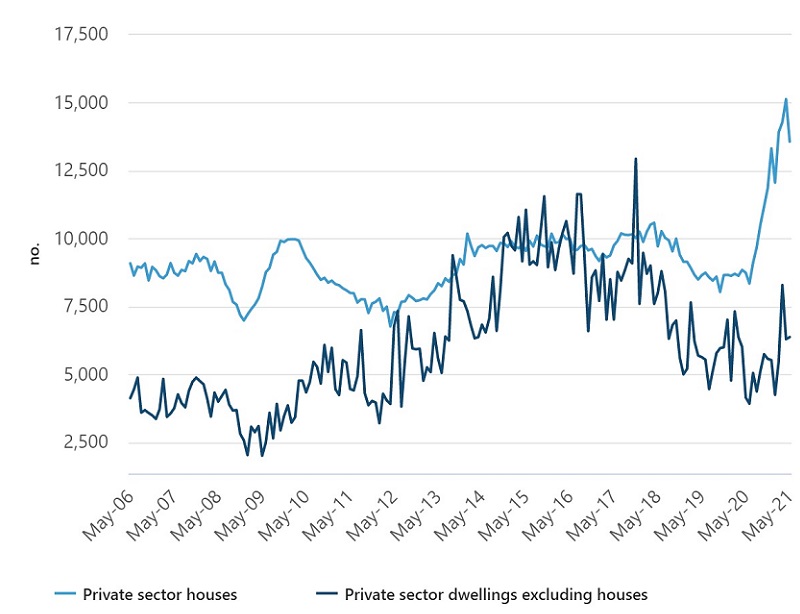

Approvals by building type

^Source: Australian Bureau of Statistics

Ai Group head of policy, Peter Burn said while there is strong growth in the industry the pace of expansion was slipping as it faced capacity constraints and rising input prices.

“New orders were at very healthy levels indicating further expansion in the months ahead,” Burn said.

“However, lag times are extending with capacity already stretched.”

BIS Oxford Economics senior economist Maree Kilroy said the end of HomeBuilder was also contributing to the results.

“The impact of stimulus measures concluding will continue to wash through dwelling approval figures over the 2022 financial year,” Kilroy said.

“The easing of the HomeBuilder commencement requirement from six to eighteen months will smooth out the fall.”