Australia's Investment Market A Titan Of Industry

A new report by global property services firm JLL has revealed that Australia achieved the second highest industrial investment activity in Asia Pacific in 2016, behind Japan.

With a $2.68 billion investment number and ranking as the most popular destination for cross-border investment, it was suggested that Australia’s multi-billion dollar infrastructure development underway will drive the investment market over the next five years.

JLL’s Australian Industrial Investment Review 2017 reported it was another year of new records for Australia’s industrial and logistics sector in 2016. All-time highs were reached for total transactional volumes, portfolio sales and inbound cross-border capital.

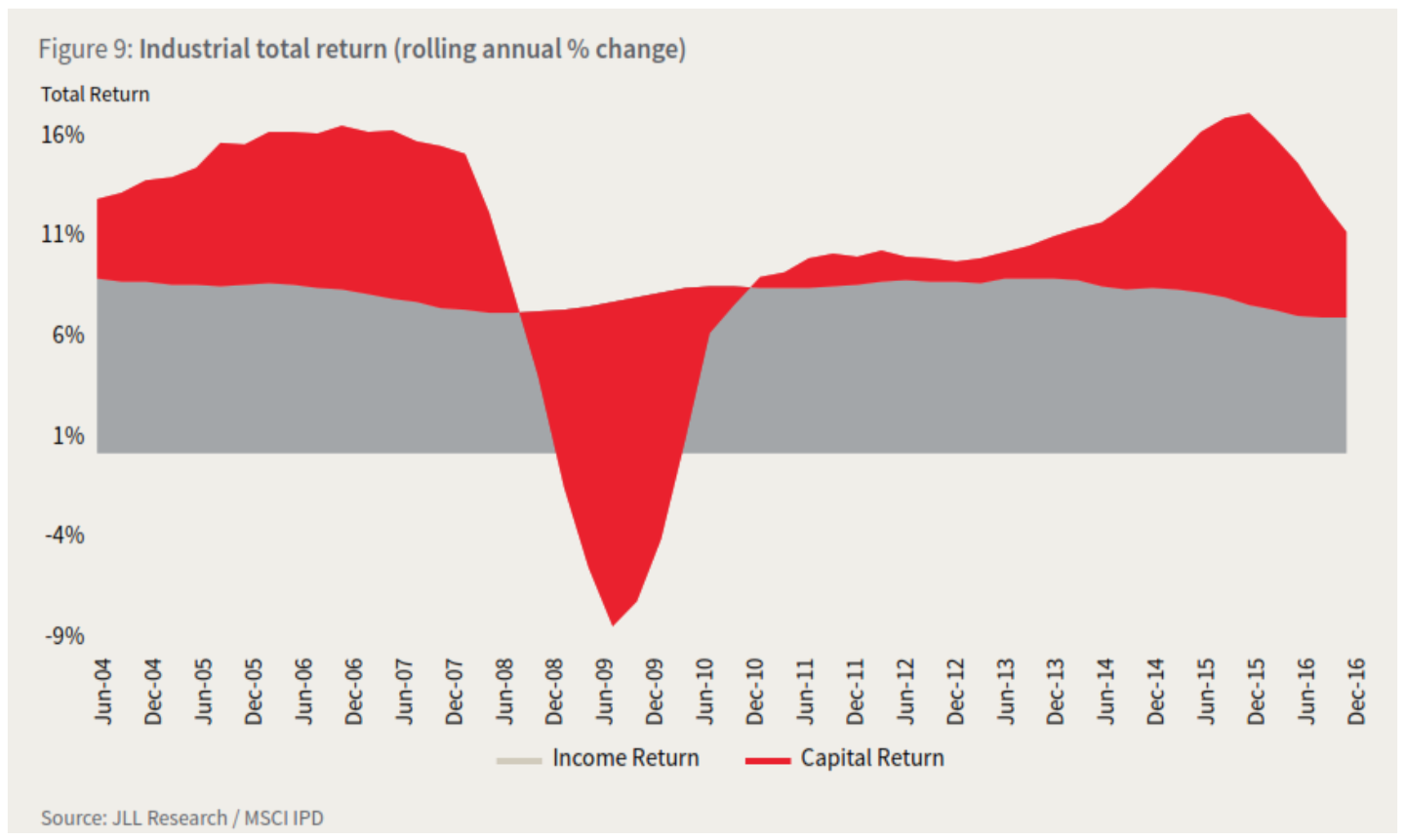

Robust underlying growth fundamentals coupled with accommodative monetary policy were accretive to asset price inflation.

JLL Head of Industrial Michael Fenton said the gradual institutionalisation of the sector in Australia has gained impetus over the past four years.

"Industrial annual sales volumes have had nine consecutive years of growth, with new records reached every year since 2014.

"2016 volumes reached $6.89 billion, surpassing last year’s all-time high. Portfolio transaction volumes have grown 155% per annum since 2013," he said.

“Sale and leaseback deals remained the theme in 2016 and we expect to see an increased frequency of this type of deal in 2017. As additional transactional evidence emerges, the case for re-rating has strengthened for many industrial assets.

“Current pricing levels will spur vendor motivation with an increased number of transactions likely to occur off-market.

"Given the stage of the cycle, corporates will look to capitalise on current pricing to sell existing assets while fund managers will continue to pay premiums for stabilised income profiles – bringing forward more sale and leasebacks. Moreover, the limited investable opportunity and pricing will ensure AREITs focus on land acquisitions and bolster forward pipelines,” Mr Fenton said.

Australia has more than $86.8 billion in transportation infrastructure projects currently underway, and $47 billion of those are expected to be completed in the next five years which will have a profound impact on the industrial market to reduce the operating costs for distributors, raise the implicit value of existing assets and unlock new markets.

“We are also seeing further consolidation of the sector. Australia’s industrial market has undergone a rapid institutionalisation over the past decade," Mr Fenton said.

"Portfolio transaction volumes have risen by an annual average of 155% since 2013.

"Never has the sector had such high stock of capital invested, or stock of capital looking to be placed.

"Such growth, in part, was a function of the increased offshore demand for Australian logistics assets. In 2016, just under a half of all transactions ($2.9 billion or 39%) was capital from direct offshore investment,” Mr Fenton said.

JLL Senior Industrial Analyst Sas Liyanage said a sustained rise in bond yields could sway focus away from capturing value through accelerated cap rate compression toward maximising asset cash flows through income growth and value-add opportunities.

“Low-interest rates, robust economic fundamentals and the drive for income will likely ensure the continued sustainable expansion in supply.

“The good news is that supply conditions between now and previous construction peak are markedly different. Firstly, this year’s expected supply is approximately 34% below that in 2006 to 2008.

"Secondly, the majority of new stock coming online is being absorbed by the market.

"During the previous peak, 34% of the newly-built space was vacant upon completion. This year, we are running at an unleased rate of 13% for assets completed or under-construction,” Mr Liyanage said.

2016 industrial investment activity highlights

Sydney and Melbourne accounted for more than 68% of the national sales volumes and were the second and fourth largest markets in Asia Pacific. Transaction volumes have mirrored domestic economic activity in those states.

Offshore investment has grown too, rising by 107% per year since 2014. Australia is the preferred destination in Asia Pacific for industrial cross border activity.

Average national prime yields reached a record low. Record low levels were set in all state capitals excluding Perth and Adelaide.

Unlisted property trusts were the most active participants in the market in 2016.

Sale and leaseback deals were widespread in 2016.