Domestic Investors Leading Build-to-Rent Surge

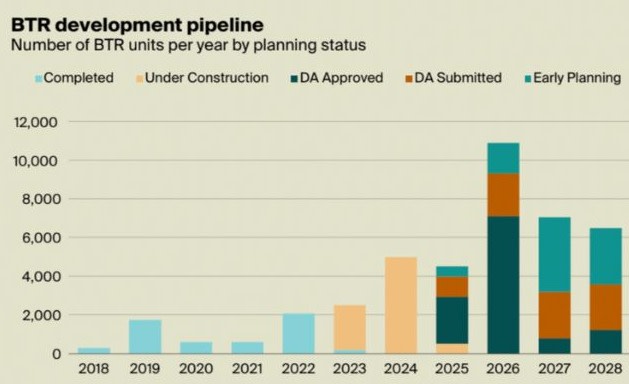

More than 8000 purpose-built build-to-rent apartments are under construction in September 2023 as a groundswell of support rises in the sector.

A further 13,000 were approved for development in the near term and Australia’s market was forecast to reach 55,000 apartments by 2030.

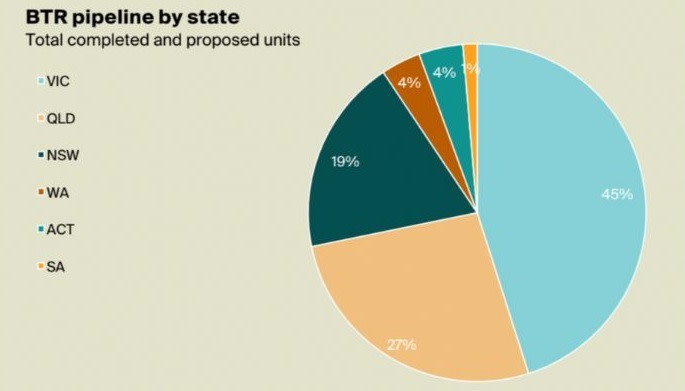

According to Knight Frank, the build-to-rent sector is most advanced in the Melbourne and Brisbane markets.

But it’s not just big foreign capital shoring up the nation’s pipeline.

Almost two-thirds of existing and proposed build-to-rent apartments were owned by domestic capital, while about 35 per cent was backed by global capital either exclusively or in joint ventures.

Knight Frank chief economist Ben Burston said that although developers were wed to the inner-city fringes at present he expected that to change as the sector followed its growth trajectory.

“Over time we expect to see a broadening of developer interest to encompass middle-ring suburbs with high levels of amenity and connectivity,” he said.

“Based on the current pipeline of build-to-rent developments in Australia and the demonstrated growth trajectory in the UK, by 2030 we forecast that around 55,000 dedicated apartments will have been completed.

“If total stock grows to this level, build-to-rent would still only represent 1.5 per cent of total rental supply underlining the potential for scale.”

But Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV) data confirms APAC investors are most interested in exposure to the residential sector in Australia.

“The most recent ANREV survey of global investor intentions highlighted that for the first time, residential is the most sought-after sector for global investors targeting the Asia-Pacific region,” the Knight Frank report stated.

“The shift to living sectors is part of a wider shift from major institutions globally to focus predominantly on core investment strategies in 2023 and commensurately reduce their allocation to value-add and opportunistic strategies.”

The data revealed that Sydney’s build-to-rent sector was the most favoured city and asset class for APAC investors, followed by Melbourne build-to-rent and Sydney office.

Burston said the underlying demand-side drivers for the build-to-rent market had been in place for some time, but a combination of cyclical and structural supply-side impediments had held back development.

“Many of these constraints have either abated or been removed and the sector appears set to expand rapidly over the next decade,” he said.

“Given the size of the market for rental accommodation, investors and developers are able to access a market offering the potential for large-scale capital deployment, while the community stands to benefit from a much-needed additional source of supply to help address Australia’s structural undersupply of housing.”

Knight Frank research found that among the major cities, Melbourne was leading the way for build-to-rent developments, with 4920 apartments under construction and another 8250 approved.

Brisbane is second in line with 1743 apartments under construction and a further 2567 approved.

To date, development has focussed on one and two-bedroom units, representing 36 per cent and 44 per cent of overall units respectively.