Investor Home Loan Values Lift 30pc for Year

The total value of new housing loans lifted 1.3 per cent to $29.2 billion last month.

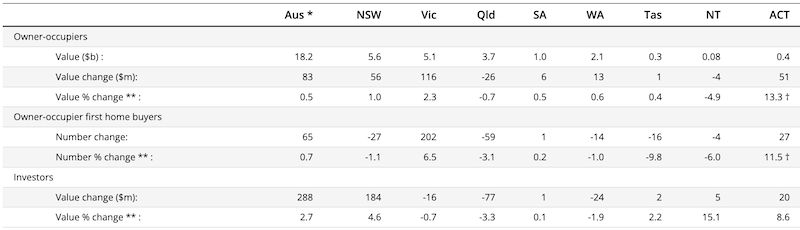

According to data for June by the Australian Bureau of Statistics, the value of new owner-occupier loans grew by 0.5 per cent to $18.2 billion, while the value of new investor loans grew by 2.7 per cent to $11.0 billion.

ABS head of finance statistics Mish Tan said investor lending growth had continued to outpace the growth of owner-occupiers in June.

“The total value of new investor loans was 30.2 per cent higher compared to a year ago, while for owner-occupiers it was 13.2 per cent,” Tan said.

While growth in the value of new investor loans was experienced across all states and territories during the past 12 months, it was driven by NSW (up 27.3 per cent or $901 million), Queensland (up 34.5 per cent or $587 million) and Western Australia (up 56.7 per cent or $428 million).

By comparison, growth was relatively slower in Victoria (up 9.4 per cent or $199m) and South Australia (up 38.3 per cent or $175m).

“Over the past 12 months, NSW continued to have the highest average loan sizes for both owner-occupiers and investors,” Tan said.

“In June, it rose to $780,000 for owner-occupiers and $818,000 for investors.”

The number of new owner-occupier first home buyer loans rose 0.7 per cent in June and was 3.4 per cent higher compared to a year ago.

That growth was driven by a rise of 6.5 per cent in Victoria, which since June 2017 has continued to have the highest number of first home buyer loans of all states and territories.

Housing finance loan commitments seasonally adjusted, June 2024

The value of new loan commitments for total fixed-term personal finance rose 1.1 per cent to $2.6 billion and was 11.7 per cent higher compared with a year ago. Lending for the purchase of road vehicles rose 0.5 per cent in the month.

Oxford Economics Australia senior economist Maree Kilroy said that after the latest CPI inflation read, they expected the RBA would keep rates on hold for the remainder of 2024.

“With rates on hold, housing affordability will remain a constraint and place a lid on the pace of property price growth,” Kilroy said.

“We expect the combined capital city median house price to increase by a softer 5 per cent in FY2025.”

HIA economist Maurice Tapang said the number of loans issued for the purchase and construction of a new home had been steadily increasing since the start of 2024 “from a very low base”.

“Market confidence appears to be stabilising following nine months without a change in interest rates,” Tapang said.