NOMINATIONS CLOSE SEPTEMBER 12 RECOGNISING THE INDIVIDUALS BEHIND THE PROJECTS

NOMINATIONS CLOSING SEPTEMBER 12 URBAN LEADER AWARDS

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

While much has be written on the

Treasurer's handing down of the 2017/18 Federal Budget, Cushman and Wakefield have focused on the issues more relevant to commercial property.

Their analysis covered investment, tenant demand, and the industrial, office and retail sectors, outlining that the focus on infrastructure is positive for long-term economic growth and the industrial sector in particular.

Budget 2017/18 - Commercial property implications

By Cushman & Wakefield

Industrial

A range of initiatives were announced providing $10bn in infrastructure funding and financing over the next ten years. If enacted, these should make the industrial/logistics market the commercial property sector likely to benefit most from the Budget.

Major announcements included $5.3bn for the Western Sydney Airport Corporation and $8.4bn for the Melbourne to Brisbane Inland Railway.

Earth moving for the Western Sydney Airport is expected to begin next year and the development is forecast to generate 20,000 direct and indirect jobs by the 2030s. This should drive commercial property development in Western Sydney with industrial property in particular likely to be a winner.

The Melbourne to Brisbane Inland Rail is likely to be positive for industrial property in Melbourne and Brisbane as well as areas along the route such as Toowoomba, Moree, Parkes and Albury. The project is expected to generate 18,000 jobs at its peak.

Another positive for the sector are tax cuts for small and medium size business. These include a cut to 27.5% in 2016/17 for incorporated small businesses with turnover less than $10m, extending to other companies with annual turnover less than $50m by 2018/19.

The banking sector is a major space user in office markets around Australia, e.g. the finance and insurance sector accounts for around 30% of Sydney CBD employment. One Budget proposal likely to pass through the Senate without too much fuss is the $6.2bn levy on the big four banks plus Macquarie. The cost of the levy will probably be passed on in some form to customers and investors and may, at the margin, inhibit space use but the impact should be minimal.

Office tenants associated with infrastructure development, such as engineers, accountants, lawyers and tech, are likely to benefit from the Budget.

Tenants which utilise workers from overseas, such as the tech sector, may suffer through the proposed tax on foreign workers and the end of the 457 visa scheme. The 457 visa is being replaced by a temporary skill shortage visa, but the intention seems to be to reduce foreign workers numbers.

The co-working space market may benefit from plans to encourage innovation and grow our FinTech industry.

As per the industrial sector, small to medium size businesses should benefit from proposed tax cuts.

The office market in Canberra is likely to be a beneficiary from the Budget. Office demand in Canberra is usually correlated with Government finances. Often slipping during times of deficit and/or when a new Government is elected. Expanding during times of surplus and/or when re-election priorities increase. The 2017/18 Budget is a re-election Budget and a range of measures such as the new Infrastructure and Projects Financing Agency should flow through to stronger office demand in Canberra.

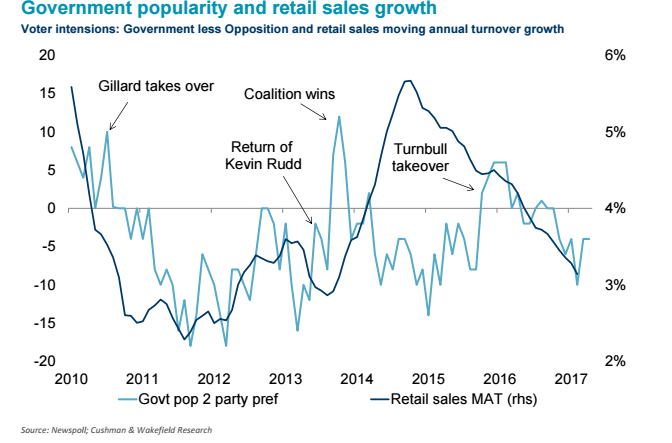

Retail sales data released today highlights the anaemic state of the sector with sales growth falling in three of the past four months. Moving annual turnover (MAT) growth has been slipping steadily from a peak of 5.7% in late 2014 to just 3.1% in March.

The decline has been driven by soft employment growth associated with record high levels of underemployment leading to very weak income growth. This had been offset to a degree by the housing boom in South East Australia, but the impact has waned as affordability has declined.

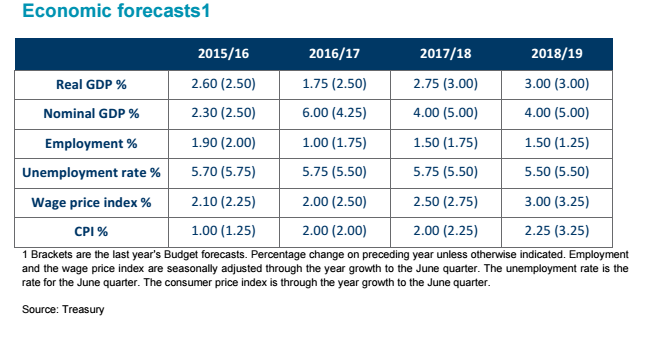

With low employment and wages growth as the main drag on the sector, retailers and shopping centre landlords will be looking for stronger economic growth to boost employment and wages. Unfortunately, the forecasts in Budget don’t support this. Growth for most variables for this year and next have been revised down. Wage growth is forecast to accelerate to 3.0% by 2018/19. While weaker than last year’s forecast, it still represents a lift from the current very low growth rate of 1.9%.

The Medicare levy will rise from 2% to 2.5% in 2019 (if it passes the Senate), while the Budget Deficit levy ends on 30 June. This should provide an immediate boost to discretionary spending for higher income earners, but the potential income hit to all tax payers from the Medicare levy increase, while two years away, promises to be a contentious issue and shouldn’t be positive for consumer sentiment.

A range of measures to limit energy cost increases are expected to be positive for sentiment, disposable income and discretionary spending.

Government popularity is often correlated with consumer sentiment and this can flow on to retail sales growth. For example, Government popularity, sentiment and spending can fall when consumers feel their financial situation is deteriorating and perceive the Government can’t or won’t do enough to help them. If the Budget lifts the Government’s re-election chances, as intended, it could help overall consumer sentiment and sales growth, though much will depend on how difficult the Senate proves to be.

Investment Demand

Investment demand for commercial property in Australia has been very strong over the past few years. The Budget is unlikely to have a major impact on this, but could create further opportunities for investment around infrastructure development. This should mean investment demand for Australian commercial property stays strong.

The ‘First Home Super Saver Scheme’ and encouragement for older Australians to ‘downsize’ and make additional non-concessional contributions to super, may lift the Australian super ‘wave of capital’ searching for property investment a little further.

Residential property, such the US multifamily sector, has not been a feature of institutional investment in Australia. This has largely due to very low yields from residential property.

However, a proposal to allow Managed Investment Trusts to develop and own affordable housing, which provides greater income certainty by enabling direct deduction of welfare payments from tenant and increased capital gains tax discount of 60%, could see the sector grow in Australia.

The proposed bank levy will likely be passed on to customers and investors in some form.

As the Government specifically noted it is “not a levy on pensioners’ and others’ ordinary deposit accounts, nor is it on home loans”, it is possible the banks may look to pass more of the cost onto the business sector. This may raise borrowing rates for some investors seeking bank financing for commercial property.