‘Volatile’ Apartment Sector Helps Drive Home Approvals

The “volatile” apartment sector has helped drive up the number of home approvals by 20.6 per cent in May.

It follows a 6.8 per cent decrease in April, according to the latest data from the Australian Bureau of Statistics (ABS).

ABS head of construction statistics Daniel Rossi said the rise in approvals “was driven by the more volatile ‘homes excluding houses’ series, which rose 59.4 per cent”.

“This increase reflected a large number of apartment developments approved in New South Wales in May.

“Approvals for private sector houses remain more subdued, rising 0.9 per cent, following a 3.0 per cent fall in April.”

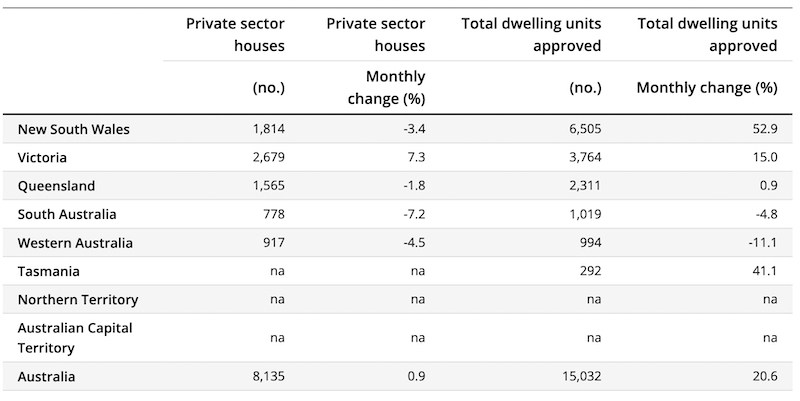

Across Australia, total home approvals were mixed, with rises in New South Wales (52.9 per cent), Tasmania (41.1 per cent), Victoria (15.0 per cent) and Queensland (0.9 per cent).

Falls were recorded for Western Australia (11.1 per cent) and South Australia (4.8 per cent).

Homes approved, states and territories, seasonally adjusted

Approvals for private sector houses were driven by a rise in Victoria (7.3 per cent), while falls were recorded in all other states: South Australia (7.2 per cent), Western Australia (4.5 per cent), New South Wales (3.4 per cent) and Queensland (1.8 per cent).

Urban Taskforce chief executive Tom Forrest said that the figures showed the first signs that the planning system had re-awoken following the NSW election.

“One month’s data does not spell the end of the housing supply crisis but this is a solid move in the right direction,” he said.

“The annual data to the end of May for each year shows that apart from the start of the pandemic in 2020, NSW approvals are at their lowest level of the last decade.

“Nonetheless, the May results show what is possible and if this can be repeated over and over, we will be in a much stronger place.”

Values on the rise

The value of total building approvals rose 11.1 per cent, after a 1.7 per cent rise in April.

The value of total residential building approvals rose 15.2 per cent, comprised of a 17.1 per cent rise in new residential building and a 4.3 per cent rise in alterations and additions.

The value of non-residential buildings approved reached the highest level since March 2021, rising a further 6.6 per cent in May, following a 10 per cent rise in April.

Loans ratchet up

The value of new loan commitments for housing rose 4.8 per cent to $24.9 billion in May 2023, after a fall of 1 per cent in the previous month, the ABS said.

ABS head of finance statistics Mish Tan said the value of new owner-occupier loan commitments rose 4 per cent to $16.4 billion in May, while the value of new investor loan commitments rose 6.2 per cent to $8.5 billion.

The value of new owner-occupier home loan commitments (excluding land and alterations, additions and repairs) rose 4.2 per cent to $15.3 billion.

The number of these commitments rose 5.1 per cent to 26,253.

Compared to pre-pandemic levels in February 2020, the value of new owner-occupier home loan commitments was 17 per cent higher in May 2023, while the number of commitments was 0.2 per cent lower.

The average value of these loans has risen by 21.8 per cent (in original terms) over this period.

The number of new owner-occupier first home buyer loan commitments rose 2.7 per cent, after a fall of 0.3 per cent in April.

This was 17.4 per cent lower compared to a year ago.

The value of new owner-occupier housing loan refinances between lenders rose 8.6 per cent and reached a new high of $14.1 billion.

“Borrowers continued to switch lenders amid an environment of increasing interest rates,” Tan said.

Home prices

Meanwhile, Australian housing values have recorded a fourth month of recovery but the pace appears to be slackening.

According to CoreLogic’s national Home Value Index, values rose 1.1 per cent in June, decelerating slightly from the 1.2 per cent gain in May.