Call for Help as Construction Insolvency Crisis Looms

The federal government must help the high-rise construction industry as it faces an imminent insolvency crisis brought on by the Covid pandemic, say apartment developers.

Speaking at The Urban Developer's vSummit on the Australian property outlook, developer Tim Gurner said although 2020 had been big for him in terms of acquisitions, the wider construction industry had seen a huge downturn in CBD projects.

“The city construction firms are seriously hurting and the builders are desperate for work, particularly in Victoria,” Gurner said.

“If the state government doesn't get serious about getting construction activity going in the city soon there’s going to be significant hurt. This year is going to be tough, there’s going to be some shake out.

“We’ve got to see what happens out of Jobkeeper, we’ve got to see what businesses can survive that.”

Sarah Slattery, managing director of quantity surveying firm Slattery, warned an insolvency crisis was looming for the construction industry.

“There’s a huge risk [of insolvency] and we are advising clients to do their due diligence … who knows who will survive,” Slattery said.

“A lot of work was completed last year but new work hasn’t come in behind it. Construction work is at an all-time low from 12 months ago. Covid and lockdown were major disruptions.”

Gurner's comments were supported by Queensland developer Don O’Rorke, the chairman of Consolidated Properties.

“HomeBuilder obviously applies to house and land—there hasn’t really been any stimulus provided by the federal or state governments for apartment building,” O’Rorke said.

“That’s really been an issue in terms of off-the-plan sales for us.”

O’Rorke said the luxury high-end market was under-serviced and Consolidated Properties would focus on this market segment to shore up its workflow.

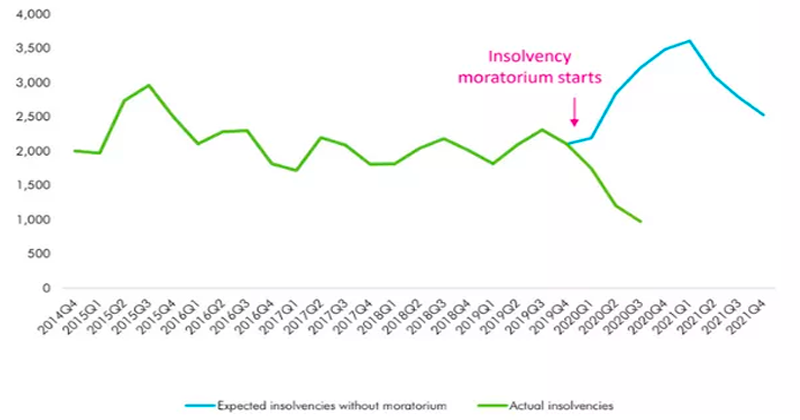

Companies entering external administration - quarterly

^Source: ASIC and CBRE Research

Slattery said the price of construction had forced prices down 10 to 15 per cent in Sydney and Melbourne, putting downward pressure on margins.

She said tier-two construction firms were down as low as 2 per cent while tier one margins had dropped from an average of 6 per cent down to about 3 per cent.

Slattery said confidence in the sector and the resumption of immigration, particularly international students, would help stimulate the construction industry.

Former CBRE researcher Ben Martin-Henry said there was a significant number of zombie companies—businesses that relied completely on fund assistance—underpinned by JobKeeper, which is due to end in March.

Martin-Henry predicted the number of business insolvencies would spike in the first half of 2021.

The Reserve Bank estimates a further 5,200 business will fail on top of the usual closures (not all are insolvencies) of 15,000 to 20,000 per year if business revenue falls by the forecast 9.5 per cent in 2020-21.