Housing Taxes Double in Five Years: HIA

Half the cost of a new house and land package in Sydney goes on taxes and regulatory charges, research claims.

The Housing Industry Association (HIA) makes the claim in its report, Taxation of the Housing Sector in Australia, undertaken by the Centre for International Economics (CIE).

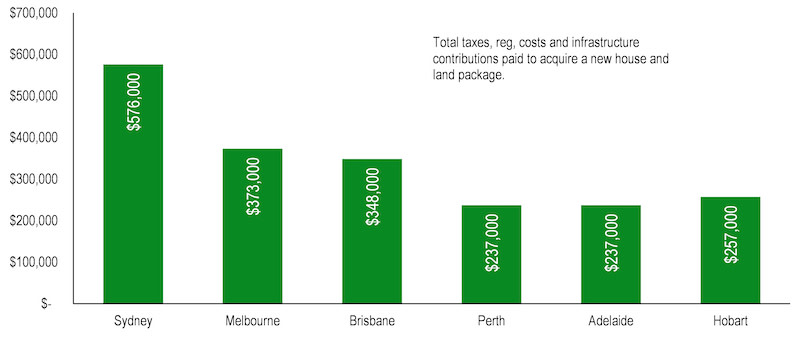

The report said $576,000 of the median package cost was government taxes, regulatory costs and charges.

The report is an update to the work undertaken in 2019.

For new apartments in Sydney, $346,000, or 38 per cent, of the cost is government taxes, regulatory costs and charges.

It said the value of taxes and charges in Sydney had increased 38 per cent or $160,000 since the 2019 report.

However, the largest increase in the value of tax and regulatory imposts was in Brisbane, up by $179,000 or more than double (106 per cent) compared to the 2019 report.

The value of the tax and regulatory cost component of a new apartment has increased by $104,000 or 68 per cent in Brisbane compared with the 2019 report.

The report also found that nationally it took more than a year to obtain a development approval for subdivision, and up to seven months were attributed to unnecessary delays, the HIA said.

“Australia has an acute shortage of housing because governments continue to tax new home building and impede productivity in the sector,” HIA chief economist Tim Reardon said.

“In Sydney, governments are adding in excess of half-a-million dollars to the cost of a new home that new home buyers are then required to repay for decades as part of their mortgage.

Government charges on greenfield homes by state

“With half of the cost of a new home being taxes and government charges, new home buyers are spending 15 years of a 30-year mortgage just paying off that tax.

“New home buyers also must pay interest on top of that tax. Over 30 years, the value of taxes plus the interest on it amounts to more than the value of the home itself.”

Reardon said that in Brisbane and Adelaide, government taxes, fees and charges on new homes had doubled in five years.

“The primary solution to resolve Australia’s housing shortages is to remove government taxes and red tape to allow the industry to deliver the homes Australians are demanding,” he said.

“Delays on getting approvals take much longer than the time it takes to actually build a home.

“It is incongruous that governments set home building targets, while at the same time tax new home building even more. The more government tax new homes, the fewer homes will be built.

“If governments were keen to solve the affordability problem, they need to look at the tax they are imposing on new housing.”