Caydon Collapse Puts $1bn Nylex Project in Peril

Melbourne developer Caydon Property Group is on the ropes, falling into receivership this week with over a billion dollars worth of projects in peril.

The prolific apartment developer cited the pandemic, builder insolvencies and supply chain issues as the straw that broke the camel’s back, following the collapse of ProBuild, which had been engaged to build the iconic $1-billion Nylex building project in Melbourne.

Receivers McGrathNicol and liquidators Jirsch Sutherland were appointed on Tuesday to take control of Caydon’s assets, including apartment projects under construction at Moonee Ponds, Preston and Alphington.

But Caydon managing director Joe Russo said HOME at Alphington and Due North at Preston, would not be affected by the collapse as they were “fully funded”.

“Sadly, over the last few years, Caydon has had to deal with one difficult market situation after another,” Russo said.

“The latest and really confronting challenge we’ve been facing has been the pricing factors affecting the Australian property and construction industry.

“It has been extremely difficult to make this decision, but to ensure the best possible outcome for all of our partners and customers, we have had to commence the liquidation of part of our Australian business.”

Asia-based financier OCP Asia, which holds security over Caydon’s assets, tipped Caydon Property Group into receivership, tapping McGrathNicol partners Matthew Hutton and Matthew Caddy as receivers.

“The receivers are undertaking an urgent financial assessment of the properties and assets under their control,” Hutton said in a statement.

“We will be working constructively with all stakeholders, including financiers of individual properties, to secure the best possible outcome for all parties.

“OCP Asia intends to support the receivership process, including through the provision of additional funding, to ensure the properties and assets can be progressed and maintained while options for development and-or disposal are explored.”

Jirsch Sutherland liquidator Malcolm Howell said purchasers with contractual arrangements in Caydon projects should not be impacted.

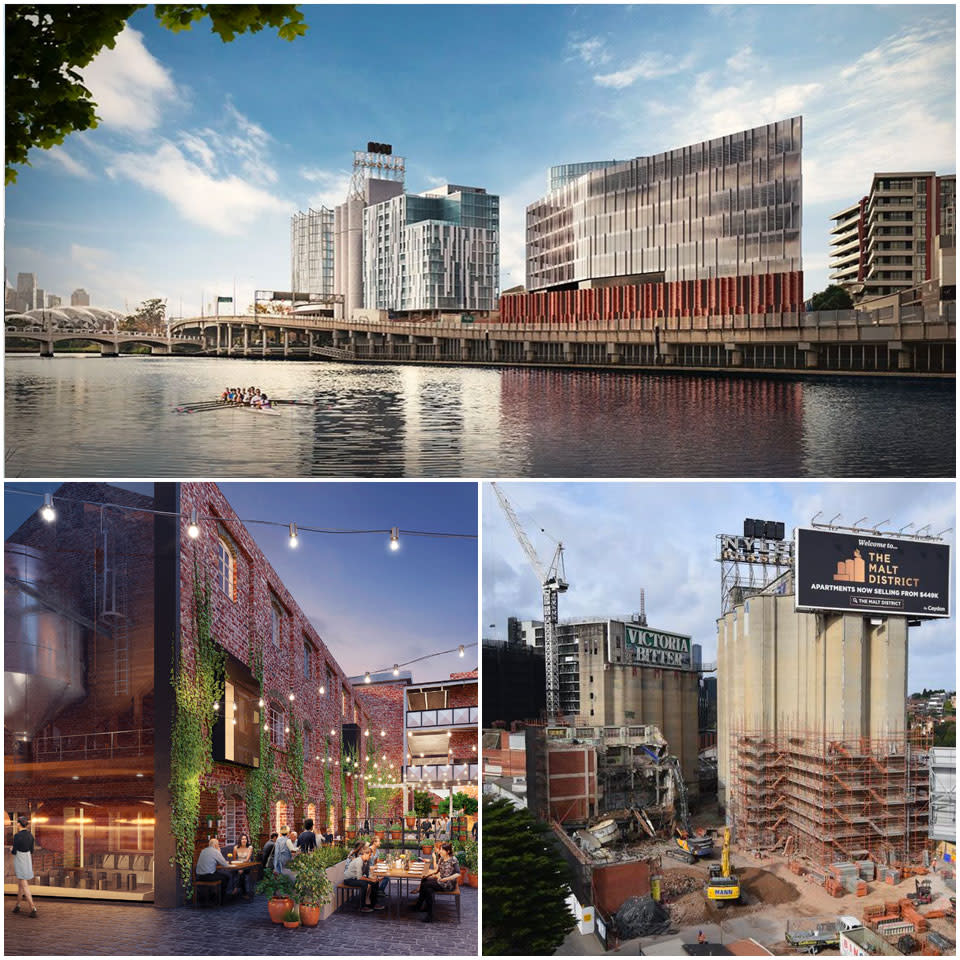

Caydon acquired the former malt factory Nylex site in 2014 for about $38 million and was progressing its multi-million-dollar plans for the Malt District.

Probuild reached practical completion for The Malt District, a significant mixed-use precinct in the emerging office market at trendy Cremorne, in the weeks before its collapse.

The first stage of the project, being developed by Melbourne-based Caydon, includes a 15 and 12 split-level tower featuring 200 one-, two-, and three-bedroom apartments, and lower-level retail and hospitality outlets.

It also included construction of a nine-level tower with 8800sq m of office space on the site’s south-eastern corner, which is now leased to software giant MYOB and sold to global investment house AXA in a fund-through arrangement.

The apartment developer had made its first move into the Gold Coast market late last year, filing plans for an 18-storey apartment tower at Miami.

It was not clear how much Caydon owed OCP Asia.