Goodman Closes in on $70bn Portfolio

Industrial property powerhouse Goodman Group has sailed through much of the pandemic disruption with its total assets under management surging towards the $70-billion mark.

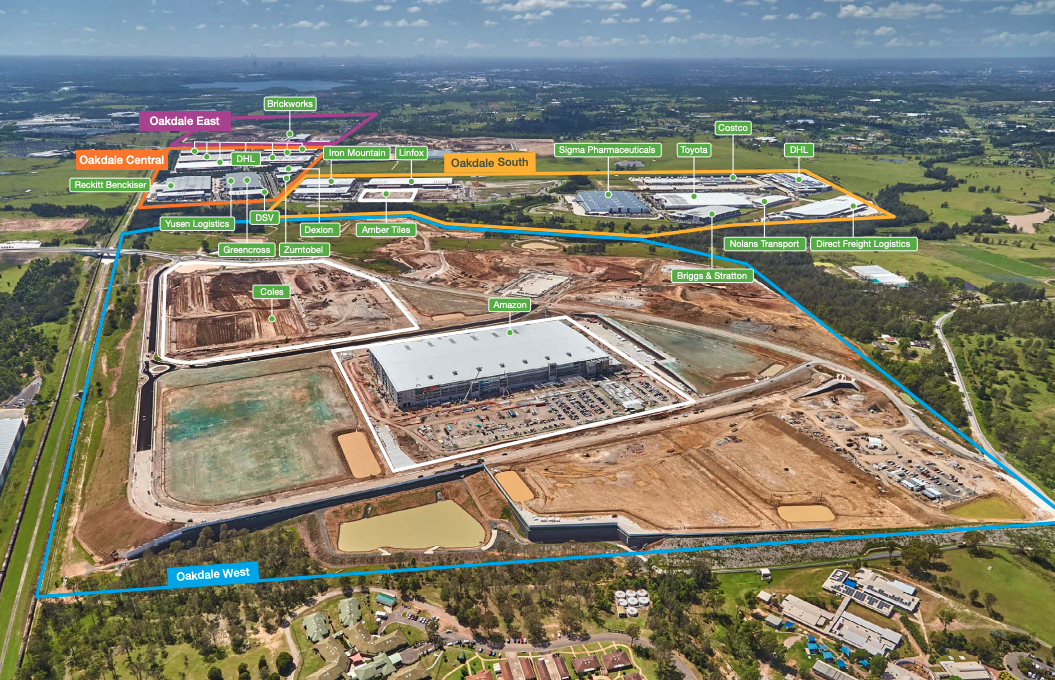

The $37-billion group is riding the wave of consumer demand for e-commerce by building warehouses in key global cities in partnership with institutional investors and on behalf of customers such as Amazon, JD.com, Deutsche Post and Australia Post.

The ASX-listed group currently has a diverse range of 1600 customers across e-commerce, logistics, retail, consumer goods, automotive, pharmaceutical and technology industries.

This ramping up and automating of supply chains has fuelled Goodman’s growth over the past financial year with shares up 4.5 per cent.

It also drove Goodman to beat its earnings guidance and report operating earnings per security of 30 cents, up 23 per cent.

Goodman chief executive Greg Goodman said the requirements for the intensification of next generation warehousing in urban locations had kept industrial supply contracted.

“Goodman has had another strong quarter with our operating results reflecting the highly targeted location of our portfolio,” he said.

“Tight supply and demand continues to support leasing across our stabalised portfolio and developments, with high occupancy in our markets.”

Goodman said development activity in Australia was forecast to remain at above average levels due to strong leasing and investment demand.

As of March, Goodman has maintained occupancy of 98.7 per cent with like-for-like net property income rising to 3.7 per cent while its average lease term hit five years.

Over 4.3 million square metres of warehouse space was leased, equating to $590 million of annual rental property income, while gearing lifted slightly to just 7.2 per cent and the company had $2 billion in the bank.

The company currently has 89 projects, valued at a combined $13.4 billion, with $6 billion in completions expected by the end of the financial year.

It has so far completed $4.7 billion in projects in the last nine months and said it expected work in progress at its sites to remain around current levels at the end of June, and is working through brownfield sites and regeneration of existing assets.

The company noted that while construction costs were rising, yields on cost were expected to remain at 6.5 per cent.

“We have continued to take a prudent approach to financial positioning, maintaining low gearing, combined with significant hedging and liquidity in the face of tumultuous market conditions,” Goodman said.

“The business environment is changing, with increased interest rates, inflation, geopolitical risks and ongoing impacts of the pandemic, however, the long-term structural drivers of demand have not changed.

“Our portfolio is concentrated in key high barrier to entry markets and we are continuing to prudently deploy capital alongside our partners.”

Ratings agency Moody’s has maintained a stable outlook rating for the industrial giant reflecting the company’s sizeable development and investment management businesses where earnings are often more volatile than at a traditional REIT.

“Moody’s expects Goodman to maintain lower gearing than more traditional REITs at the same rating level.”

Goodman is now readying a $700 million note issue for sustainability-linked guaranteed senior unsecured notes, that would be due 2032.

The note would be guaranteed by Goodman Industrial Trust and Goodman Logistics (HK)’s responsible entities Goodman Limited and Goodman Funds Management Limited.