Foreign Buyer Slump Worsens Outlook for Housing

Foreign investment in property has fallen to the lowest levels in 10 years, tumbling 58 per cent to $13 billion in 2017-18.

The usual suspects — Chinese capital controls, credit curbs and taxes — have been blamed for stifling demand, with new housing leading the fall in approvals with a 62 per cent drop to $10 billion.

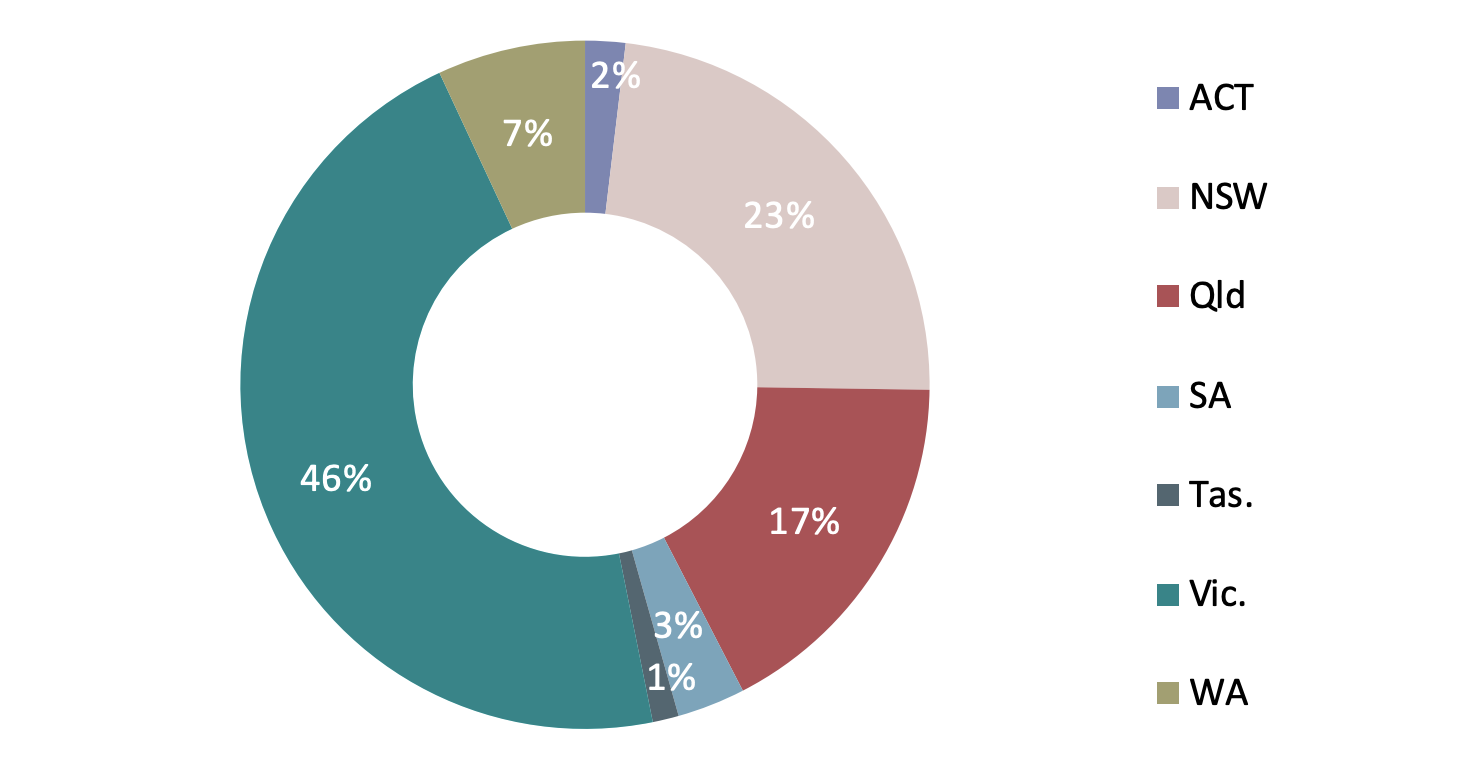

Official data released by the Foreign Investment Review Board on Monday showed that 10,036 approvals for residential real estate were given last year, with Victoria making up nearly half of all real estate investment.

More than 8,000 approvals for development were given last year including approvals for new dwellings, vacant land and other residential property, while there were 1,615 approvals for established dwellings — a 21 per cent fall.

Chinese buyers still account for a majority of residential real estate approvals – spending $12.7 billion in 2017-18, a 17 per cent decrease on the 2016-17.

Related: Chinese Developers Double Down on Australian Property

Housing outlook 'getting worse'

UBS economists said that the collapse in foreign investment reinforced its view that the outlook for housing is getting worse.

“We expect dwelling investment to fall sharply, with house prices to double the fall so far, and drop a record 14 per cent peak- to-trough,” the economists wrote in a research note.

“This will see a negative household wealth effect, causing consumption to moderate, GDP to ease below trend and unemployment tick up.”

Victoria popular for foreign buyers

Victoria is still the housing market of choice, with foreign investors and buyers investing $5.1 billion into Victorian residential real estate.

The state received nearly 50 per cent of all FIRB approvals last year, compared with 23 per cent in NSW and 17 per cent in Queensland.

As for breaches and forced divestments, 131 foreign buyers were forced to sell their properties last year, up from 96 the year prior.

Victoria accounted for 53.7 per cent of the total breaches, while NSW made up 20 per cent.

There were 600 breaches in total over 2017-18.