Property giant Charter Hall’s Social Infrastructure REIT is buoyant on the back of robust alternatives, with its backing firmly behind life sciences.

The REIT (ASX: CQE) sold 16 childcare properties at a 4.6 per cent yield, it told the ASX in its half-year results announcement, which has allowed it to reinvest in a major laboratory acquisition.

It increased its exposure to life sciences in January of this year via the acquisition of a Perth pathology lab leased to Clinipath Pathology for $47 million at an initial yield of 6.4 per cent.

Leased by Sonic Healthcare Group, an ASX-listed business with a market capitalisation of $13 billion, it is the largest private laboratory in Western Australia with 5000sq m of space.

The Charter Hall REIT said it was part of its strategy to “invest in social infrastructure property delivering essential community services” especially those which have government backing which life sciences has proven capable of attracting alongside private investment.

The REIT has not given up on childcare though, as its childcare divestment, which represent a small number of its 347 total assets, “highlights the ongoing demand and liquidity for childcare property.”

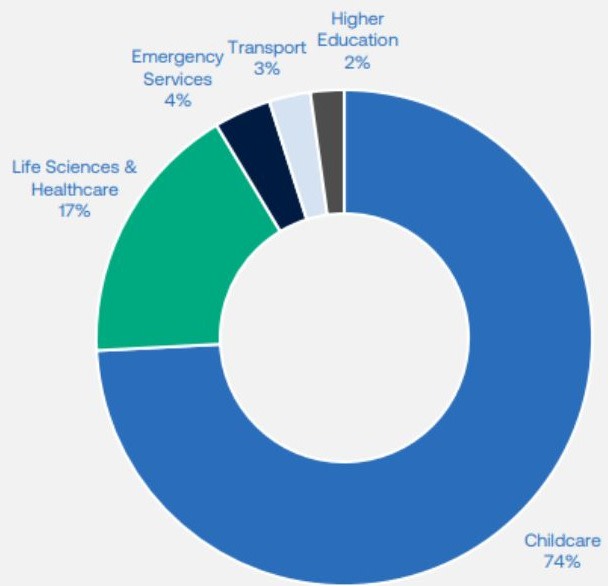

SI Sub-Sector by percentage of income as at December 31, 2024

▲ Source: Charter Hall Social Infrastructure REIT Results Presentation

REIT fund manager Travis Butcher said recent market rent reviews on 15 properties delivered a 16.4 per cent increase, “highlighting the under-rented nature of CQE’s childcare portfolio”.

According to its half-year result, it has strong fundamentals with 100 per cent occupancy across its assets and a weighted average lease expiry of 11.9 years.

Steady like-for-like net property growth income of 3.2 per cent for the year to $51.6 million was offset by its divestment activity with operating earnings down slightly to $28.5 million compared to $29.6 million in the same period the previous year.

Profits of $31 million also contrasted to a $10.9 million loss in the corresponding period in 2023.

▲ Childcare remains the majority of assets in the REIT’s portfolio.

Elsewhere on the stockmarket, which is in the swing of its half-year reporting season, Hotel Property Investments reported strong results.

HPI, which is in the middle of a takeover bid by Charter Hall and Hostplus, reported statutory profit of $16.7 million, up from $9.5 million of the corresponding period in 2023.

It also sold Hotel HQ at Underwood, Queensland, for $34 million and is investing in a “venue enhancement program” across its billion-dollar pub portfolio as it negotiates the takeover.

Meanwhile, Dexus Convenience Retail put on an average performance, with revenue from ordinary activities sitting at $29.1 million for the half-year, up slightly from the $29 million it returned in the same six months in 2023.

The REIT blamed cost of living, although “the recovery of fuel and convenience transaction volumes in 2024 now sits broadly in line with historic levels despite a challenging interest rate”, it told the ASX.