Are Retail Developments Ready For An International 'Space Race'?

There's a 'space-race' currently in progress, but it has nothing to do with flight suits and one giant leap for mankind.

This is literally a race for space - international retailers are in search for retail spaces in the pacific region, and a new CBRE report has revealed that more than 90 groups are seeking to roll out stores in Australia.

The Viewpoint report, Pacific Retail – International Brands Driving Change, highlights that the Australian retail landscape is undergoing considerable change, with an acceleration of international brand entry into the region driving up CBD markets, asset enhancements in regional shopping centres and activated new retail precincts.

This trend presents a number of opportunities for domestic developers within the retail sector, as a total of 1.6 million square metres of retail space – or around 1,800 stores, could be sought by international retailers in Australia alone over the next five years, according to CBRE Head of Research Australia Stephen McNabb.

Mr McNabb said a strong preference for international brands, food and beverage and retail-tainment from the younger demographic was supporting this change, as was an increase in tourist arrivals from China.

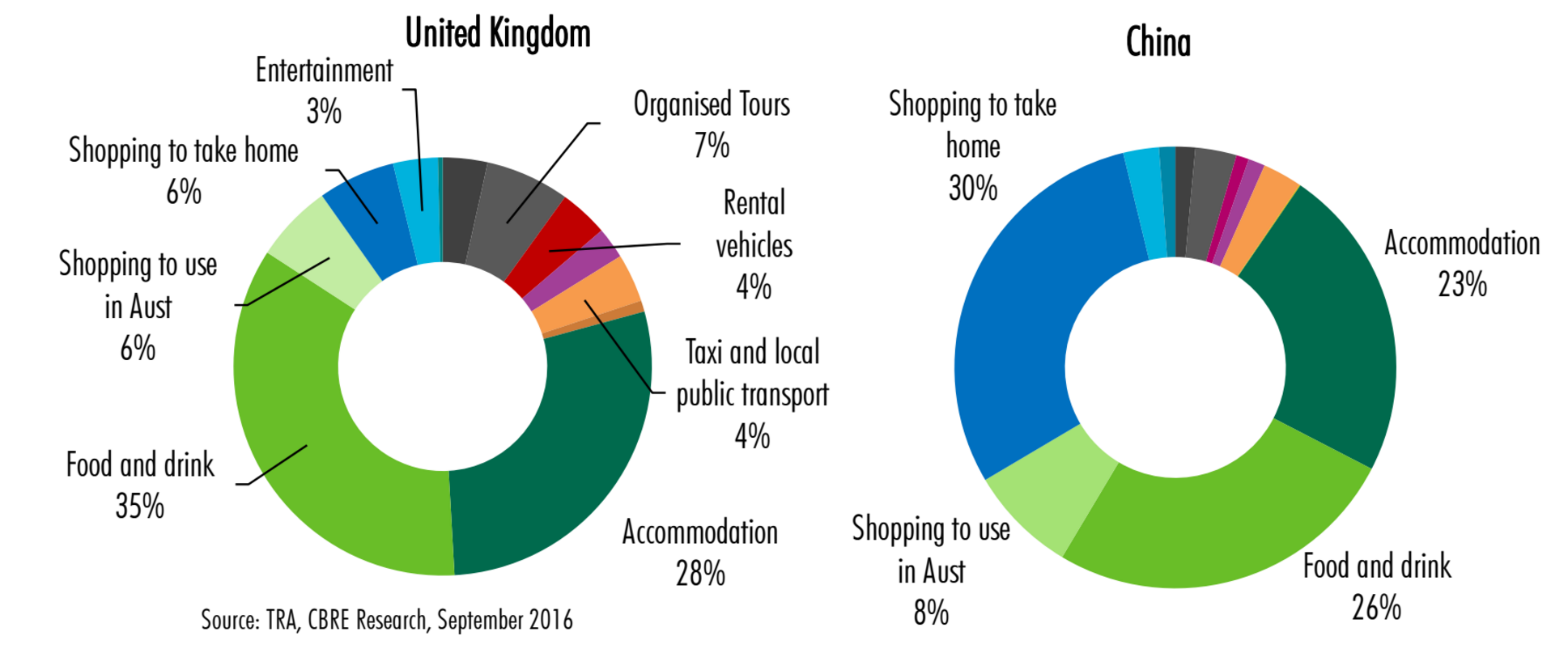

Average spending patterns of UK and China visitors in Australia.

Chinese tourist arrivals have tripled in Australia over the past decade, which is supporting retail trade, particularly in the major CBD markets.

“Chinese tourists not only spend more per visit, but they also have a higher appetite for goods purchase to take home, as opposed to western tourists,” Mr McNabb said.

“Another market driver has been Australia and New Zealand’s consumption per capita, which has grown at twice the rate of the U.S. over the past decade.

"This has contributed to the sales productivity of some international brands being among the highest in the world which, coupled with low international brand penetration rates, is making this region highly attractive.”

The report also tips that there will be a shift in the type of international retailers entering the region.

CBRE head of Pacific Retail Occupier team Tim Starling said luxury retailers were the largest group to enter Pacific last year and this trend was expected to continue for a further two to three years. However, a slow-down was then expected as these groups approach their store targets.

“Over the next five years, we expect mid-range fashion and specialist clothing brands to show a rising contribution to brand entry rates in Australia and New Zealand,” Mr Starling said.

“These retailers will have a more wide-ranging impact than the luxury brands, as they tend to focus only on CBD or prime regional centre locations.”

CBRE Retail Services Group National Director Alistair Palmer said the Viewpoint also highlighted that international retailers were increasingly viewing the Pacific as one region.

“Previously, international retailers focused on Australia followed by entry into New Zealand, usually after a few years,” Mr Palmer said.

“Recent developments indicate that international retailers increasingly view the Pacific as one region, with an initial target of the three main gateway cities of Sydney, Melbourne and Auckland followed by secondary cities in both countries.

"This is evident by the international penetration rate of Auckland being on par with Brisbane but growing at a more significant pace, on par with Sydney, in the past year.”

One of the downsides for domestic retailers has been a significant increase in competition for sites and a related increase in rents.

However, CBRE’s Viewpoint tips that displaced domestic retailers could increasingly seek secondary centres and this will have a positive impact on centres and locations that currently struggle as a result of low retailer demand.