UPCOMING EVENT - LAND LEASE DEVELOPMENT SUMMIT 10 DAYS TO GO

10 DAYS TO GO - LAND LEASE DEVELOPMENT SUMMIT

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

A rate cut will spur the recovery of the higher end of the market and lift the prices of homes across the country, if history is anything to go by.

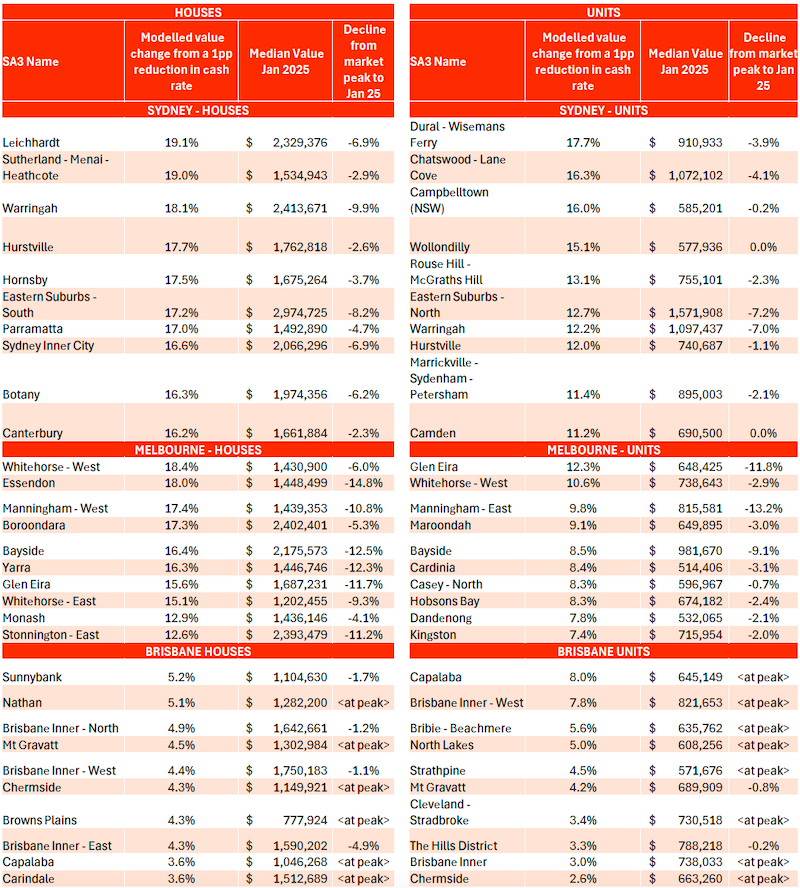

Based on previous periods of rate reductions, values would increase 6.1 per cent on average for each percentage point decline in the cash rate.

However, for the highest end of the market, values could go up by 19 per cent, according to data from CoreLogic around what’s ahead when rates come down.

Houses in Leichhardt and apartments in the Dural-Wisemans Ferry area in Sydney would be the biggest winners, followed by Melbourne’s Whitehorse-West houses and Glen Eira units.

Other capitals are expected to also experience uplift albeit not as dramatically, with Sunnybank houses and Capalaba apartments in Brisbane topping the list.

CoreLogic head of research Eliza Owen said they had identified the top 10 suburbs likely to benefit from a rate cut.

She said past experience had shown some markets would experience a bigger boost from rate reductions than others

“It may be because of market characteristics like price point, location and investor interest,” Owen said.

“Lower rates mean buyers can borrow more, spend more and ultimately make housing a more attractive investment.

“In the current economic climate, these rate cuts should go a long way in boosting consumer confidence, signalling an end to the recent battle against inflation.”

Owen said Sydney and Melbourne houses and units appeared to have the most to gain from a rate reduction.

“In Leichhardt, a 1 per cent reduction in interest rates has been associated with a 19 per cent increase in house values historically,” Owen said.

“Unit markets with the biggest response to rate falls have a high price point, a high concentration of investment ownership, or both.

“In Sydney, Melbourne, Hobart and Canberra, many of the markets with a solid response to rate reductions are also seeing values well below their peak under recent interest rate rises.

“Easier access to credit may trigger a recovery trend in these markets.”

Owen said that in Brisbane each of the top 10 house markets had a median house value of at least $1 million, with the exception of Browns Plains.

“The Brisbane markets that have historically had the strongest reaction to a reduction in interest rates are also relatively expensive,” Owen said.

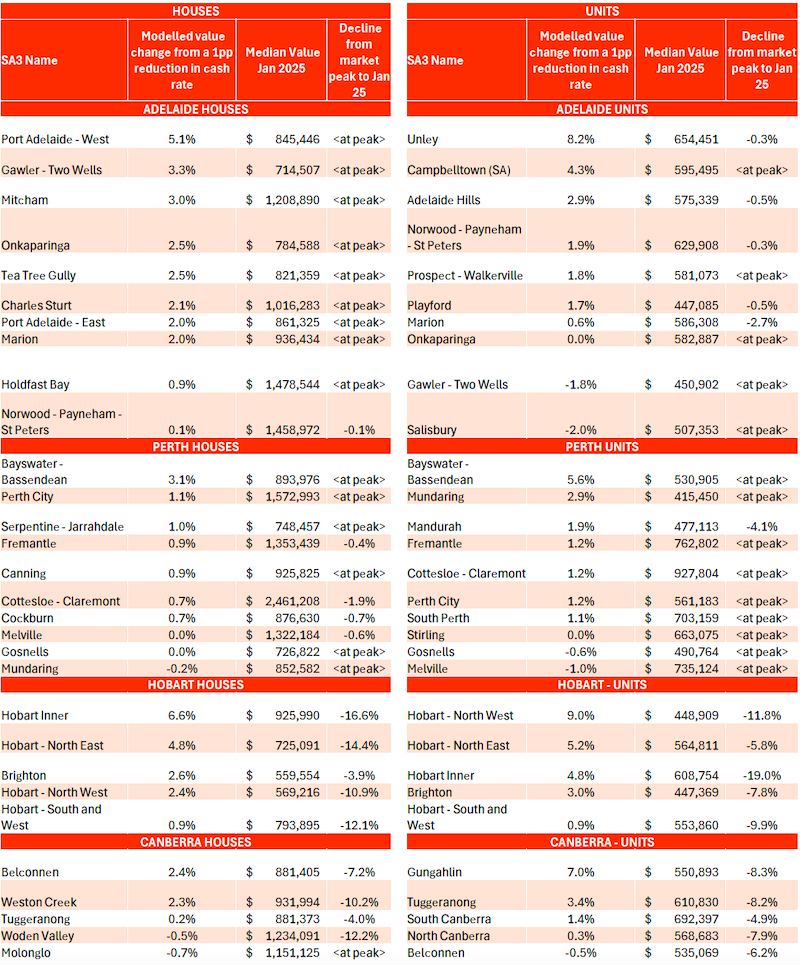

However, remaining capitals had very different market performance throughout the 2010s and were influenced by more than the cost of debt.

“In Perth and WA, market values were far more influenced by the boom-and-bust conditions in the mining sector than movements in the domestic cash rate target,” Owen said.