What to Expect from the National Construction Pipeline in 2024

The recent strides made in construction technology have been truly impressive.

Just a decade ago, the idea of consolidating the entire national construction pipeline on to a single platform appeared overwhelmingly challenging.

Fast forward to 2024, and founders, executives, business leaders and investors across all echelons of Australia’s built environment can effortlessly tap into this invaluable resource with a simple login.

BCI Central enables users to gain unparalleled access to robust construction pipeline data. BCI researches and reports on vital building sectors and project regions, uncovering opportunities and enabling strategic planning from a rich, live dataset on cloud-based platforms.

The BCI Analytix team decodes intricate patterns, offering a comprehensive view of market and company insights and empowering Australian built-environment professionals to stay ahead and outperform competitors.

And that competitive edge has never been more critical.

The BCI Construction Outlook provides a detailed view and strategic guidance for Australian developers, architects and builders, covering projects from Q3 2021 to Q3 2023 and offering forecasts for construction starts until Q3 2024.

This free resource, consolidated annually, presents a comprehensive guide for industry professionals. Here are some initial takeaways from this year’s report.

Entering the Pipeline: Concept + Design & Documentation

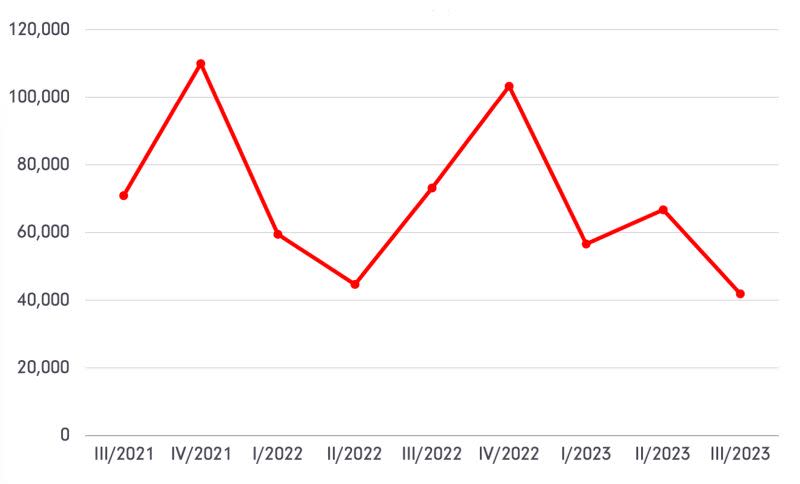

National, All Sectors ($ million)

In late 2022, the construction industry hit a peak in project values entering the pipeline, followed by a sudden trough in early 2023, a modest uptick and a continued decline through the end of the year.

Despite these post-pandemic fluctuations, the number of project proposals across Australia suggests sustained high activity levels for 2024.

NSW/ACT, Victoria, Queensland and Western Australia collectively represent nearly 80 per cent of total project proposals. NSW/ACT and QLD are leading in project investments.

Nationwide, significant early-stage project values in late 2023 are observed in the community and public buildings sectors, including community and cultural, education, health, legal and military and sports and recreation projects.

Blocking the Pipeline: Deferred & Abandoned

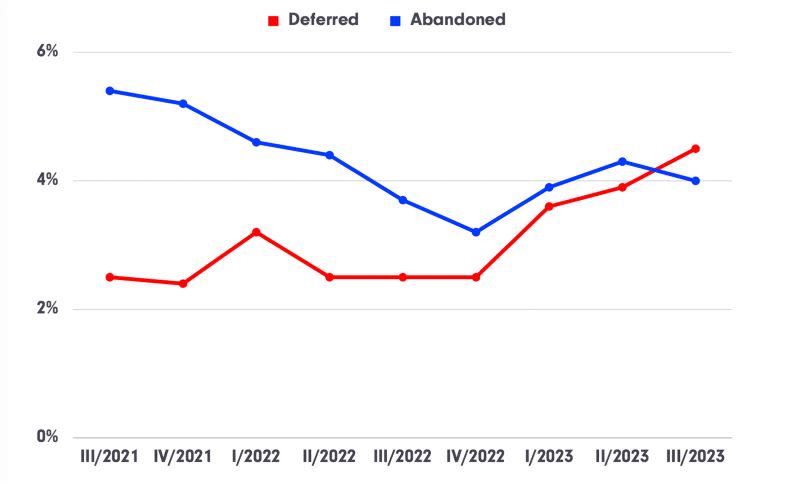

National, All Sectors (% deferred and abandoned)

While national abandonment rates show signs of slowing, the concurrent increase in deferral rates highlights the challenges facing Australian construction firms and business owners.

Between Q4 2022 and Q2 2023, the percentage of abandoned projects rose. In Q3 2023, the residential, commercial and hospitality sectors exhibited higher abandonment rates than deferrals nationally.

Ashleigh Porter, BCI Central's chief operating officer for Australia and New Zealand, attributes the cancellation or delay of projects, particularly in the residential sector, to rising construction costs and labour shortages.

Notably, many approved townhouse and apartment projects in the residential sector are not progressing to construction even with development approvals gained.

Exiting the Pipeline

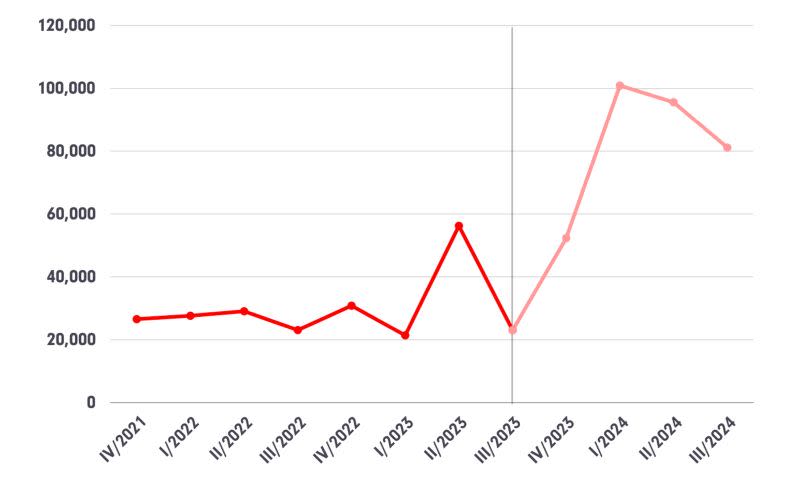

National, All Sectors ($ million)

Looking at all sectors combined, there has been a significant increase in the value of projects starting construction with project numbers peaking in Q4 2023.

The value of project commencements is forecasted to remain strong through to Q3 2024 with industrial, infrastructure and transport, along with energy and resources, contributing more than 60 per cent of total project values within this period.

BCI Central projected almost double the construction commencements, about 3000 projects in Q3 2023 lifting to more than 6000 in Q4 2023.

Decoding the pipeline for future success

Despite a high volume of work filling construction pipelines, the industry continues to tackle the challenges of a post-pandemic Australia.

Porter said the pipeline in the coming year was “robust” as several large-scale projects and some that were deferred come back into play.

“Nationally, we are expecting a significant jump in commencements,” she said.

“Total construction value, we see this peaking this quarter. If we look at projects by volume, the number of projects coming on stream, we see that upticking this quarter and peaking in the fourth quarter of 2024.

“If you compare this year both on value and number of projects nationally across all sectors, it is really positive to see significant higher rates coming into 2024, making it look like a much more fruitful year.”

Porter said she now expected early-stage works in concept and design to continue rising across 2024, indicating increased activity over the next 12 to 36 months.

Nevertheless, enduring challenges persist, with inflation taking the lead among most surveyed built environment professionals interviewed by BCI Central, closely followed by escalating material costs.

Want to learn more about the current state of the Australian construction industry? Dive deeper by downloading your free copy of the BCI Construction Outlook.

The Urban Developer is proud to partner with BCI Central to deliver this article to you. In doing so, we can continue to publish our daily news, information, insights and opinion to you, our valued readers.