Undersupply Powers Rental Affordability to Record Low

An undersupply of rental accommodation and an increase in renters has driven rental affordability to its worst level since 2014.

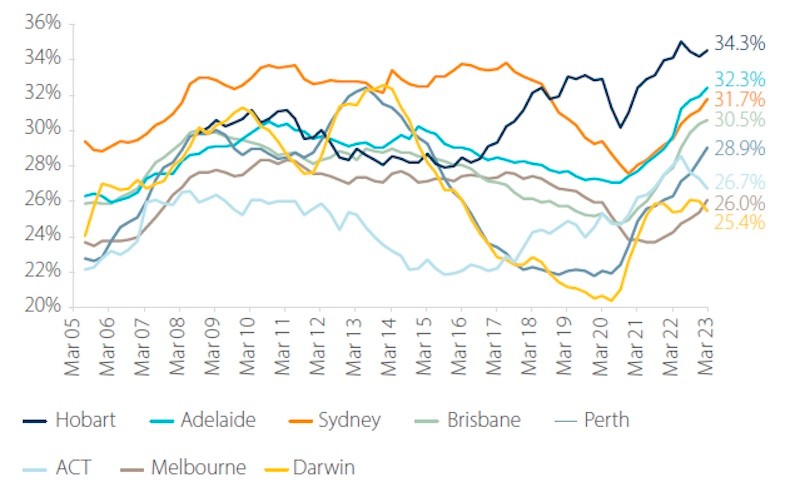

According to data from the ANZ CoreLogic Housing Affordability Report, 30.8 per cent of income is required to service a new lease nationally for a median-income household.

The report “unpacks the state of affordability in the Australian rental market and looks at the many ways in which the pandemic has influenced the supply and demand of rental accommodation”.

At the lower household income level, 51.6 per cent of income would be required, suggesting particular pressure for households at the 25th percentile income level.

Portion of income required to service rent, capital cities (median)

ANZ senior economist Felicity Emmett said it was important to factor in rental metrics when looking at housing affordability in Australia.

“Heightened economic uncertainty has seen a decline in sales volumes in the private market and an increase in those seeking rental accommodation,” she said.

“Paired with a decline in social housing, rental demand pressures are being felt in all income brackets.”

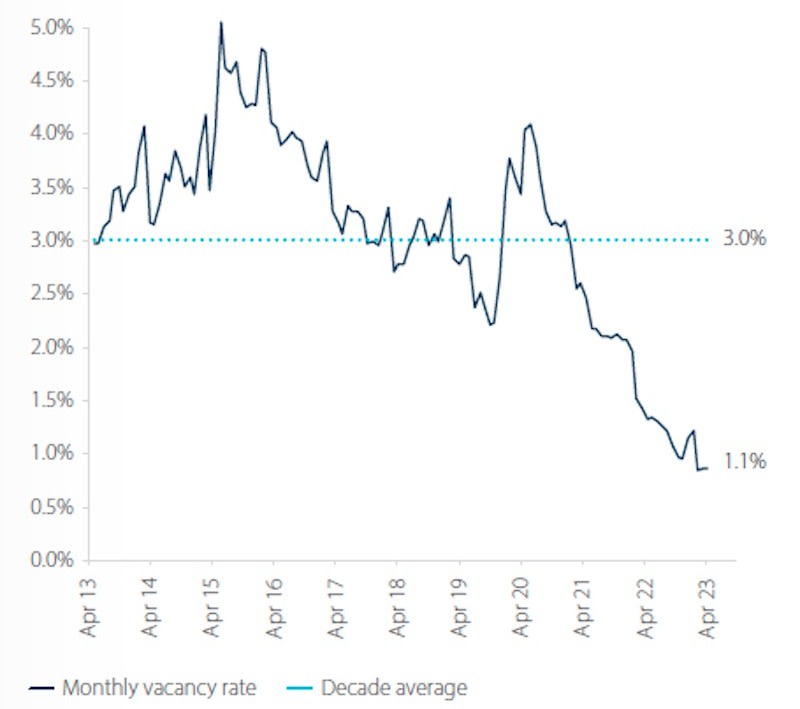

Rental vacancy rates as of April 2023 were 1.1 per cent nationally, below a decade average of 3 per cent.

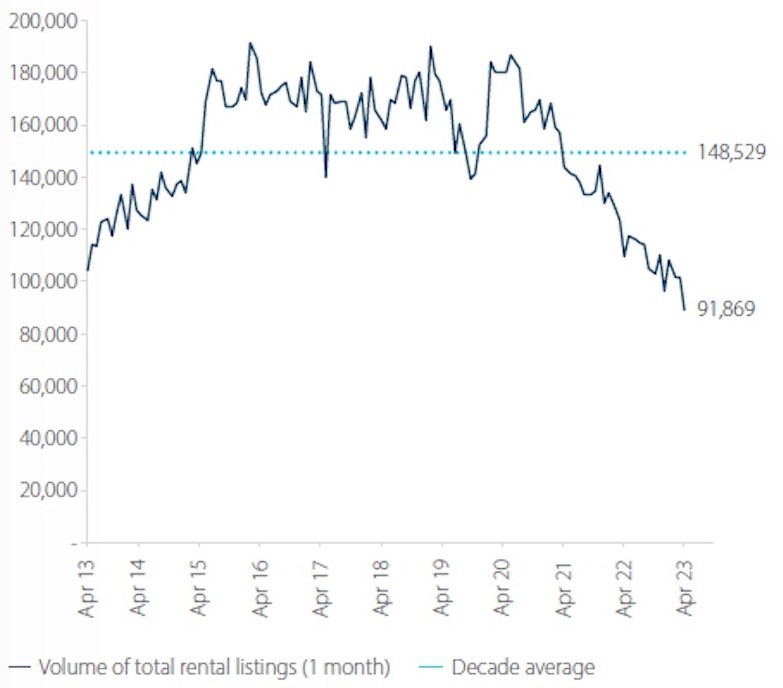

In the same period, total rent listings are 38.1 per cent below the previous decade average.

Monthly vacancy rate nationally

An increase in regional migration during the pandemic led to increased rent values and low vacancy rates in regional Australia as well as major cities.

Since March, 2020, rent values increased more across regional markets at 28.8 per cent, compared to 24.4 per cent in capital cities.

CoreLogic Australia head of research Eliza Owen said rental demand has had extraordinary shifts in the past three years with fewer people per household requiring more homes coupled with a strong return in overseas migration.

More recently, rental growth has eased across the regions and houses while ramping up in capital cities and units.

Montly volume of listings—national homes

“As rents have risen sharply, the increase in the cash rate and pressures in the construction sector have slowed the rate of home completions,” she said.

“This has meant investor conditions are not ideal and has stemmed the flow of new rental properties to the market.

“Through February and March, ABS lending data has shown signs of an increase in investment borrowing, but it will take some time for a supply response to ease pressures in the rental market.”

While rental affordability was most strained across Hobart, regional Queensland and regional NSW, housing affordability metrics highlighted Sydney as the most unaffordable market for home ownership, the report said.

Sydneysiders on average require 51.6 per cent of income to service a new mortgage, and around 12 years to accumulate a 20 per cent deposit—this, combined with higher building and construction costs, is pushing more people out of the housing market, increasing aggregate rental demand.