Confidence at Record Highs for Property Industry

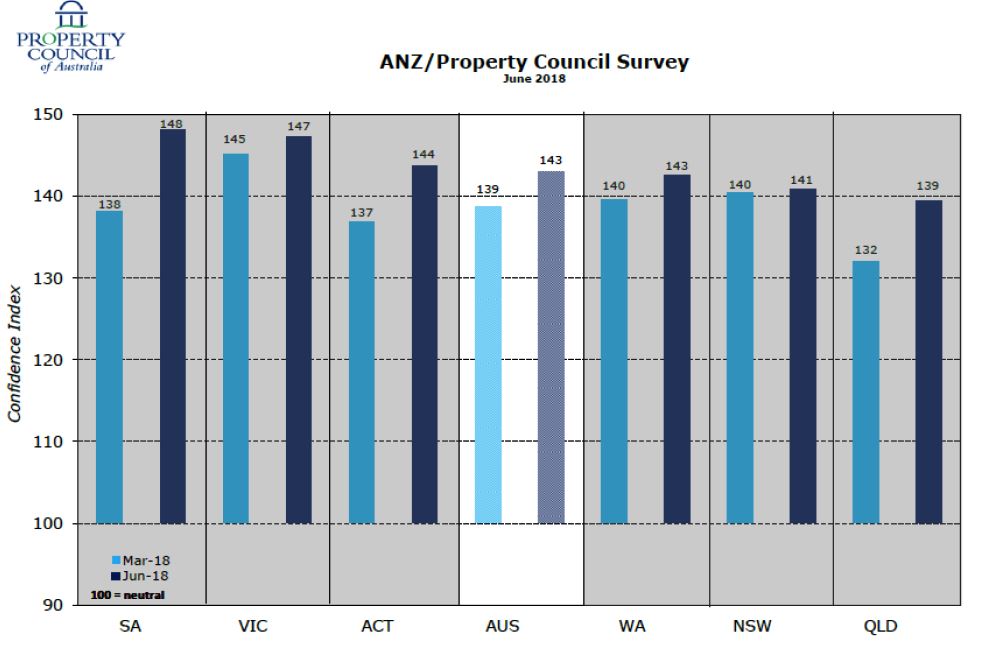

Confidence across Australia’s property industry has surged to record highs despite a Property Council of Australia and ANZ survey revealing expectations for New South Wales house prices are the worst in the survey’s history.

While the NSW property industry confidence index rose slightly to 141 index points, up from 140 points last quarter, sentiment has dropped four index points.

The broader industry was buoyed by a range of positive sentiment – for economic growth, improving value in the office and industrial property markets and confidence in a growing retirement living sector.

Related reading: Sydney Still the Most Expensive Rental Market Despite Weakening Growth

Property Council chief executive Ken Morrison said the survey results, which polled more than 1000 property industry professionals nationwide, were a “cause for optimism”.

The national confidence index for the June quarter lifted four points to 143, the highest score since the survey began in 2011. A score of 100 is considered neutral.

“Hotel and Industrial sector capital growth expectations are leading the nation and these sectors, along with retirement, are now where we are seeing higher expectations of growth,” Morrison said.

Related reading: Sydney Land Prices Fall for the First Time in Two Years

Getting the policy settings right for the property industry, explained Morrison, such as better planning and cutting red tape would boost confidence which in turn drives investment, expenditure and employment.

“Now that we are in the midst of an election year, the upcoming Budget will be important to send a message to the industry. As other east coast states compete for investment, a stable, open investment environment is required in NSW to ensure our good economic fortunes continue.”

Funding Challenges a Hurdle for Development Projects

Separate research from NAB reveals developers are putting project plans on hold as sentiments around funding remains lacklustre.

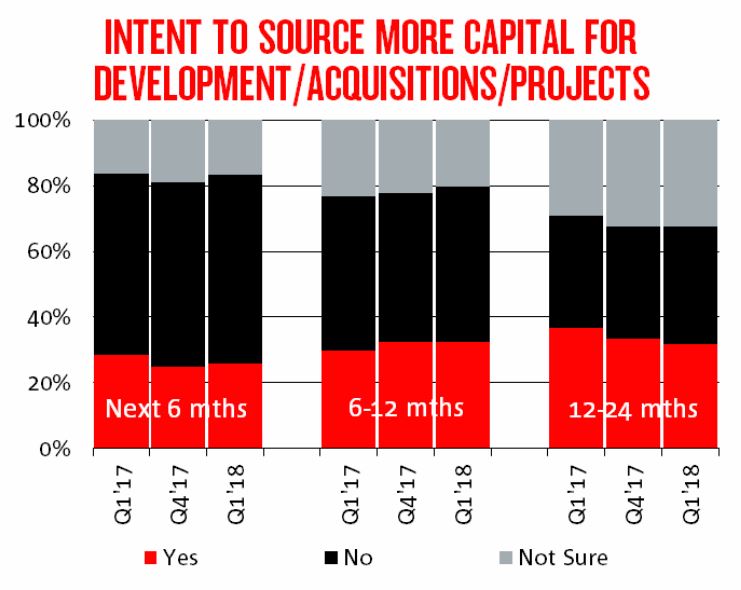

Accessing funds, for both debt and equity needed for developers’ property businesses is still a major challenge but less so than in the last quarter of 2017, according to the latest NAB Commercial Property Index.

Australia-wide, the number of surveyed property developers who said they were aiming to commence new building works in the next six months increased to 49 per cent, up from 47 per cent in the last quarter of 2017.

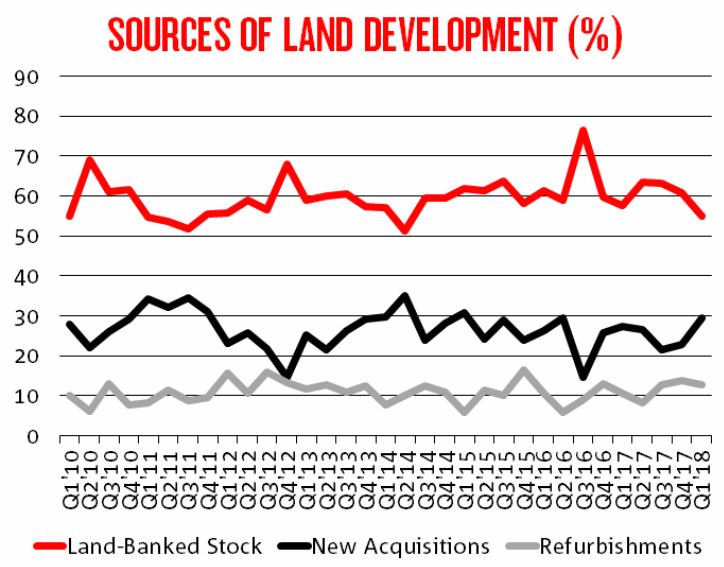

“Fewer property developers are looking to use land-banked stock for their new projects and an increasing number are also seeking new acquisitions, pointing to a period of stock rebuild,” the report said.

Many survey participants expect their debt funding and equity conditions to worsen over the next six to twelve months.

Related reading: Retail Property Sentiment Takes Sharp Dive

By segment, confidence in the commercial property market is up as property experts in all states, except Queensland, believe in a buoyant market across the next one to two years. NSW and VIC were the most optimistic and WA, while the largest improver, was the least confident.

Meanwhile CBD hotels continues to outperform on the back of growing tourism and favourable global economic conditions.

The NAB Commercial Property Index, which surveyed about 300 property professionals, rose by four points in the first quarter of 2018, higher than its long-term average of a rise of three points.