Unit Yields Outstrip Houses as Rents Rebound

Unit rent prices have risen for the first time in 18 months, recording a 2.5 per cent growth in line with house rent increases.

Domain’s Rent Report showed that gross house rental yields were now at a record low of 3.56 per cent across the capital cities, while unit rental yields increased 1.1 per cent to 3.95 per cent.

Investors are moving into the unit market as asking rents for houses hit record highs in Sydney, Brisbane, Adelaide and Canberra.

Unit asking rent prices have hit record highs in Brisbane and Canberra, and maintained record levels in Adelaide.

It is the first time on record that Melbourne has had the lowest house rent of all capital cities. It is the only city in Australia to have house rents lower than before the pandemic.

Domain chief economist Dr Nicola Powell said renters in Sydney, Melbourne and Brisbane were starting to shift into cheaper apartment living, which was consistent with rent price rises.

“[This is] largely being driven by affordability, whether that’s people seeking a better deal or cities that have record high house rents become a strain on budgets,” Powell said.

“However, space is an important factor for tenants who may have a family or need to share a house.

“In some cities, it’s clear that tenants are willing to pay a premium for space necessary for their lifestyle, as house rents achieve highs and rise at a faster pace for rentals with more bedrooms.”

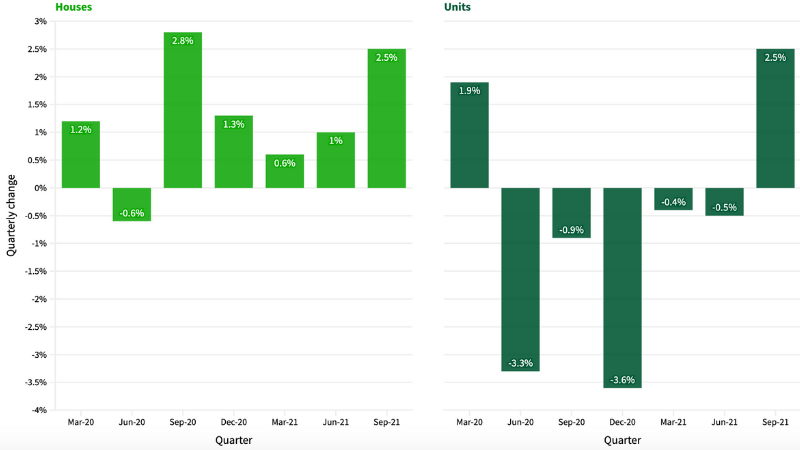

Houses vs units: quarterly rent changes

^Source: Domain Quarterly Rent Report

Interstate and regional migration has impacted Melbourne’s asking rents for houses, which are the lowest of all capital cities, according to Powell.

“Melburnians have grappled with the longest lockdown of any city in the world, and this has contributed to the market's weak rental growth,” Powell said.

“It is a good sign for tenants who are wanting more space and now is the time to negotiate on asking rents to secure a good deal.

“However, we have seen that vacancy rates have continued to decline, suggesting that the empty pool of rentals will continue to shrink and rents will not stay this low for much longer.”

Houses vs units: quarterly rent price changes

| City | House rent | Quarterly change | Unit rent | Quarterly change |

|---|---|---|---|---|

| Sydney | $580 | ▲$30 | $485 | ▲$15 |

| Melbourne | $430 | - | $370 | ▲$5 |

| Brisbane | $460 | ▲$10 | $410 | ▲$10 |

| Adelaide | $440 | ▲$10 | $350 | - |

| Perth | $450 | - | $380 | - |

| Canberra | $645 | ▲$15 | $520 | ▲$20 |

| Darwin | $620 | ▲$27 | $470 | ▲$20 |

| Hobart | $495 | - | $400 | - |

^Source: Domain Quarterly Rent Report

Capital cities that have escaped harsh lockdowns such as Perth and Hobart have maintained rent asking prices over the quarter.

This is a positive sign for tenants indicating that after a year of rapid growth, asking rents will start to slow.

Australian Bureau of Statistics data showed investors had taken up a further 5 per cent of the share of home loan values as first home buyer demand contracted.

“There’s tailwind behind rising investment activity boosting rental supply, tighter lending could stall this, particularly if we see further moves from the regulators,” Powell said.

“Some Aussies who made a tree change will start returning to the city as well as people immigrating from other countries will cause vacancy rates to decrease in inner cities driving up rent prices.”