Chinese Investors Tipped to Return This Year

Chinese investors will re-enter the Australian real estate market in the second half of this year according to Asian proptech company Juwai.

Australian real estate attracts more than six times the Chinese GDP-adjusted investment than that of the United States, but it has dropped significantly due to travel bans during the Covid-19 pandemic.

Chinese investment enquiries in Australian real estate fell almost 20 per cent last year during the pandemic. But Asian proptech firm Juwai is forecasting a turnaround in the second half of 2021.

“Chinese real estate enquiry levels in Australia should begin to recover in 2021 as the pandemic recedes and Asian economic wealth-creation machines continue to bounce back from their early 2020 doldrums,” a Juwai spokesman said.

“Because of the pandemic-related economic uncertainty and closed borders, aggregate Asian cross-border residential investment fell significantly in 2020.”

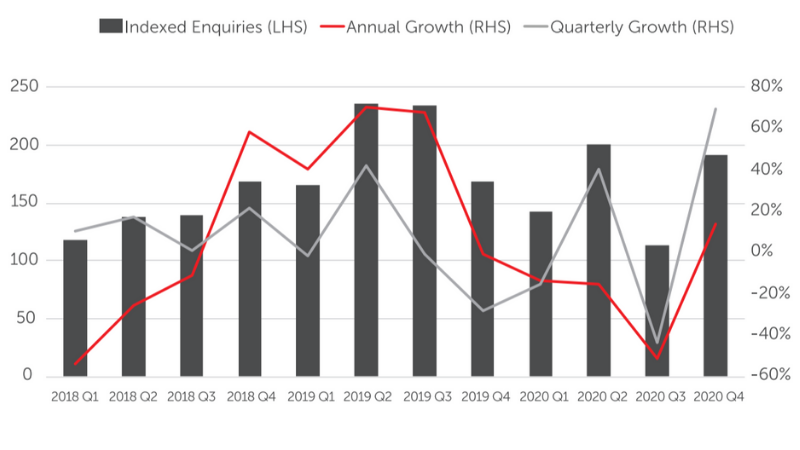

Australia: Chinese real estate buying index

^Source: Juwai Q1 2021 Report - Residential Real Estate

A Juwai spokesman said post-pandemic Australia would continue to appeal to Chinese migrants, second-home buyers, tourists and students.

“Two factors have supported overseas demand for Australian real estate throughout the pandemic, especially in new properties,” he said.

“The first factor has been consumer sentiment, which has been positively affected by the Chinese economic revival

“The second is the real estate industry's rapid response to the travel bans.

“The industry successfully deployed technology that enabled buyers to research, inspect, negotiate for, purchase, and manage overseas properties, entirely online.

“It took just six months for the industry to make 10 years' technological progress.”

Juwai is forecasting foreign buying, including acquisitions made by permanent residents, should reach pre-pandemic levels by the end of 2022.